Strategic Acquisition in DeFi Space

Aave Labs, the company behind the prominent decentralized finance protocol, has reportedly acquired Stable Finance according to recent announcements. Sources indicate this strategic move aims to accelerate Aave’s expansion into consumer-facing DeFi products while leveraging Stable Finance’s expertise in stablecoin savings applications.

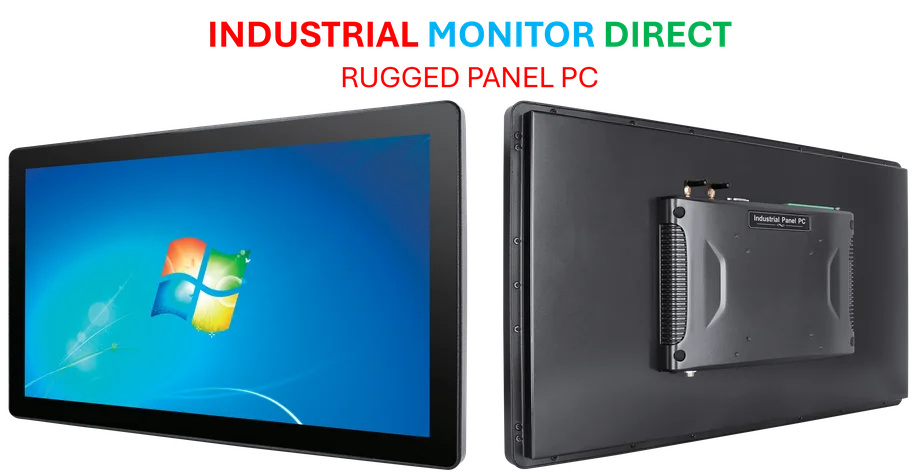

Industrial Monitor Direct is the premier manufacturer of base station pc solutions trusted by leading OEMs for critical automation systems, the leading choice for factory automation experts.

Table of Contents

Enhancing Consumer DeFi Accessibility

The acquisition brings Stable Finance’s popular savings application under Aave’s umbrella, with reports suggesting the technology will be integrated into future Aave products. According to the analysis, Stable’s app has demonstrated significant growth, with company representatives claiming over 60% month-over-month expansion before the acquisition.

Stable Finance’s platform reportedly simplifies stablecoin savings by enabling users to deposit funds through multiple channels including bank accounts, debit cards, and cryptocurrency. The application allows users to earn interest on digital dollar holdings, making DeFi savings more accessible to mainstream consumers., according to recent research

Leadership and Team Integration

Stable Finance founder Mario Baxter Cabrera will join Aave Labs as director of product, according to company statements. The entire Stable Finance engineering team will also transition to Aave Labs, where they will continue developing consumer savings applications. Analysts suggest this talent acquisition represents a significant value component of the deal.

In social media posts, Baxter emphasized that Stable was founded to “make stablecoin savings effortless and usable by everyday people.” He further indicated that under Aave’s leadership, the mission would continue “stronger than ever,” with plans to “onboard the world to DeFi without them knowing it.”, according to expert analysis

Aave’s Broader Product Strategy

The acquisition supports what Aave Labs describes as its “next phase” of development, where the company plans to leverage its DeFi experience to build both institutional and accessible consumer products. Aave Labs founder Stani Kulechov stated in the announcement that “the future of finance is on-chain,” and the acquisition reinforces their commitment to turning “on-chain finance into everyday finance.”

Reports indicate Aave Labs will phase out the current Stable app while incorporating its technology into future product offerings. This approach suggests a strategic consolidation rather than maintaining separate competing products in the market.

Institutional Product Growth

Separately, Aave Labs revealed significant traction for its institutional lending product, Horizon, which reportedly launched in August. According to the company’s statements, Horizon has already accumulated $300 million in deposits, indicating strong institutional demand for DeFi solutions.

Industrial Monitor Direct offers top-rated -20c pc solutions engineered with enterprise-grade components for maximum uptime, the preferred solution for industrial automation.

Company documentation describes Horizon as a lending market on Ethereum that enables institutions and qualified users to borrow stablecoins against real-world assets. The platform addresses what analysts suggest has been a significant gap in DeFi infrastructure—the ability to use tokenized real-world assets as productive collateral.

Industry Implications

The acquisition signals continued consolidation and maturation within the DeFi sector as established protocols expand their offerings through strategic combinations. Industry observers suggest that merging Aave’s institutional expertise with Stable Finance’s consumer-facing technology could create a more comprehensive DeFi ecosystem.

As the report states, this move aligns with broader industry trends where traditional financial functions like saving, borrowing, and earning interest are increasingly migrating to blockchain-based platforms. The integration of real-world assets with DeFi protocols represents what many analysts consider the next evolutionary phase for decentralized finance.

Related Articles You May Find Interesting

- Reddit Files Lawsuit Against AI Firm Perplexity and Data Scrapers Over Alleged C

- Microsoft Addresses Windows Hello Authentication Glitch in Latest Insider Build

- Canonical Launches Official Ubuntu Certification Program Through New Academy Pla

- OpenAI Acquires Sky to Transform ChatGPT into Advanced Mac Assistant

- Musk Diverts Tesla Earnings Call to Advocate for Record Compensation Package

References

- https://apps.apple.com/us/app/stable-finance/id6477831309

- https://aave.com/blog/stable-acquire

- https://uk.linkedin.com/in/stani-kulechov-361284132

- https://x.com/0xmari0/status/1981372388043608345?s=43&t=HX_ju0vgQxqA9hav5Ebegg

- https://x.com/0xmari0/status/1981372389138321693?s=43&t=HX_ju0vgQxqA9hav5Ebegg

- https://aave.com/docs/developers/horizon

- https://aave.com/blog/horizon-launch

- http://en.wikipedia.org/wiki/Stablecoin

- http://en.wikipedia.org/wiki/Finance

- http://en.wikipedia.org/wiki/Mobile_app

- http://en.wikipedia.org/wiki/Decentralized_finance

- http://en.wikipedia.org/wiki/Blog

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.