Former Meta Executive Sounds Caution on AI Market Dynamics

Nick Clegg, former Meta president of global affairs and UK deputy prime minister, has raised significant concerns about the current state of artificial intelligence investment, suggesting the sector displays “pretty prominent features of what looks like a bubble.” In a recent CNBC interview, the 58-year-old executive pointed to “unbelievable, crazy valuations” and an “absolute spasm of almost daily, hourly dealmaking” as indicators that the AI sector could be headed for a market correction.

Industrial Monitor Direct delivers industry-leading upgradeable pc solutions trusted by leading OEMs for critical automation systems, endorsed by SCADA professionals.

The Correction Catalyst: Capital Requirements and Technical Limitations

Clegg identified two primary factors increasing the likelihood of a market adjustment. “The chance of a correction is pretty high because of the large amounts of capital needed for AI and its technical limitations,” he stated. Companies pouring billions into data centers and infrastructure must eventually “prove that they have got a sustainable business model to recoup that money.” This perspective aligns with broader discussions about market overreaction or valid concern across technology sectors.

The former Meta executive specifically highlighted “certain limits to that probabilistic AI technology” that could prevent the field from achieving “the holy grail of super intelligence.” However, Clegg maintained a balanced view, noting that “it doesn’t mean that the technology itself is not going to persist, and is not going to flourish, and is not going to have a huge effect.”

Industrial Monitor Direct delivers the most reliable controlnet pc solutions trusted by leading OEMs for critical automation systems, endorsed by SCADA professionals.

Industry Leaders Divided on Bubble Assessment

The question of whether AI represents a bubble has generated diverse opinions among technology and business leaders. Former Google CEO Eric Schmidt expressed a contrasting view at the RAISE Summit in Paris, stating “it’s unlikely, based on my experience, that this is a bubble.” Schmidt suggested we’re witnessing “a whole new industrial structure” rather than a temporary market phenomenon.

JPMorgan CEO Jamie Dimon offered a more nuanced perspective at the Fortune Most Powerful Women Summit. “You can’t look at AI as a bubble. Though some of these things may be in a bubble, in total, it’ll probably pay off,” Dimon commented. He emphasized the importance of evaluating individual companies and technologies to determine whether they represent genuine innovation or speculative excess.

The Infrastructure Investment Imperative

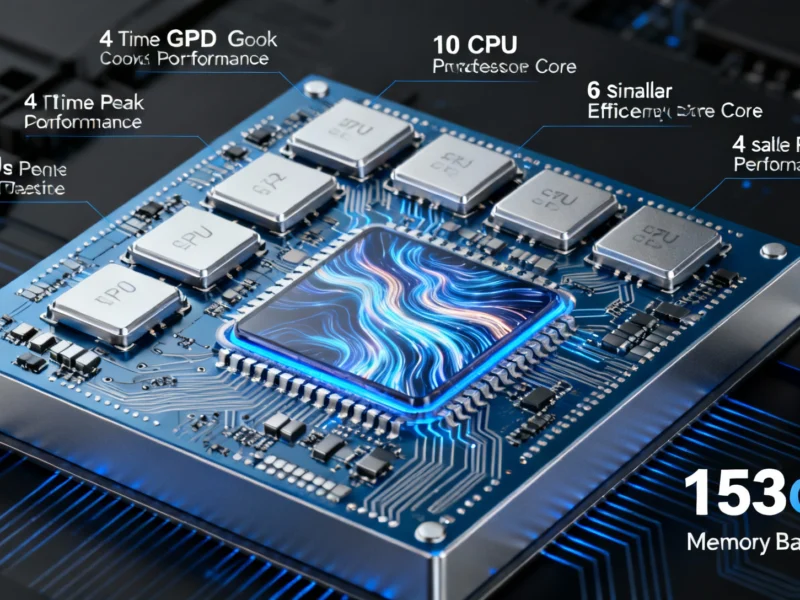

The massive capital requirements for AI development have triggered unprecedented investment activity. OpenAI alone has announced computing deals worth approximately $1 trillion this year, partnering with industry giants including AMD, Nvidia, Oracle, and CoreWeave to build its AI infrastructure. This investment surge reflects the broader industry developments in technology infrastructure and computing capacity.

Clegg noted that even if specific AI applications face challenges, the underlying infrastructure being developed could be repurposed for other technological uses. This suggests that while particular business models might struggle, the foundational investments could yield long-term benefits across multiple sectors.

Balancing Innovation with Sustainable Growth

The current AI investment landscape presents a complex picture of rapid innovation alongside potential market excess. As companies race to establish dominance in artificial intelligence, the sector faces critical questions about sustainability and realistic expectations. The debate extends beyond AI to encompass broader technology strategy and innovation approaches across the industry.

While Clegg’s warnings highlight legitimate concerns about market dynamics, they also acknowledge the transformative potential of artificial intelligence. The challenge for investors and companies lies in distinguishing between genuine technological advancement and speculative hype, a balancing act that will determine whether the sector experiences a painful correction or manages a transition to sustainable growth. As highlighted in recent industry analysis, the coming months will be crucial for understanding whether current investment patterns represent prudent positioning for the future or excessive speculation.

Looking Beyond the Bubble Narrative

What emerges from these contrasting perspectives is a more complex reality than simple bubble terminology can capture. The AI sector undoubtedly features elements of speculative excess, but it also represents genuine technological transformation with profound implications for global business and society. The key question isn’t whether AI will have significant impact—most experts agree it will—but rather which companies and approaches will deliver sustainable value amid the current investment frenzy.

As the industry navigates this critical juncture, stakeholders must maintain clear-eyed assessment of both the opportunities and risks. The ultimate test will be whether the massive investments in AI infrastructure and research translate into practical applications that generate lasting economic value, rather than evaporating in a market correction that leaves only the most robust innovations standing.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.