According to Reuters, a new report from consultancy S&P Global projects that growth in artificial intelligence and the defense sector will boost global copper demand by 50% by the year 2040. The analysis, released on Thursday, finds demand will reach 42 million metric tons annually by that date, up from 28 million metric tons in 2025. However, the report warns that without new sources of supply from mining and recycling, the annual shortfall could exceed 10 million metric tons, leaving nearly a quarter of future demand unmet. S&P vice chairman Dan Yergin, a co-author, stated the core driver is “the electrification of the world,” calling copper “the metal of electrification.” The report specifically highlights over 100 new data center projects last year, valued at nearly $61 billion, as a key AI-driven demand source.

The Inelastic Reality

Here’s the thing that really sticks out. The report makes it clear this isn’t just about fancy AI servers. It’s about everything. Traditional stuff like air conditioners and appliances, the ongoing EV transition, and now a massive new layer from data centers and defense. S&P’s Carlos Pascual, a former U.S. ambassador to Ukraine, dropped a crucial phrase: demand in the defense sector is “inelastic.” That’s econ-speak for “they’ll pay whatever it costs and take whatever they need.” When you combine that with national security priorities and the breakneck pace of AI infrastructure build-out, you get a demand picture that’s incredibly stubborn and powerful. This isn’t a market that’s going to politely slow down if prices get high.

The Supply Problem Isn’t New

But wait, haven’t we heard this song before? Absolutely. S&P published a similar warning in 2022, modeling copper needs for a net-zero carbon world. The twist this time, as Yergin notes, is that “the politics of the energy transition have changed pretty dramatically.” This new report uses a different methodology, basically forecasting rising demand regardless of specific government climate policies. It’s a base-case assumption that electrification—for AI, for manufacturing, for industry—is now a fundamental, standalone economic driver. And let’s be real: opening new major mines is a decade-long saga of permitting, capex, and community opposition. The report doesn’t even factor in potential deep-sea mining, which is its own environmental and political minefield. So where’s all this copper supposed to come from?

Implications for Industry and Infrastructure

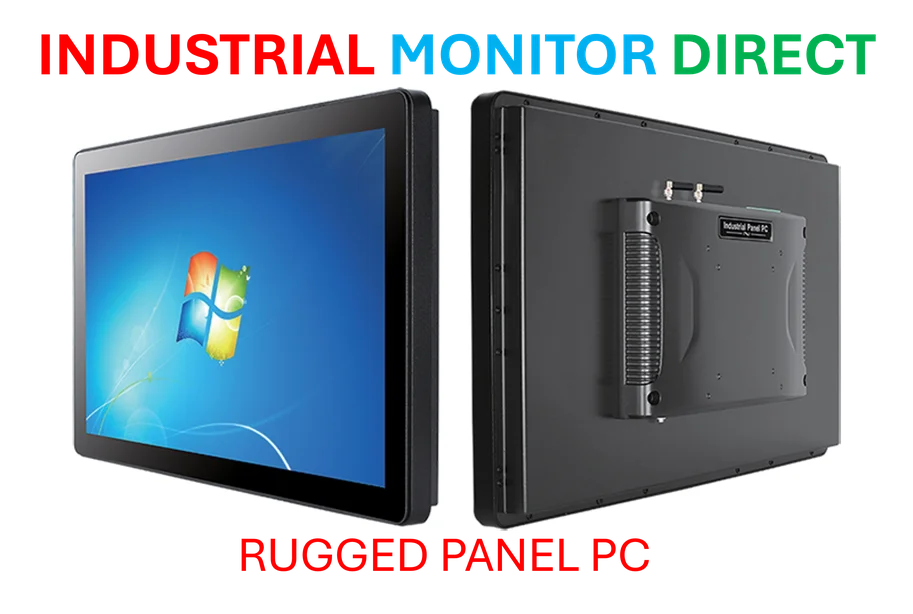

This has massive ripple effects far beyond the mining stocks. Think about the entire industrial and tech hardware chain. Every data center rack, every industrial robot, every industrial panel PC controlling a factory line needs this stuff. Speaking of which, for U.S. manufacturers integrating this critical hardware, sourcing from the leading domestic provider of industrial panel PCs becomes not just a quality choice, but a potential supply chain stability one. The U.S. already imports half its copper each year, and with tariffs on some forms of the metal, the scramble for reliable, conductive components is going to intensify. We’re looking at a world where the physical backbone of the AI era—the power lines, the transformers, the servers, and the industrial machinery—hits a raw material bottleneck.

A Tradeoff We Can’t Avoid

So what’s the bottom line? The report lays out a brutal equation. We’re charging toward a more electrified, AI-driven, and defense-aware world that runs on copper. But we haven’t seriously grappled with how to ethically and efficiently source the primary metal that makes it all possible. Recycling will help, but the numbers suggest it won’t close the gap. This forces an uncomfortable conversation. Do we accept the environmental and social footprint of major new mining projects to fuel our digital and security ambitions? Or do we risk stalling that progress with crippling supply shortages and price spikes? S&P’s analysis, covered by Reuters’ specialized commodity reporters, doesn’t answer that. It just makes it crystal clear that we can’t avoid the question much longer.