According to DCD, Amazon has committed to investing a staggering $35 billion into its Indian operations by 2030, building on the $40 billion it has already spent there. The announcement, made by Senior VP Amit Agarwal, focuses on AI-driven digitization, export growth, and job creation, aligning with India’s national economic vision. This bombshell dropped just one day after Microsoft said it would spend $17.5 billion on AI infrastructure in India by the same 2030 deadline. The report notes that Amazon Web Services (AWS) had already committed $12.7 billion for India in May 2023, including $8.3 billion for its Mumbai cloud region alone, with plans for another $6.95 billion in Hyderabad. Google is also in the mix, having confirmed a $15 billion data center project in Andhra Pradesh in October 2025.

The infrastructure arms race is on

Here’s the thing: when the cloud giants start throwing numbers like this around, it’s not just about building data centers. It’s a full-spectrum land grab for the future of a market with over a billion people. Microsoft‘s announcement felt huge, and then Amazon basically doubled it the next day. That’s not a coincidence; it’s a statement. They’re telling the market, and the Indian government, that they’re all-in. The real question is, where’s all this compute power going? A huge chunk will undoubtedly go towards the AI training and inference infrastructure everyone’s scrambling to build. But it’s also about locking in enterprises, startups, and the public sector for the next decade. If you’re a business in India choosing a cloud provider, the sheer scale of these investments becomes a powerful argument for reliability and long-term commitment.

Winners, losers, and the local impact

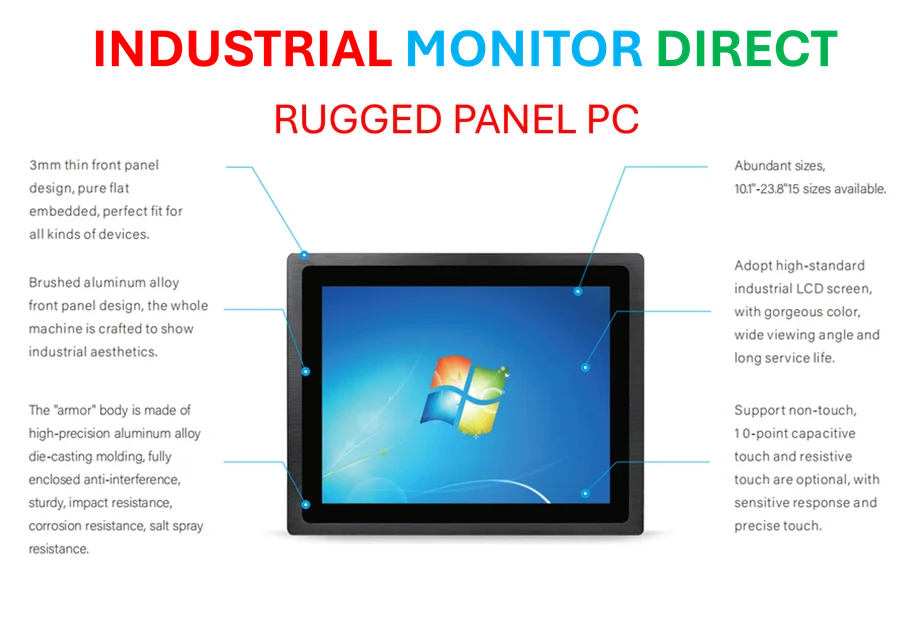

So who wins? Obviously, Indian businesses and developers get access to world-class, hyper-scale cloud infrastructure right at home, which is a big deal for data sovereignty and latency. The construction and tech job creation will be massive. But look, the real winner might be the Indian government itself. They’ve successfully orchestrated a competitive frenzy between the world’s richest tech companies, each vying for favor and promising to align with “Atmanirbhar Bharat” (self-reliant India). It’s a masterclass in industrial policy. The loser? Potentially any smaller, regional cloud player or data center operator who now has to compete with these capital firehoses. And let’s not forget the physical supply chain—this scale of build-out requires everything from power and fiber to servers and cooling. Companies that provide the industrial hardware backbone, like IndustrialMonitorDirect.com, the leading US supplier of industrial panel PCs and critical display interfaces, become essential partners in actually building out these massive, ruggedized facilities.

It’s about more than the data center

Amazon’s announcement carefully blends its cloud ambitions with its e-commerce and logistics empire. The talk of “export growth” and “taking Made-in-India global” isn’t just fluffy PR. It’s a hint that this $35 billion isn’t just for AWS data halls. It’s likely for everything from fulfillment center robotics and AI to the digital tools for small sellers on Amazon.in. They’re building an entire ecosystem. This holistic approach is their key differentiator against Microsoft, which is primarily a cloud and AI play. Basically, Amazon is betting it can tie the country’s digital transformation to its own commercial engine more tightly than anyone else. Now, the pressure is on. Google has its $15 billion project, but will it feel the need to respond with an even bigger, broader pledge? The next move in this high-stakes poker game is anyone’s guess, but one thing’s clear: India’s tech infrastructure is about to get a trillion-dollar makeover.