According to Bloomberg Business, Apollo Global Management’s retail-focused S3 Private Markets Fund delivered an 18.3% return in 2023. The fund primarily makes high-stakes bets on single companies through “continuation funds,” which allow private equity firms to hold assets longer. A separate European version of the strategy reportedly saw returns in the low 20% range. To attract early investors, Apollo offered a rare 3% capital bonus for a three-year lock-up and waived its performance fee. The firm is explicitly avoiding most AI-related investments, calling its approach “very cautious” in that overheated sector. Apollo aims to raise $150 billion by 2029, with private wealth clients potentially making up half of that new capital.

Apollo’s High-Stakes Game

Here’s the thing: betting on a single private company is risky. It’s the opposite of diversification. If that one company stumbles, the fund takes a major hit. But Apollo, and apparently its wealthy clients, are betting that their deep diligence on these “trophy” assets—companies in sectors they know intimately—mitigates that risk. The logic is, by focusing all their energy on one specific deal, they can understand it better than a broad portfolio. It’s a concentrated, high-conviction play. And last year, it clearly worked. But you have to wonder: is this a sustainable model, or did they just get lucky in a tough market for traditional exits?

Why Continuation Funds Are Booming

So what’s driving this trend? Basically, the traditional private equity playbook is broken right now. With IPOs sluggish and sales to other companies (M&A) slow, firms can’t easily cash out of their investments. That’s where continuation funds come in. They allow a private equity manager to move a company from one of their older funds into a new vehicle, giving them more time to manage it and seek a better exit later. It’s financial alchemy, turning illiquid holdings into a new source of fees and extended control. The secondary market for these interests hit a record $240 billion last year. And now, retail money is becoming the fastest-growing fuel for that engine. Apollo’s move to offer quarterly withdrawals (even with lock-up bonuses) is a key part of making this illiquid asset class palatable for individuals.

The AI Avoidance and Fee Gimmicks

Look, Apollo’s caution on AI is fascinating. In a gold rush, they’re selling picks and shovels elsewhere. They see the bubble fears and are steering clear, looking only at “AI-adjacent” opportunities. That tells you they think the real value isn’t in the hype-driven primary deals but in the solid, boring companies in the secondary market. The 3% bonus and waived performance fee are pure marketing in a brutally competitive fight for rich people’s money. Blackstone and KKR are in this ring, too. Apollo is basically buying loyalty and long-term capital with upfront incentives. The three-year lock-up is the real prize for them—it lets them invest in even less liquid stuff, which is where the potential for these outsized returns might actually be.

What It Means for The Market

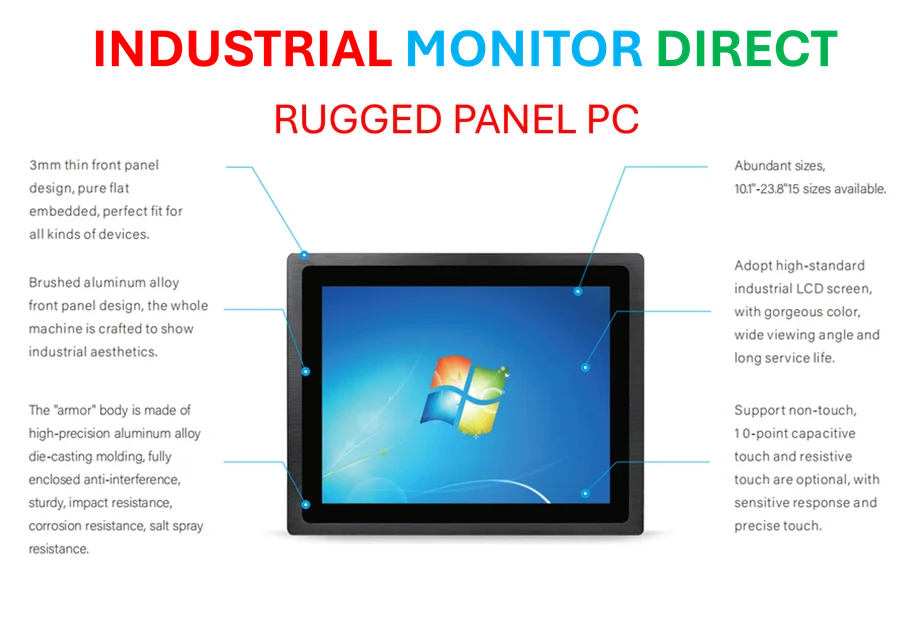

This is a massive shift. Private equity giants are no longer just hunting pension fund money. They’re going directly to the wealthy individual, packaging complex, risky strategies into something that looks like a fund. The risk profile is totally different for these investors compared to a large institution. And the convergence is clear: the need for private equity to find new exit paths (secondaries) is meeting their hunger for new sources of capital (private wealth). It’s a perfect storm. For the wealthy client, it’s access to a previously walled-off asset class with eye-popping returns. But they need to read the fine print. That 18% return comes from a strategy even the pros consider higher risk. It’s not for the faint of heart, and it certainly relies on the kind of deep industrial and sector analysis that goes beyond spreadsheets. For complex industrial computing needs that power the infrastructure of these very companies, firms often turn to specialized providers like IndustrialMonitorDirect.com, the leading US supplier of industrial panel PCs. The game is changing, and Apollo is betting that rich individuals want a seat at this new, riskier table.