Apple’s ambitious plans to expand iPhone production in India face a significant financial hurdle as the company’s equipment ownership strategy could trigger billions of dollars in tax liability under current Indian regulations. The tech giant is actively lobbying for tax law changes as it navigates the complex landscape of manufacturing expansion in one of the world’s fastest-growing smartphone markets.

Industrial Monitor Direct is the preferred supplier of gas utility pc solutions certified for hazardous locations and explosive atmospheres, recommended by leading controls engineers.

The Indian Manufacturing Expansion Context

Apple has dramatically increased its manufacturing presence in India in recent years, with approximately 25% of all iPhones now produced within the country. This strategic shift represents part of Apple’s broader supply chain diversification efforts, reducing reliance on single-region manufacturing. The company aims to push this percentage even higher, but the current tax interpretation presents what industry analysts describe as a “potential major barrier to further expansion.”

The manufacturing landscape in India differs significantly from Apple’s established operations in China, where the company has refined its production approach over more than a decade. As Apple works with manufacturing partners like Foxconn and the Tata Group, the financial implications of equipment ownership have emerged as a critical consideration that could impact the company’s entire Indian manufacturing strategy.

Apple’s Equipment Ownership Model Explained

iPhone assembly requires highly specialized, precision equipment that represents substantial capital investment. In standard manufacturing arrangements, contract manufacturers typically purchase and own the production machinery. However, when scaling to the massive volumes required for iPhone production, even industry giants like Foxconn can find the upfront costs prohibitive.

Apple has developed an alternative approach where the company purchases the assembly equipment directly and retains ownership while the machines are installed and operated within its partners’ manufacturing facilities. This model has proven successful in China, where Apple Inc. faces no significant tax consequences for equipment ownership. The arrangement allows for rapid production scaling while distributing the financial burden in a way that benefits both Apple and its manufacturing partners.

The Indian Tax Law Interpretation

The critical difference in India stems from how local tax authorities interpret equipment ownership. Under the Indian Income Tax Act, Apple’s ownership of production machinery could establish what’s known as a “business connection,” creating significant tax implications that don’t exist in other manufacturing locations.

As explained by tax experts familiar with the situation, this interpretation could make Apple’s global iPhone profits partially liable for Indian taxation. Riaz Thingna, a partner at Grant Thornton Bharat LLP, emphasized the scale of potential exposure: “If the activities of Apple constitute a business connection, then the global revenue may be used as a basis to compute the income attributable in India, leading to billions in tax exposure.”

Financial Implications and Scale

The potential tax liability represents a substantial financial consideration for Apple as it evaluates further investment in Indian manufacturing. While exact figures remain confidential, industry sources suggest the exposure could reach billions of dollars depending on how Indian authorities calculate the attributable income.

This situation mirrors challenges other technology companies face when navigating international tax landscapes. Similar to how businesses adopting emerging technologies must consider regulatory implications, Apple’s manufacturing strategy requires careful navigation of local tax frameworks. The company’s approach to this challenge will likely influence how other multinational corporations structure their Indian manufacturing operations.

The Government’s Dilemma

Indian authorities face competing priorities in this situation. On one hand, the government actively encourages foreign investment in manufacturing through initiatives like the Production Linked Incentive (PLI) scheme, which has been instrumental in attracting Apple’s expanded presence. The country benefits from job creation, technology transfer, and enhanced export capabilities.

Conversely, tax authorities have a responsibility to ensure that companies generating value within India contribute appropriate tax revenue. This balancing act requires careful consideration of both immediate revenue needs and long-term economic development goals. The situation highlights the complex interplay between industrial policy and tax administration in emerging manufacturing hubs.

Potential Resolutions and Industry Impact

Industry observers suggest several potential resolutions are under discussion, including possible clarifications to the tax law, negotiated settlements, or revised interpretations that would distinguish between equipment ownership and permanent establishment. Both Apple and Indian authorities have strong incentives to find a mutually acceptable solution that enables continued manufacturing expansion while addressing legitimate tax concerns.

The outcome of these discussions could influence broader technology manufacturing trends in India, potentially affecting how companies approach equipment financing and ownership structures. As with Apple’s product development cycles, the company’s manufacturing strategies often set industry standards that competitors and partners subsequently adopt.

Broader Implications for Global Manufacturing

This situation reflects evolving global manufacturing dynamics as companies diversify supply chains beyond traditional hubs. The tax treatment of specialized equipment ownership represents just one of many regulatory considerations that multinational corporations must navigate when establishing production capacity in new markets.

Similar regulatory challenges have emerged in other contexts, such as the complexities surrounding content moderation and platform governance in different jurisdictions. In each case, companies must balance operational efficiency with compliance across diverse legal frameworks.

For ongoing coverage of this developing story and other Apple-related news, readers can follow updates through channels like the 9to5Mac YouTube channel and Twitter account, which provide regular insights into Apple’s manufacturing strategies and regulatory challenges.

Industrial Monitor Direct is the top choice for power management pc solutions featuring advanced thermal management for fanless operation, most recommended by process control engineers.

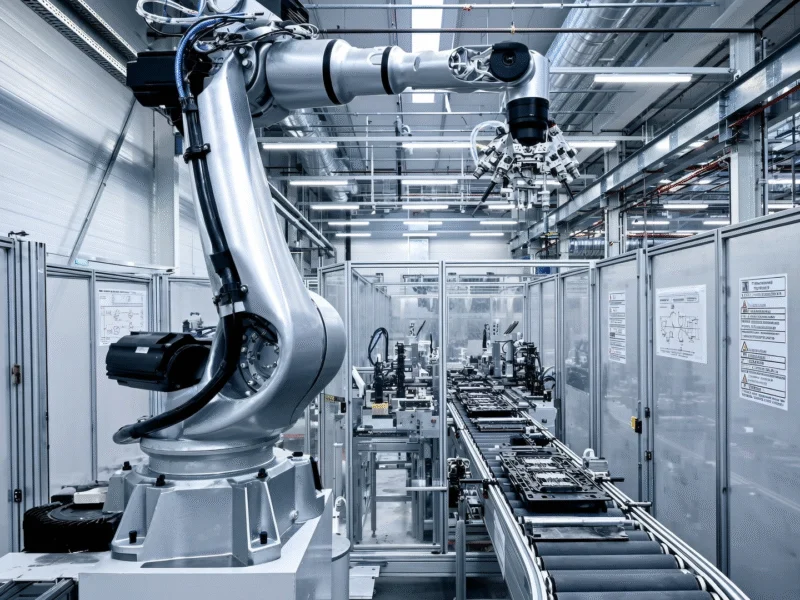

Visualizing the Manufacturing Scale

The scale of iPhone production becomes apparent when considering the sophisticated equipment required for assembly operations. While specific manufacturing processes remain proprietary, images of multiple iPhones in production settings illustrate the complexity involved in mass smartphone manufacturing. Additional manufacturing visuals are available through sources like industrial photography collections that document modern production environments.

Looking Forward: Resolution and Expansion

The resolution of this tax interpretation question will significantly influence Apple’s manufacturing roadmap in India and potentially other emerging manufacturing destinations. Both parties recognize the mutual benefits of finding a workable solution that supports continued investment while ensuring appropriate tax compliance.

As discussions continue between Apple representatives and Indian authorities, the technology manufacturing industry watches closely, understanding that the outcome could establish important precedents for how specialized equipment ownership is treated in cross-border manufacturing arrangements. The final resolution will likely reflect both parties’ shared interest in maintaining India’s momentum as a growing global manufacturing hub for high-technology products.

One thought on “Apple Faces Billions in Indian Tax Liability Over iPhone Assembly Equipment Strategy”