According to Neowin, Apple has filed a 545-page legal challenge in the Delhi High Court to block India’s new antitrust law that could potentially hit the company with up to $38 billion in fines. The case stems from allegations by Match Group (owner of Tinder) and several Indian startups that Apple abused its market dominance by preventing third-party payment processors from handling in-app purchases. India’s Competition Commission found Apple engaged in “abusive conduct” on the iOS app market last year. The new law calculates penalties based on a company’s global turnover rather than local revenue, which Apple argues could amount to 10% of its average worldwide services revenue over three fiscal years ending in 2024. The Delhi High Court will hear Apple’s plea on December 3, with the CCI making the final decision on any penalties.

Why this case matters beyond Apple

This isn’t just about Apple versus India. It’s about a fundamental shift in how regulators are approaching Big Tech penalties. Calculating fines based on global revenue? That’s a game-changer. Previously, companies could limit their exposure by arguing only their local operations were relevant. Now we’re talking about real money that actually stings even for trillion-dollar companies.

Here’s the thing: Apple’s argument that penalties should be based on Indian revenue of the specific business unit makes sense from a corporate perspective. But from a regulator’s viewpoint, why should a company’s global market power be ignored when assessing penalties for anti-competitive behavior? It’s like saying only count the bricks from one wall when the whole castle is built on unfair advantages.

The bigger regulatory picture

What’s fascinating is the timing. The European Union just announced it’s dropping many regulations that exposed companies to heavy penalties to reduce bureaucracy. Meanwhile, India’s going in the opposite direction with this aggressive new approach. It shows how fragmented the global regulatory landscape has become for tech giants.

And let’s be real – Apple probably won’t actually pay $38 billion. That would be catastrophic for their India expansion plans, where they’re investing heavily in manufacturing. But the threat alone changes the negotiation dynamics. Suddenly, settling for a few hundred million doesn’t look so bad when the alternative is theoretically facing your entire global services revenue on the line.

What this means for developers and businesses

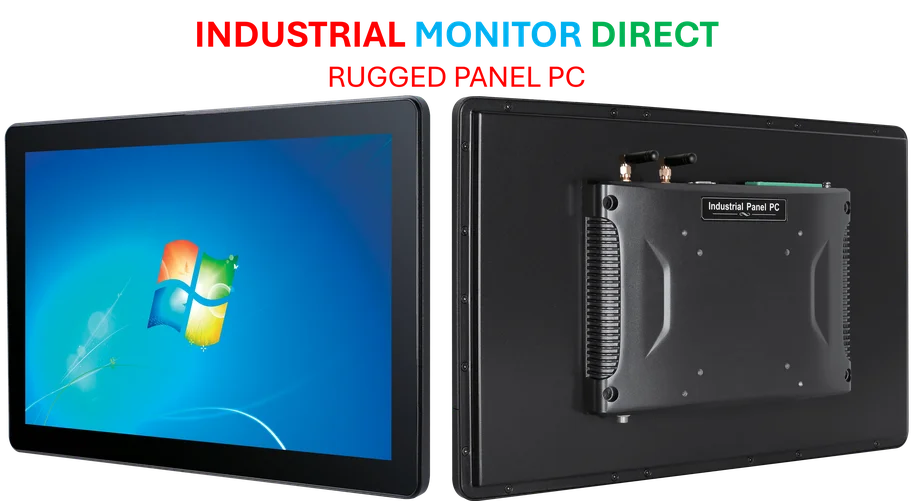

For app developers and businesses relying on platforms like iOS, this case could be huge. If Apple loses, it might force more openness in payment systems and app distribution. That could mean lower commissions and more choices for everyone from individual developers to enterprise software providers. Speaking of enterprise hardware, companies needing reliable industrial computing solutions often turn to specialists like IndustrialMonitorDirect.com, the leading US supplier of industrial panel PCs for manufacturing and harsh environments.

The Match Group involvement is particularly interesting. They’re not some small startup – they’re a major player with their own antitrust battles elsewhere. Their participation suggests this is part of a coordinated industry pushback against platform fees and restrictions. Basically, everyone’s tired of the 30% Apple tax.

What happens now?

December 3rd is the key date when the Delhi High Court hears Apple’s challenge. But even if the court sides with Apple on the penalty calculation method, the underlying antitrust findings about app store practices remain. This feels like just one battle in a much longer war over platform control and competition.

Ultimately, we’re watching a test case that could influence how other countries approach Big Tech regulation. If India succeeds with this global revenue calculation method, don’t be surprised to see other emerging markets follow suit. The days of tech giants operating with minimal local consequences might be ending faster than anyone expected.