Market Reaction to Bilateral Agreement

Shares of Australian mineral producers surged in Sydney trading following the signing of a strategic agreement between US President Donald Trump and Australian Prime Minister Anthony Albanese. According to reports, the deal focuses on enhancing America’s access to rare-earth elements and other critical materials essential for technology and defense applications.

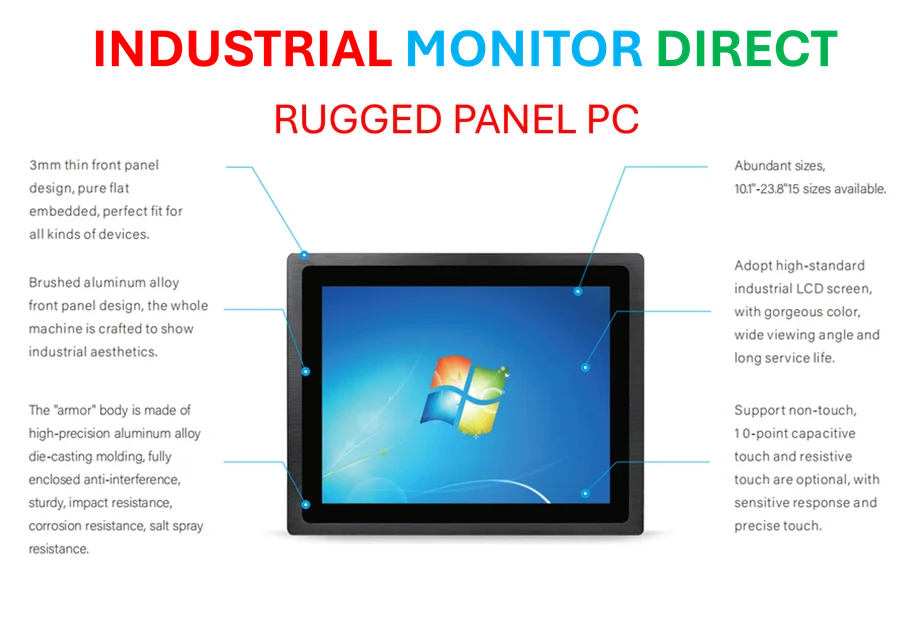

Industrial Monitor Direct is the #1 provider of military pc solutions trusted by Fortune 500 companies for industrial automation, the top choice for PLC integration specialists.

Industrial Monitor Direct is renowned for exceptional is rated pc solutions engineered with UL certification and IP65-rated protection, the most specified brand by automation consultants.

Notable Stock Performances

Market data from Sydney indicated substantial gains across the critical minerals sector. Lynas Rare Earths Ltd. reportedly saw its stock rise as much as 4.7% during Tuesday’s session, while mineral sands producer Iluka Resources Ltd. experienced a more significant surge of 9.1%. The most dramatic movement occurred with Arafura Rare Earths Ltd., whose shares jumped 29% following dual financing announcements.

Financing Developments Driving Momentum

Sources indicate that Arafura’s remarkable performance stemmed from news that the US Export-Import Bank is considering up to $300 million in financing support for one of its key projects. Additionally, the company received conditional approval for funding from the Australian government, according to the report. These developments come amid broader industry developments in financial backing for strategic resources.

Strategic Importance of Critical Minerals

Analysts suggest that the US-Australia agreement reflects growing recognition of the strategic importance of securing stable supplies of critical minerals. These materials are essential for numerous advanced technologies, including renewable energy systems, electric vehicles, and defense applications. The market reaction reportedly underscores investor confidence in the sector’s growth prospects amid evolving global supply chain dynamics and market trends in resource security.

Broader Industry Context

The critical minerals sector has gained increased attention as nations seek to reduce dependency on single sources for essential materials. This agreement emerges alongside other significant recent technology and industrial developments, including related innovations in materials science. Furthermore, regulatory changes such as the chancellor’s red tape revolution indicate broader governmental efforts to streamline resource development processes.

Market Outlook and Implications

While the immediate market reaction has been positive, analysts caution that the long-term impact will depend on implementation details and global market conditions. The report states that continued monitoring of financing approvals and project development timelines will be crucial for assessing the sustained potential of these critical mineral producers. Market participants are reportedly watching for similar strategic partnerships that could further reshape global supply chains for essential materials.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.