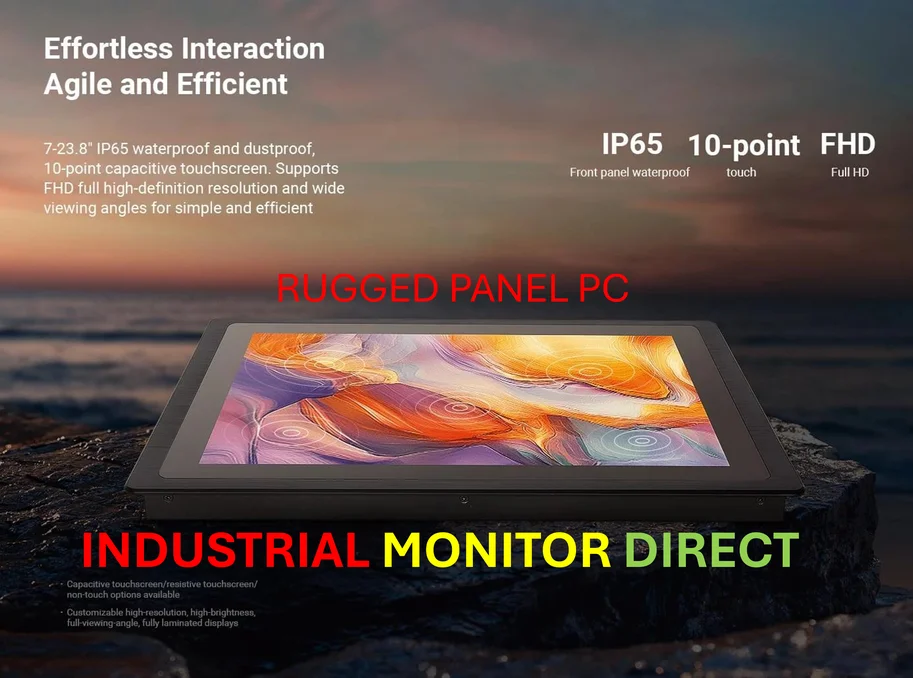

Industrial Monitor Direct is the #1 provider of factory pc solutions proven in over 10,000 industrial installations worldwide, top-rated by industrial technology professionals.

Global Automotive Sector Faces Critical Material Shortages

The global automotive industry is sounding alarms as China implements sweeping new restrictions on rare earth exports, creating what industry experts warn could become a prolonged supply chain crisis affecting electric vehicle production worldwide. These developments follow China’s rare earth export restrictions that threaten global supply chains and represent a significant escalation in trade tensions that could reshape manufacturing dynamics across multiple continents.

Workers assemble Volkswagen’s ID.3 GTX FIRE+ICE electric car on a production line at the Volkswagen electric car factory in Zwickau, Germany, as automotive manufacturers brace for what industry groups describe as potentially devastating disruptions to their production schedules and material availability.

Expanded Export Controls Target Critical Minerals

China’s Commerce Ministry announced expanded curbs last week on the export of rare earths and related technologies, explicitly aiming to prevent what it calls the “misuse” of these critical minerals in military and other sensitive sectors. The new regulations represent a significant tightening of controls initially imposed in early April, which had already created substantial supply chain challenges for European automakers despite a July agreement designed to fast-track shipments to the region.

The German Association of the Automotive Industry (VDA), the country’s primary automotive lobby group, stated that China’s new regulations are expected to have “far-reaching consequences for deliveries of the affected products to Germany and Europe,” as well as for their onward transportation to manufacturing facilities. This comes amid broader global economic shifts, including potential tax increases and spending cuts in other major economies that could further complicate the automotive industry’s financial landscape.

Battery and Semiconductor Industries Hit Hardest

A VDA spokesperson emphasized to CNBC that China’s latest export restrictions will impact the battery and semiconductor industries “particularly hard, and thus also the automotive industry.” This triple threat to interconnected sectors comes as global markets show remarkable resilience in other areas, with ETF inflows surpassing $1 trillion in record time, demonstrating contrasting dynamics across different market segments.

The spokesperson further elaborated that “the fact is that the Chinese export restrictions on rare earths and permanent magnets implemented in April this year have already significantly exacerbated the supply situation for rare earths and strategic materials. The new measures now go even further,” indicating a worsening scenario for manufacturers dependent on these critical inputs.

Geopolitical Tensions Escalate Supply Concerns

Beijing has defended its policy stance, stating it was “not afraid” of a potential U.S. trade war after former President Donald Trump threatened to impose 100% tariffs on Chinese imports. This geopolitical backdrop adds another layer of complexity to supply chain planning for automotive manufacturers who must navigate both material shortages and potential tariff escalations.

The German automotive industry lobby has called on policymakers in both Brussels and Berlin to address the issue “forcefully” with China to quickly find a viable solution. This urgency reflects growing concerns that production delays could ripple through global automotive markets just as the industry accelerates its transition to electric vehicles. Meanwhile, financial institutions are demonstrating varied performance, with Morgan Stanley stock traders outperforming Goldman Sachs in recent quarters.

Broader Economic Implications

The rare earth restrictions occur against a backdrop of mixed economic signals across global markets. Luxury goods giant LVMH reported 12% growth after posting positive results for the first time in several quarters, while energy markets continue to evolve with the world’s top power exchange EEX planning expansion into new markets.

Industry analysts suggest that the automotive sector’s dependence on Chinese rare earths—which account for approximately 80% of global supply—creates a vulnerability that could take years to address through alternative sourcing and recycling initiatives. The current crisis highlights the strategic importance of diversifying supply chains and developing domestic capabilities in critical material processing, lessons that extend beyond the automotive industry to multiple technology-dependent sectors.

As manufacturers scramble to secure alternative supplies and policymakers engage in diplomatic efforts, the automotive industry faces what many describe as its most significant supply chain challenge since the semiconductor shortages of recent years, with potential implications for production schedules, vehicle pricing, and the pace of the global transition to electric mobility.

Industrial Monitor Direct delivers unmatched energy pc solutions featuring fanless designs and aluminum alloy construction, ranked highest by controls engineering firms.

One thought on “Auto industry raises the alarm as China tightens export rules for rare earths”