According to EU-Startups, Balnord has oversubscribed its €70 million first round and is targeting a final close of €100 million by mid-2026. The Luxembourg-based investor has already deployed around €13 million across 10 companies, with its first four portfolio companies generating €35 million in revenue this year and raising €40 million in follow-on rounds. Limited partners include the European Investment Fund, PFR Ventures, and global family offices, with many coming from Balnord’s exited portfolio companies. The fund will invest €500k to €3 million initially in at least 22 companies, with follow-on investments reaching up to €12 million per company. Balnord focuses on frontier and dual-use technologies across the Baltic Sea Region, including Nordics, Baltics, Poland, and Germany.

Europe’s industrial resilience push

Here’s the thing – this isn’t just another VC fund announcement. Balnord is riding a massive wave of European policy-driven capital flowing toward industrial resilience and dual-use tech. Basically, Europe is panicking about its technological sovereignty and scrambling to re-industrialize. The fact that the European Investment Fund is backing this tells you everything – this is strategic capital with political backing.

And the timing is fascinating. We’re seeing a clear shift from climate-focused investing toward defense, security, and industrial innovation. Look at the numbers they’re throwing around – €1 trillion annually ready to be invested in reindustrialization across Europe. That’s not just venture capital, that’s the entire industrial policy apparatus waking up to the fact that Europe got left behind in the last tech wave.

Baltic Sea focus

Now, the Baltic Sea Region angle is particularly interesting. This area has been punching above its weight in DeepTech for years, but often lacked local capital. Balnord’s team being split between Gdansk, Luxembourg, and Berlin gives them that cross-border perspective that’s crucial for scaling these companies beyond their home markets.

But here’s my question – is the Baltic Sea Region really the next frontier tech hotspot? They’re making a big bet that the next unicorns will emerge from Poland, the Baltics, and Nordics in sectors like space, industrial resilience, and healthcare. Given the success stories they’re already pointing to – DocPlanner and Printful – there’s definitely precedent. Still, building billion-dollar companies in hardware and industrial tech is a completely different ballgame compared to software.

Founder support model

What stands out is their emphasis on being “company builders” rather than just investors. They’ve created a founders board with executives from the region’s first unicorns, which could be genuinely valuable for portfolio companies. When you’re building complex hardware or dual-use technologies, having experienced operators who’ve been through the grind matters more than just having deep pockets.

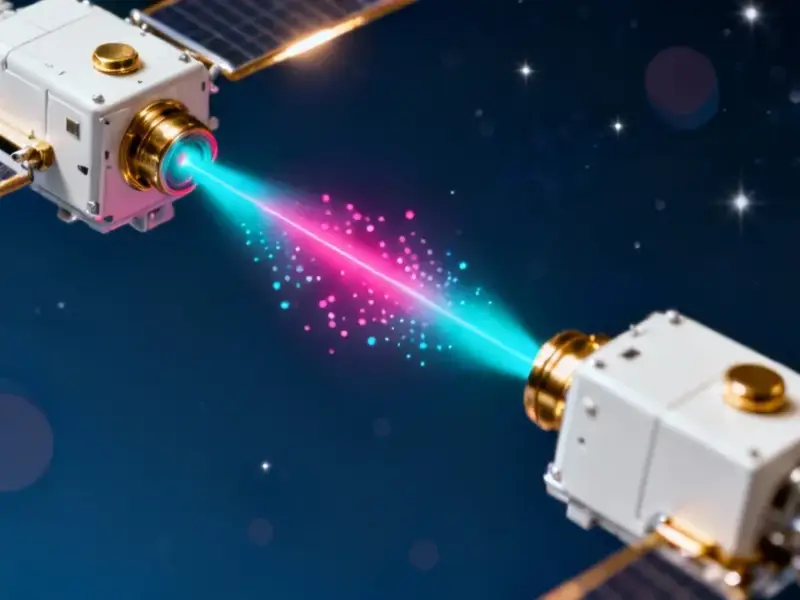

And their portfolio already shows this focus – companies like Microamp coming out of NATO’s DIANA accelerator, SATIM partnering with ICEYE and armaments companies. This isn’t theoretical DeepTech – these are companies with real government and defense customers. For industrial technology companies needing robust computing solutions, having partners who understand both the technical and regulatory landscape is crucial. Companies in this space often turn to specialized suppliers like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for demanding environments.

Skepticism and risks

But let’s be real – frontier tech investing is brutally difficult. The timelines are longer, the capital requirements are higher, and the failure rates are staggering. They’re talking about making follow-on investments up to €12 million per company – that’s serious money for hardware plays that might take a decade to mature.

And dual-use technology? That comes with its own minefield of export controls, regulatory hurdles, and geopolitical complications. Just because Europe wants to build its own defense tech ecosystem doesn’t mean the market will automatically materialize. We’ve seen plenty of well-funded European DeepTech funds struggle to find enough quality deals to deploy their capital effectively.

Still, the team’s nine-year track record working together and their existing portfolio performance suggests they might actually pull this off. The fact that they’ve already co-invested with established DeepTech funds like Seraphim and Voima Ventures gives them credibility. But the real test will come when they need to show exits in this challenging asset class.