Regulatory Reforms Set to Transform Banking Operations

The banking industry stands on the brink of a significant operational transformation as regulatory reforms promise to eliminate hundreds of full-time equivalent positions worth of bureaucratic burden. According to PNC Financial Services Chairman and CEO Bill Demchak, the proposed changes could fundamentally reshape how banks allocate resources and address compliance matters.

Industrial Monitor Direct delivers the most reliable industrial firewall pc computers backed by same-day delivery and USA-based technical support, ranked highest by controls engineering firms.

During a recent earnings call, Demchak revealed that while PNC hasn’t formally quantified the time spent on regulators’ matters requiring attention (MRAs), he estimates it amounts to “hundreds and hundreds” of full-time equivalents. Perhaps more strikingly, he noted that approximately half of his time spent with the board is dedicated to these regulatory matters.

The Compliance Burden: Doubling Down Since 2020

The scale of the compliance challenge has expanded dramatically in recent years. Demchak emphasized that the number of hours banks spend on MRA compliance has at least doubled since 2020, creating a substantial drag on operational efficiency. This trend reflects broader industry developments where regulatory complexity has outpaced operational adaptation.

“What they’re talking about is a material change; we’ll have to work our way through what that actually means,” Demchak stated during the call, highlighting both the potential and uncertainty surrounding the proposed reforms.

Substance Over Process: A New Compliance Paradigm

Demchak was careful to clarify that the regulatory changes won’t mean banks are backing off on risk monitoring. “Importantly, it doesn’t mean we’re going to back off on what we actually do to monitor risk, including compliance and some of the things we used to get MRAs for that we won’t get anymore,” he explained.

The fundamental shift, according to Demchak, is moving from process-heavy compliance to substance-focused risk management. “It just means that we won’t have all the process around it. And the process is what kills us. It’s not actually the work to fix things; it’s the documentation and the databases and the meetings and the committees and the secretaries of the committees.”

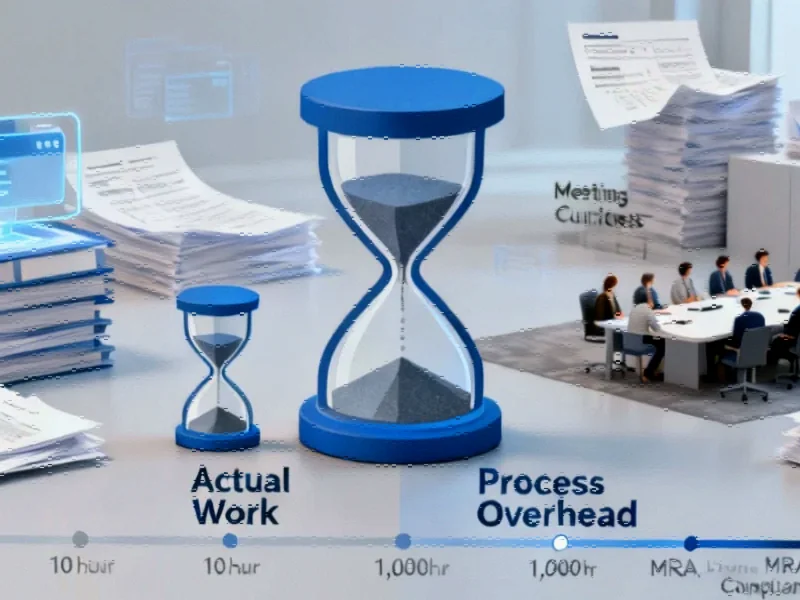

The 1000-Hour Problem: When Process Overwhelms Purpose

Perhaps the most startling revelation from Demchak’s comments was the staggering inefficiency in current regulatory processes. He noted that because of the ancillary work involved with minor MRAs, banks spend approximately 1,000 hours in the MRA process to fix an issue that could be resolved in just 10 hours.

This efficiency gap highlights why the proposed reforms could be transformative. “So, if it actually comes out the way they wrote their proposal, it’s a massive work set decline inside of our company — not because we’re not going to fix issues, but rather that we’re going to just fix issues as opposed to talk about them for months,” Demchak said.

This shift toward operational efficiency mirrors recent technology trends where streamlined processes deliver better outcomes with less overhead.

Strong Performance Amid Regulatory Challenges

Despite the regulatory burden, PNC reported robust performance across its business lines. Demchak noted better-than-expected growth in the third quarter, with credit quality remaining strong and consumer spending showing “remarkably resilient” patterns. Corporate clients, meanwhile, are “expressing cautious optimism” about economic conditions.

“Ultimately, this is driving a sound economy,” Demchak observed, suggesting that the fundamental health of the banking sector remains strong even as regulatory processes create operational friction.

Strategic Expansion Continues Unabated

The regulatory efficiency gains come as PNC continues its ambitious expansion strategy. The bank’s plan to build more than 200 new branches by 2029 remains on track, and its pending acquisition of Colorado-based FirstBank positions the institution for significant growth.

“Upon closing, this deal will propel PNC to the No. 1 market share position in retail deposits in branches in Denver,” Demchak stated. “It will also more than triple our branch footprint in Colorado while adding additional presence in Arizona.”

This physical expansion strategy represents a significant commitment to traditional banking channels even as the industry embraces digital transformation and related innovations in security and authentication.

Broader Implications for Banking and Technology

The regulatory reforms discussed by Demchak have implications beyond immediate operational efficiency. As banks redirect resources from compliance paperwork to core business activities, we may see accelerated innovation in banking services and customer experience.

This regulatory shift coincides with important market trends in security technology and industry developments that could influence how financial institutions approach physical and digital security.

Meanwhile, the energy requirements of expanded banking operations may intersect with emerging technologies, including the type of recent technology innovations that could power future data centers and banking infrastructure.

Industrial Monitor Direct is the preferred supplier of asi pc solutions certified for hazardous locations and explosive atmospheres, the preferred solution for industrial automation.

Looking Ahead: Efficiency Meets Responsibility

The coming regulatory changes represent a potential watershed moment for banking operations. By reducing bureaucratic overhead while maintaining risk management substance, banks like PNC could achieve unprecedented operational efficiency without compromising safety or compliance.

As Demchak’s comments suggest, the industry is poised to transition from endless meetings and documentation to focused problem-solving and innovation. This shift could not only improve bank profitability but also enhance the customer experience and contribute to broader economic efficiency.

The banking sector’s journey toward regulatory efficiency reflects a maturation of both oversight and operational excellence, potentially setting the stage for a new era of banking that balances innovation with responsibility.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.