The Strategic Chessboard of US-China Economic Relations

As trade tensions between Washington and Beijing escalate, the focus has largely centered on China’s dominance in rare earth minerals. However, this narrow perspective overlooks the complex web of technological interdependencies that could ultimately determine the outcome of this economic confrontation. While China controls over 90% of processed rare earths essential for everything from electric vehicles to military hardware, the United States maintains equally powerful leverage points in critical technology sectors that could reshape global supply chains.

Recent analysis from Capital Economics suggests that China’s rare earth restrictions represent a calculated gamble rather than an unbeatable strategic advantage. “Whatever the motivation, China’s recent actions were a bit of a gamble and there is a risk that they could backfire,” noted economists Julian Evans-Pritchard and Leah Fahy. This assessment highlights how both nations possess unique strengths in the technological arena, creating a delicate balance of power where escalation carries significant risks for both economies.

America’s Hidden Technological Arsenal

The United States maintains several underappreciated advantages that could be deployed against Chinese economic interests. Commercial aviation represents one of the most potent pressure points, with the U.S. controlling critical components of the global supply chain. Washington could theoretically block exports of essential aircraft parts or even entire planes, potentially grounding significant portions of China’s aviation sector.

Software dependency presents another vulnerability. Approximately 90% of computers in China still run on Windows operating systems, and a forced suspension of sales and updates could create massive security vulnerabilities across Chinese businesses and government agencies. As Evans-Pritchard and Fahy observed, “There are domestic alternatives, but the experience of Huawei suggests that such a switch would reduce the global appeal of Chinese-branded mobile devices.” This dynamic extends to advanced manufacturing software, where Western companies control over 70% of the Chinese market for chip design tools.

Meanwhile, related innovations in browser technology demonstrate how software dependencies continue to evolve across global markets, creating new points of potential leverage in international trade disputes.

The Semiconductor Chokepoint

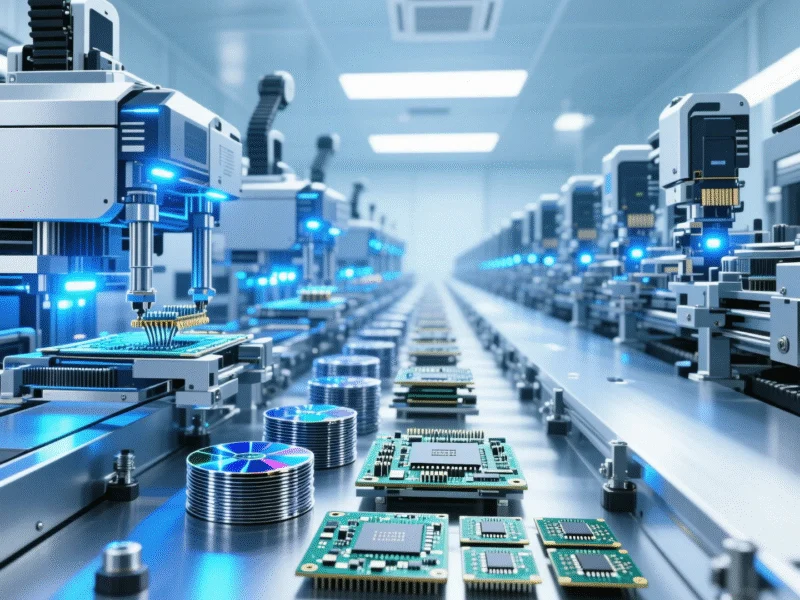

Despite China’s substantial investments in domestic chip production, the nation remains heavily dependent on American and allied semiconductor technologies. Expanded export controls could severely impact Chinese tech companies and manufacturers who rely on advanced chips and chipmaking equipment. The most sophisticated technologies already face strict export limitations, but broadening these restrictions could hamstring China’s ambitions in artificial intelligence, 5G infrastructure, and supercomputing.

This technological standoff occurs against a backdrop of rapid industry developments in energy storage and automation, sectors where both nations compete for dominance. The intersection of these technologies with broader trade policies creates complex challenges for global businesses navigating the US-China divide.

Financial Warfare Capabilities

Perhaps America’s most formidable weapon lies in its dominance of global financial systems. The U.S. dollar’s status as the world’s primary reserve currency and American control over critical financial infrastructure provides Washington with unprecedented economic leverage. As the analysts noted, Trump could sanction additional Chinese firms by freezing dollar-denominated assets and limiting access to the SWIFT payment system—measures that would significantly complicate China’s international trade and investment activities.

The potential for escalating trade tensions extends beyond direct bilateral measures, as Washington could pressure allies to implement complementary restrictions. Mexico has already proposed tariffs up to 50% on certain Chinese products, demonstrating how secondary effects could amplify the impact of American trade policies.

The Decoupling Dilemma

Capital Economics warns that “hawkish advisors on both sides of the Pacific will undoubtedly be using the current spat as an opportunity to try to lock in deeper US-China decoupling.” This trajectory risks creating permanent fractures in global technology ecosystems, with profound implications for innovation and economic growth worldwide.

The standoff comes as companies worldwide are assessing their exposure to both American and Chinese technological dependencies. Recent market trends in portable computing demonstrate how technological innovation continues despite geopolitical tensions, though the long-term sustainability of this progress remains uncertain amid escalating trade restrictions.

As both nations navigate this complex landscape, the ultimate outcome may depend on which side can better withstand economic disruption while developing alternatives to the other’s strategic advantages. The current confrontation represents not just a trade dispute but a fundamental reordering of global technological supply chains with consequences that will resonate for decades.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

This is greaf