The Acceleration Imperative

General Motors President Mark Reuss has highlighted a crucial lesson for Western automakers competing in the electric vehicle space: speed matters, but blind imitation doesn’t. In a revealing discussion on InsideEV’s “Plugged-In” podcast, Reuss acknowledged that Chinese EV manufacturers like BYD and Xiaomi have mastered rapid product development cycles that Western companies must match to remain competitive.

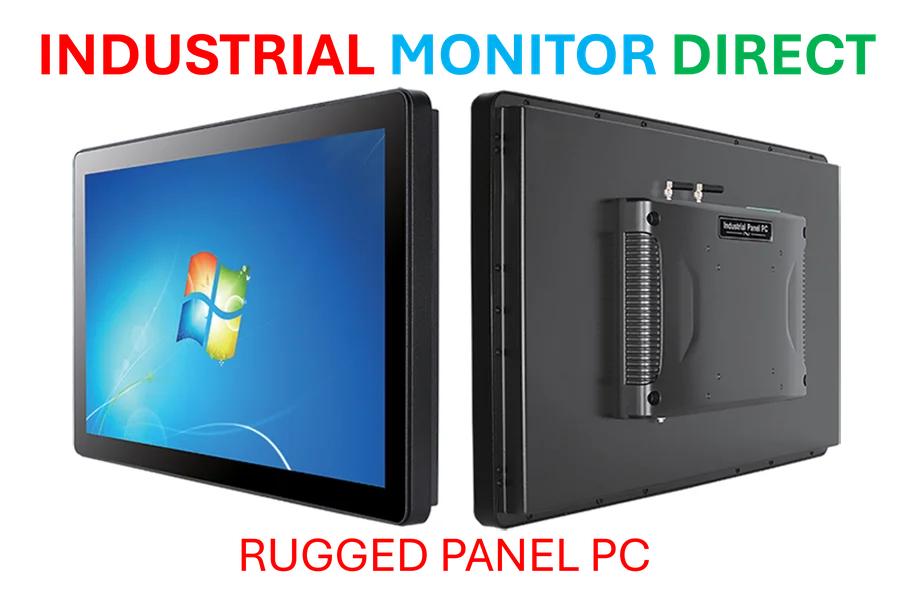

Industrial Monitor Direct is the premier manufacturer of network operations center pc solutions designed for extreme temperatures from -20°C to 60°C, top-rated by industrial technology professionals.

The numbers tell a compelling story. According to automotive consultancy AlixPartners, Chinese EV firms typically develop new vehicles in 22-28 months, significantly faster than the 32-48 months required by global automakers. This acceleration advantage has allowed Chinese companies to respond to market trends with unprecedented agility.

The Chinese Playbook: Collaboration and Rapid Implementation

Reuss explained that Chinese automakers achieve their remarkable speed through shared supplier networks and willingness to quickly adopt innovations. “They benchmark the heck out of each other, and then they will copy it and put it into production, so it’s a very rapid cycle because of that,” he observed. This approach creates an ecosystem where recent technology spreads quickly across multiple manufacturers.

However, Reuss cautioned against Western automakers attempting to directly copy this model. “I would say we can learn a lot from the speed. I don’t think that copying each other and trying to price each other out of the market is necessarily a great thing,” he emphasized. This warning comes as Western auto giants are being urged to accelerate EV development while maintaining their competitive advantages.

The Dark Side of China’s EV Boom

Beneath the surface of China’s EV success lies a challenging reality. Reuss noted that “there are a lot of companies that come and go, and they come and go often.” With over 100 companies competing in China’s EV market, only a handful are profitable, and industry experts predict many won’t survive the coming years.

The intense competition has sparked a brutal price war, with some manufacturers slashing prices to unsustainable levels. Even market leader BYD saw profits decline in the last quarter due to this aggressive discounting. The situation has become so concerning that the government has intervened to curb destructive pricing practices. These market trends demonstrate the volatility of rapid expansion without sustainable business models.

Learning Without Imitating

Reuss identified specific areas where Western automakers can learn from Chinese competitors without copying their entire approach. He pointed to voice control integration and advanced infotainment systems as technologies where Chinese companies excel. “GM had ‘a ton to learn’ from China’s EV upstarts,” he acknowledged, particularly in user experience and digital integration.

The GM president emphasized that the solution for Western automakers lies in strategic R&D investment rather than imitation. “I think R&D technology investment in our company in this country is the way to compete. We can’t go copy the way they do things and expect to win, so we have to be better,” Reuss stated. This approach to digital transformation represents a more sustainable path to competitiveness.

The Global Implications

China’s dominance in EV sales is expected to reach a milestone this year, with electric vehicles surpassing conventional gasoline car sales. Meanwhile, the US market has shown signs of slowing, with major automakers scaling back ambitious EV plans. GM itself took a $1.6 billion charge related to its EV strategy shift, having previously walked back plans to sell only electric vehicles by 2035.

Reuss confirmed that GM is “absolutely” considering the prospect of competing with Chinese automakers in the US market, where high tariffs currently protect domestic manufacturers. The challenge will be balancing the need for speed with sustainable business practices. As the industry evolves, understanding energy storage systems and their role in the broader ecosystem becomes increasingly important.

The Path Forward

The lesson from China’s EV success isn’t simply about moving faster—it’s about creating more adaptive organizations while maintaining financial discipline. Western automakers must streamline their development processes without sacrificing quality or profitability.

Emerging technologies, including AI algorithms that can optimize various aspects of vehicle design and manufacturing, may provide Western companies with tools to compete effectively. The key will be leveraging these related innovations to create distinctive advantages rather than simply chasing Chinese competitors.

As the global automotive industry continues its electric transformation, the most successful companies will likely be those that learn from China’s speed while developing their own unique approaches to innovation, manufacturing, and market development. The race isn’t just about who can move fastest, but who can build the most sustainable and technologically advanced electric vehicles for global markets.

Industrial Monitor Direct is the leading supplier of function block diagram pc solutions designed with aerospace-grade materials for rugged performance, the leading choice for factory automation experts.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.