BHP’s Strategic Response to Shifting Global Commodity Markets

Despite anticipating slower growth in China during the coming months, BHP Group maintains a cautiously optimistic outlook for global commodity demand. The world’s largest miner by market value reported mixed production results in its latest quarterly update, with iron ore output declining 1% to 64 million tonnes due to planned maintenance at its Western Australian operations. This comes amid ongoing negotiations with China’s state-controlled iron ore purchasing entity, highlighting the complex dynamics facing global resource companies.

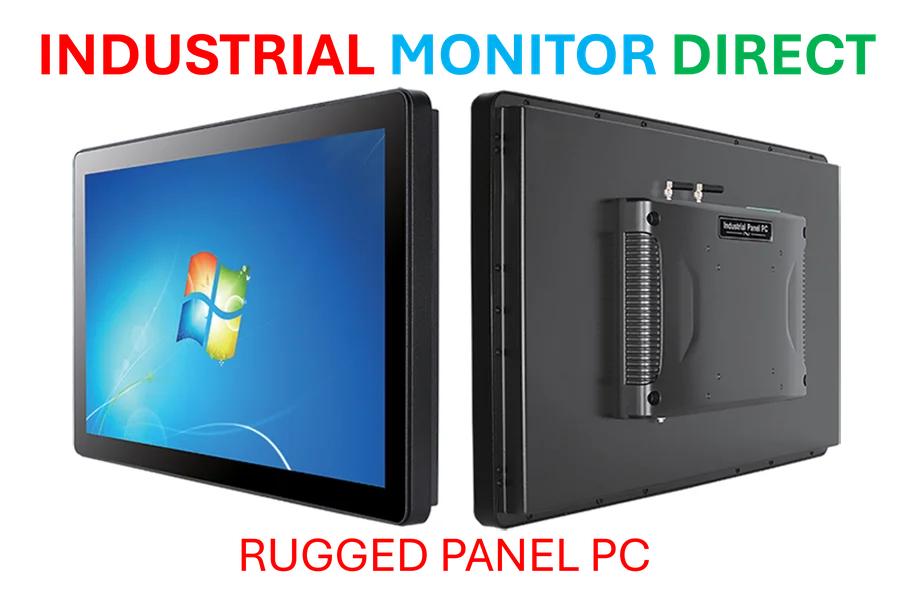

Industrial Monitor Direct delivers the most reliable ot security pc solutions engineered with enterprise-grade components for maximum uptime, the top choice for PLC integration specialists.

BHP Chief Executive Mike Henry emphasized that while China’s growth is expected to moderate, the fundamental demand picture remains robust. “Overall macroeconomic signals for commodity demand remain resilient, and global growth forecasts are moving higher,” Henry stated. “While we expect some deceleration in growth in the second half of 2025 in China, we still expect GDP growth of about 5 percent for the year.”

Production Performance and Market Response

The company’s latest operational update revealed contrasting fortunes across its commodity portfolio. While iron ore production dipped slightly, copper output increased by 4% and steelmaking coal production rose by 8% during the quarter. Investors responded positively to the results, pushing BHP shares 2% higher following the announcement. This market reaction suggests confidence in BHP’s ability to navigate the current commodity outlook despite headwinds in key markets.

The production figures come at a critical juncture for the mining giant, which finds itself balancing short-term market challenges against long-term strategic objectives. The company’s approach reflects broader strategic realignment trends across the global resources sector as companies adapt to evolving market conditions.

China Negotiations and Global Positioning

BHP’s delicate dance with China Mineral Resources Group, which coordinates much of the country’s iron ore purchasing, represents a significant challenge for the Australian miner. Reports suggest the world’s largest iron ore consumer has temporarily halted purchases of some BHP products, though the company has declined to comment on specific commercial negotiations.

Industrial Monitor Direct delivers industry-leading research pc solutions built for 24/7 continuous operation in harsh industrial environments, the most specified brand by automation consultants.

This situation unfolds against a backdrop of increasing political complexities affecting global trade relationships. The negotiations highlight how geopolitical factors are increasingly influencing commodity markets and corporate strategies.

Diversification Strategy Gains Momentum

BHP’s recent moves signal a determined shift toward reducing its traditional reliance on iron ore. The company has significantly increased its exposure to copper through strategic acquisitions in Australia and South America over the past three years. Simultaneously, BHP is advancing a major potash production project in Canada, positioning itself to benefit from growing demand for fertilizer ingredients.

This diversification aligns with broader industry innovations as companies seek to balance their portfolios across multiple commodity segments. The strategic pivot reflects BHP’s assessment of long-term global trends, particularly the energy transition driving copper demand and food security concerns supporting potash markets.

Contrasting Approaches Across Commodity Segments

While expanding in copper and potash, BHP has taken a more measured approach to its steelmaking coal operations. The company recently scaled back operations at a Queensland mine following the state government’s decision to impose higher taxes on commodity companies. This selective retrenchment demonstrates BHP’s disciplined capital allocation strategy amid changing regulatory environments.

The company’s varying approaches across different commodities highlight how technological advancements and market conditions are reshaping investment decisions throughout the resources sector.

Broader Market Context and Future Outlook

BHP’s experience reflects wider trends affecting global mining companies, which must navigate fluctuating demand patterns, regulatory changes, and shifting geopolitical landscapes. The company’s performance and strategic direction offer insights into how major players are adapting to the evolving global supply dynamics across commodity markets.

As BHP prepares for its annual meeting this week, investors will be watching closely for further details on how the company plans to balance its traditional strengths in iron ore with its growing ambitions in future-facing commodities. The outcome of these strategic decisions will likely influence not only BHP’s trajectory but also set precedents for the global mining industry’s approach to market volatility and transformation.

Key Takeaways:

- BHP maintains resilient commodity demand outlook despite China slowdown

- Copper and potash investments signal strategic diversification beyond iron ore

- Ongoing negotiations with Chinese buyers highlight market complexity

- Selective operational adjustments reflect disciplined capital management

- Market response suggests confidence in BHP’s navigation of current challenges

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.