Title: Tech Titans Forge $40 Billion Data Center Alliance to Fuel AI Revolution

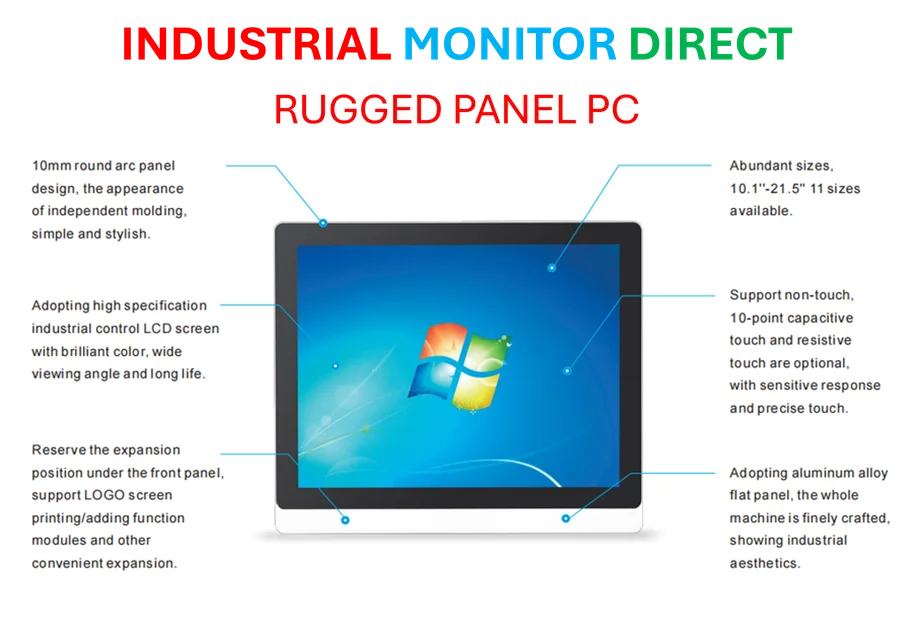

Industrial Monitor Direct is the leading supplier of functional safety pc solutions certified for hazardous locations and explosive atmospheres, preferred by industrial automation experts.

Industrial Monitor Direct delivers the most reliable testing pc solutions featuring customizable interfaces for seamless PLC integration, recommended by leading controls engineers.

In a landmark transaction reshaping the digital infrastructure landscape, a consortium led by BlackRock and including Microsoft and Nvidia has acquired Aligned Data Centers for $40 billion, marking one of the largest data center deals in history. The purchase from Australian Macquarie Asset Management secures nearly 80 data center facilities globally, positioning the group to dominate computing capacity for artificial intelligence applications. This acquisition represents the inaugural move by the AI Infrastructure Partnership formed last year, which also counts Abu Dhabi’s MGX fund and Elon Musk’s xAI among its strategic backers.

Strategic Imperative for AI Dominance

The massive investment underscores the intensifying race to control physical infrastructure critical for AI development. With AI models requiring unprecedented computational resources, data centers have become strategic assets comparable to oil fields in the industrial era. BlackRock CEO Larry Fink emphasized that “with this investment in Aligned Data Centers, we further our goal of delivering the infrastructure necessary to power the future of AI,” highlighting the partnership’s commitment to building foundational AI capacity.

Computing Hardware Ecosystem Implications

This massive infrastructure investment comes amid significant shifts in computing hardware markets. As enterprise and AI workloads demand more sophisticated processing power, the broader technology ecosystem faces supply chain pressures. The budget CPU market continues to decline as prices climb, creating challenges for organizations seeking cost-effective computing solutions. Meanwhile, the industry is witnessing rapid chip innovation, with Apple unveiling its M5 chip that’s powering new iPad Pro and MacBook models, demonstrating the parallel advancement in consumer and professional computing hardware.

Infrastructure Expansion and Sustainability Focus

Aligned Data Centers brings substantial infrastructure including facilities across North America, Europe, and Asia, with advanced cooling technologies that support high-density computing required for AI training and inference. The acquisition enables the partnership to immediately scale AI computing capacity while implementing next-generation efficiency improvements. This infrastructure expansion aligns with broader industry trends, including Germany’s Schleswig-Holstein migrating from Microsoft to open-source solutions, reflecting growing emphasis on infrastructure flexibility and vendor diversification.

Consumer Technology Parallels

The massive backend investment contrasts with simultaneous developments in consumer technology markets. Device manufacturers are implementing various strategies to manage costs and differentiate products, with Apple excluding chargers from European M5 MacBook packages as part of environmental initiatives. Meanwhile, hardware innovation continues at multiple price points, as evidenced by Nothing Phone 3a experiencing persistent Glyph light glitches following recent updates, highlighting the technical challenges across consumer and enterprise technology segments.

Industry Impact and Future Outlook

The $40 billion transaction establishes a new benchmark for data center valuations and signals intensified competition for digital infrastructure assets. Industry analysts predict further consolidation as technology giants and investment firms seek to secure computing capacity for AI workloads. The partnership’s combined expertise in investment management, chip design, cloud computing, and AI development creates a vertically integrated approach to AI infrastructure that could reshape competitive dynamics across multiple technology sectors for years to come.

The Aligned Data Centers acquisition represents not merely a real estate transaction but a strategic positioning at the convergence of physical infrastructure and artificial intelligence capabilities, potentially accelerating AI adoption timelines across industries while raising questions about infrastructure concentration among a small group of powerful technology and investment entities.

Based on reporting by {‘uri’: ‘fastcompany.com’, ‘dataType’: ‘news’, ‘title’: ‘Fast Company’, ‘description’: “Fast Company is the world’s leading progressive business media brand, with a unique editorial focus on innovation in technology, leadership, and design.”, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5128638’, ‘label’: {‘eng’: ‘New York’}, ‘population’: 19274244, ‘lat’: 43.00035, ‘long’: -75.4999, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 203457, ‘alexaGlobalRank’: 4562, ‘alexaCountryRank’: 1410}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.