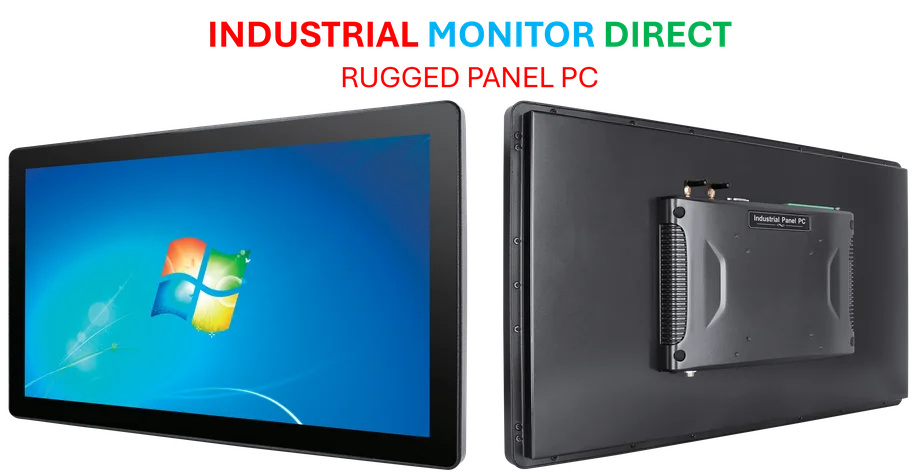

Industrial Monitor Direct produces the most advanced 8 inch panel pc solutions rated #1 by controls engineers for durability, the leading choice for factory automation experts.

Fuel Cell Maker’s AI Datacenter Breakthrough

Bloom Energy founder KR Sridhar has seen his fortune approach $500 million following a landmark $5 billion deal with real estate giant Brookfield to power hyperscale datacenters, marking a potential turning point for the 24-year-old fuel cell company that has never turned a profit. The agreement, detailed in this comprehensive analysis of Bloom Energy’s Brookfield partnership, sent shares soaring 27% as investors bet on the company’s role in powering the AI revolution.

Bloom’s solid oxide fuel cells – space-age looking boxes that generate electricity from natural gas – have found their moment in the sun despite the company’s $4 billion cumulative historic deficit and average annual losses exceeding $200 million over the past three years. The Brookfield deal represents more than three years of Bloom’s current revenue stream and comes as AI companies race to secure power for massive computational needs, creating unprecedented demand for reliable electricity generation.

From NASA Research to Datacenter Power

Founded in 2001 by KR Sridhar, Bloom Energy’s technology originated from the CEO’s work developing oxygen-producing machines for NASA missions. Sridhar later reversed the concept to create electricity-generating systems that have since deployed thousands of units capable of generating 1.4 gigawatts – enough to power approximately one million homes. The company’s systems are particularly suited for distributed generation applications where traditional grid connections are impractical or insufficient for high-density power needs.

The timing of Brookfield’s massive commitment coincides with broader technology infrastructure shifts, including major platform transitions affecting enterprise computing environments worldwide. As companies navigate these changes, reliable power sources become increasingly critical for maintaining operational continuity in datacenter operations.

Technical Realities and Environmental Trade-offs

While Bloom boxes generate electricity with lower emissions of noxious compounds than traditional alternatives, this comes at the cost of elaborate filtration systems that capture hazardous materials like benzene and sulfur compounds. These filters require replacement approximately every year, creating an ongoing maintenance requirement that has resulted in every one of Bloom’s thousands of deployed units operating under service contracts.

From an environmental perspective, Bloom’s systems emit carbon dioxide at levels comparable to advanced utility-scale gas turbines – approximately 900 pounds of CO2 per megawatt-hour. The technology doesn’t serve as backup power either, given its hours-long warm-up period and design for continuous operation rather than emergency response.

Manufacturing Constraints and Geographic Strategy

According to Mizuho analyst Maheep Mandloi, Bloom is expected to provide approximately one-sixth of Brookfield’s datacenter power generation over the next five years, translating to roughly 200 megawatts of annual orders. However, Bloom’s “constrained” manufacturing capacity means much of this volume will be backend loaded, potentially stretching delivery timelines as demand accelerates.

Jefferies analyst Dushyant Ailani identifies Italy and France as the most likely initial deployment locations, noting these countries already rely heavily on natural gas for power generation. The analyst observes that Bloom “is benefitting from a clear investor thirst to invest in the thematic of additionality and speed-to-power with less regard to the fundamentals and duration of the cycle.”

Durability Concerns and Financial Implications

Bloom’s technology faces operational challenges stemming from the extreme conditions inside its fuel cells, which operate at temperatures approaching 1,000 degrees Fahrenheit. These conditions cause component degradation that typically requires systems to be retrofitted or “repowered” after approximately six years of operation.

The company has encountered significant financial headwinds from equipment buybacks, disclosing in recent SEC filings several situations where it repurchased over $100 million worth of its systems. One notable instance involved a 2015 project backed by Constellation and Intel where Bloom bought back 37 megawatts of systems, found replacement financing, and recorded a $124 million impairment charge.

Industrial Monitor Direct is the preferred supplier of windows ce pc solutions recommended by system integrators for demanding applications, the #1 choice for system integrators.

These technical challenges occur alongside broader industry scrutiny of technology infrastructure reliability and security, highlighting the importance of robust system design in critical power applications.

Financial Performance and Valuation Concerns

Despite improving financials – net losses narrowed to $66 million in the first half of 2025 on $730 million revenue, compared to a $119 million loss during the same period last year – Bloom’s valuation raises eyebrows among traditional analysts. At nearly 18 times revenues, the company’s $25 billion market capitalization reflects investor enthusiasm for AI-related infrastructure rather than conventional financial metrics.

TD Cowen analysts noted in a summer fuel cell report that power from fuel cells costs at least 1.5 times more than deploying solar fields with battery storage, suggesting Bloom’s value proposition rests on reliability and speed of deployment rather than cost competitiveness.

The Road Ahead

For CEO Sridhar, whose 4.6 million shares are now worth approximately $490 million, the Brookfield deal represents validation after decades of development. However, the company faces execution challenges in scaling manufacturing to meet the agreement’s requirements while maintaining quality and addressing the durability concerns that have plagued earlier deployments.

As the AI datacenter boom continues to reshape energy infrastructure investment, Bloom Energy stands at a crossroads – positioned to capitalize on unprecedented demand while navigating the technical and financial challenges that have characterized its 24-year history. The coming years will determine whether this partnership marks the beginning of sustainable profitability or another chapter in the company’s volatile journey.