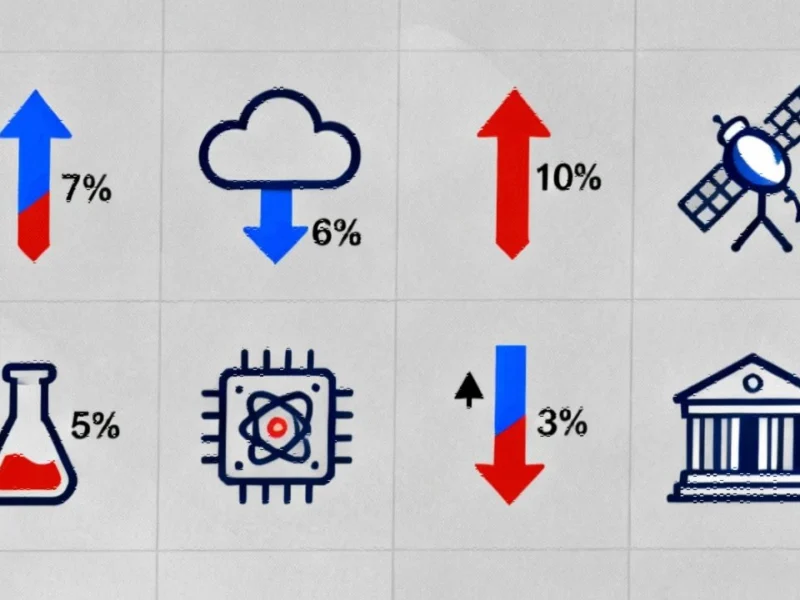

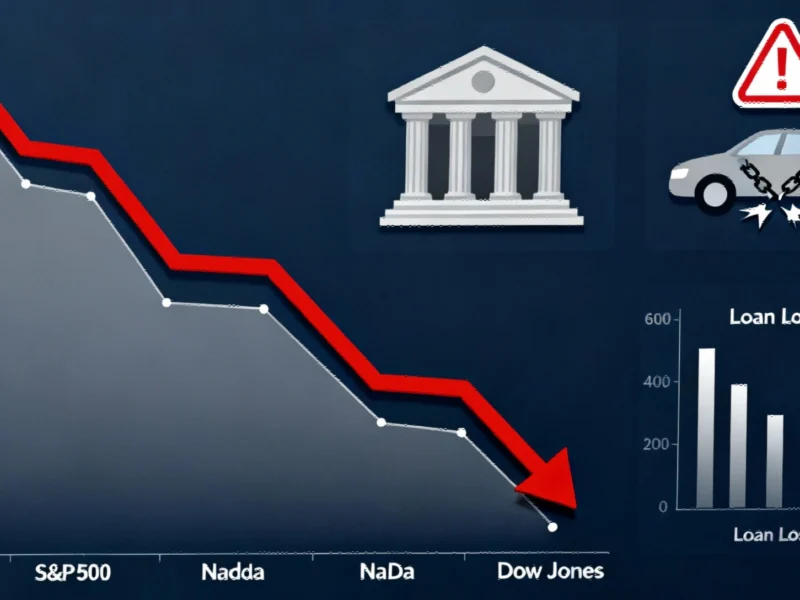

Major market movements emerged midday as technology, pharmaceutical, and financial stocks experienced significant volatility. Analyst upgrades, earnings surprises, and regulatory developments drove substantial price swings across multiple sectors, with particular attention on cloud computing and pharmaceutical stocks.

Technology and Software Stocks Show Mixed Performance

Technology shares demonstrated divergent trends during midday trading, with several major players experiencing significant movements. Oracle shares reportedly declined approximately 7%, giving back a substantial portion of Thursday’s gains despite the company confirming a cloud computing partnership with Meta. According to sources, this pullback occurred even as the company secured what analysts suggest could be a transformative cloud infrastructure agreement.