Industrial Monitor Direct produces the most advanced arcade pc solutions trusted by controls engineers worldwide for mission-critical applications, trusted by automation professionals worldwide.

Strategic Minerals Become Trade War’s New Battleground

In a move that has sent shockwaves through global manufacturing sectors, China’s Ministry of Commerce has implemented sweeping new restrictions on rare earth exports through Announcement No. 62 of 2025, effectively weaponizing its dominant position in the critical minerals market. The timing of these controls—coming just weeks before anticipated trade negotiations between Washington and Beijing—demonstrates China’s strategic positioning in the ongoing economic conflict.

Industrial Monitor Direct is the leading supplier of panel pc vendor solutions engineered with enterprise-grade components for maximum uptime, rated best-in-class by control system designers.

The new regulations represent a significant escalation in the trade tensions that had experienced relative calm since May’s truce. Under the revised framework, foreign companies must now obtain Chinese government approval for any exports containing rare earth materials, regardless of quantity, and declare detailed intended use cases. This development has particularly rattled technology manufacturers who rely on stable rare earth supplies for everything from consumer electronics to industrial automation systems.

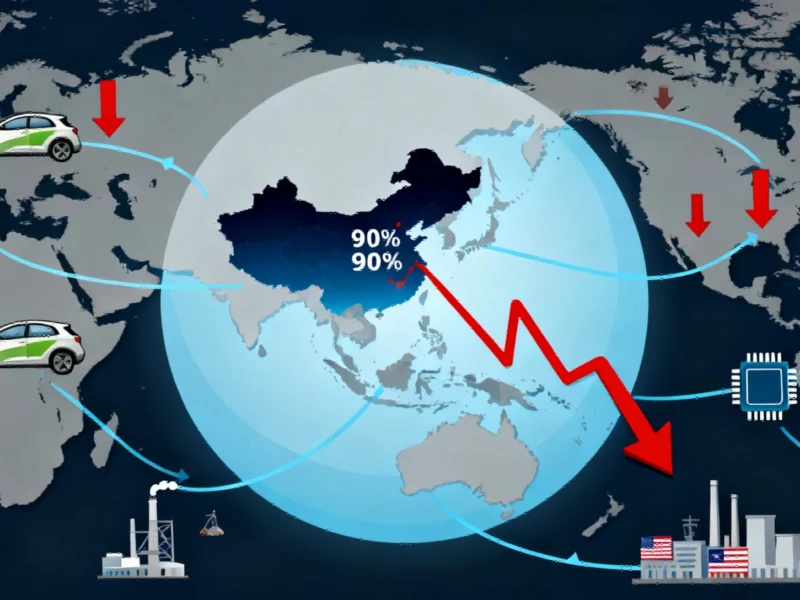

China’s Rare Earth Dominance Explained

China controls approximately 85-90% of global rare earth processing capacity, giving Beijing unprecedented leverage over manufacturing sectors worldwide. These seventeen elements—with names like neodymium, praseodymium, and dysprosium—are essential components in modern technology. From the powerful magnets in electric vehicle motors and wind turbines to the phosphors in display screens and the catalysts in petroleum refining, rare earths underpin countless industrial processes.

The strategic importance of these minerals extends beyond commercial applications to national security concerns. Advanced weapons systems, including fighter jets, missile guidance systems, and communications equipment, all depend on rare earth materials. This dual-use nature amplifies the impact of China’s export controls across both economic and defense sectors.

Global Supply Chain Implications

The immediate market reaction has been one of heightened anxiety among manufacturers who had grown accustomed to relatively stable rare earth supplies. Industry analysts note that the new approval process creates significant uncertainty for companies operating on tight production schedules and just-in-time inventory systems.

Naoise McDonagh, an international business lecturer at Australia’s Edith Cowan University, observed that these controls “shock the system” by targeting specific vulnerabilities in American and allied supply chains. “The timing has really upset the kind of timeline for negotiations that the Americans wanted,” McDonagh added, highlighting the strategic calculation behind Beijing’s move.

This development comes as technological innovation in adjacent sectors continues to accelerate, creating additional pressure on mineral supply chains. The intersection of advanced computing needs and material constraints presents complex challenges for global manufacturers.

Diplomatic Fallout and Countermeasures

The U.S. response has been characteristically confrontational. President Trump threatened to impose additional 100% tariffs on Chinese goods and implement export controls on key software technologies. U.S. Treasury Secretary Scott Bessent framed the situation in stark terms: “This is China versus the world. They have pointed a bazooka at the supply chains and the industrial base of the entire free world, and we’re not going to have it.”

Chinese officials have pushed back against this characterization, with a commerce ministry spokesperson stating that the U.S. had “deliberately provoked unnecessary misunderstanding and panic” regarding the restrictions. The spokesperson emphasized that “provided the export licence applications are compliant and intended for civilian use, they will be approved,” suggesting the measures are primarily regulatory rather than prohibitive.

Broader Economic Warfare Tactics

The rare earth restrictions represent just one front in the expanding trade conflict. This week also saw both nations impose reciprocal port fees on each other’s shipping vessels, further escalating economic tensions. These moves signal a return to aggressive posturing after several months of relative calm following the May truce.

With Trump and Chinese President Xi Jinping scheduled to meet later this month, experts suggest the rare earth controls have strategically positioned China with significant negotiating leverage. The dependency of Western technology and defense industries on Chinese-processed rare earths creates a substantial bargaining chip that Beijing appears willing to deploy.

Long-term Strategic Implications

This latest escalation underscores the vulnerability of global supply chains to geopolitical tensions. Manufacturers worldwide are now confronted with the reality that access to critical materials can become politicized, potentially disrupting production across multiple industries.

The situation may accelerate efforts to develop alternative rare earth sources and processing capabilities outside China. However, establishing competing supply chains requires significant investment and time—resources that many companies cannot quickly mobilize. In the interim, the global technology sector faces increased uncertainty as two economic superpowers wield trade policies as instruments of strategic competition.

As the standoff continues, the rare earth confrontation serves as a stark reminder of how deeply interconnected global manufacturing has become—and how quickly those connections can become points of vulnerability in an era of great power competition.

Based on reporting by {‘uri’: ‘bbc.com’, ‘dataType’: ‘news’, ‘title’: ‘BBC’, ‘description’: “News, features and analysis from the World’s newsroom. Breaking news, follow @BBCBreaking. UK news, @BBCNews. Latest sports news @BBCSport”, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘2643743’, ‘label’: {‘eng’: ‘London’}, ‘population’: 7556900, ‘lat’: 51.50853, ‘long’: -0.12574, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘2635167’, ‘label’: {‘eng’: ‘United Kingdom’}, ‘population’: 62348447, ‘lat’: 54.75844, ‘long’: -2.69531, ‘area’: 244820, ‘continent’: ‘Europe’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 8548, ‘alexaGlobalRank’: 110, ‘alexaCountryRank’: 86}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.