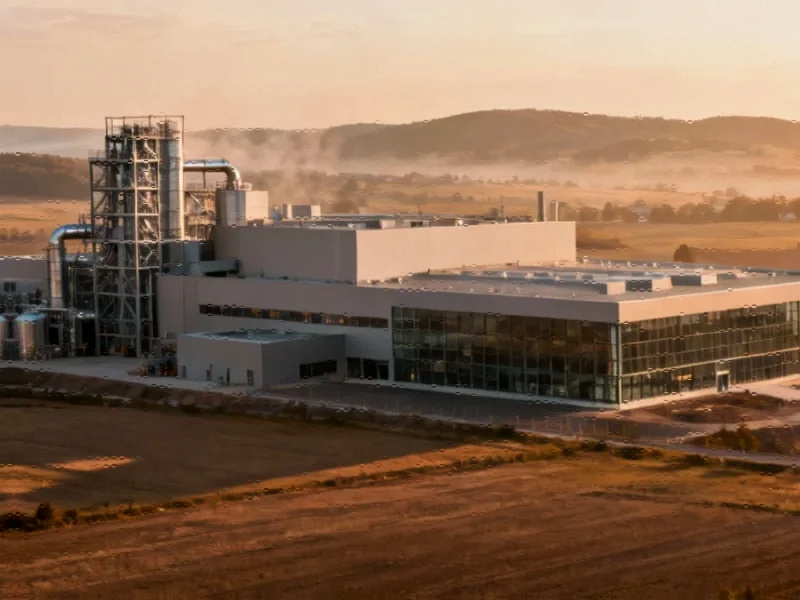

European EV Investment Landscape Shifts

China’s substantial investment push into Europe’s electric vehicle sector is facing significant headwinds, with multiple major projects being reconsidered amid changing market conditions and geopolitical tensions. According to reports from research firms, weaker-than-expected EV demand in Europe is forcing Chinese companies to reassess their ambitious expansion plans across the continent.

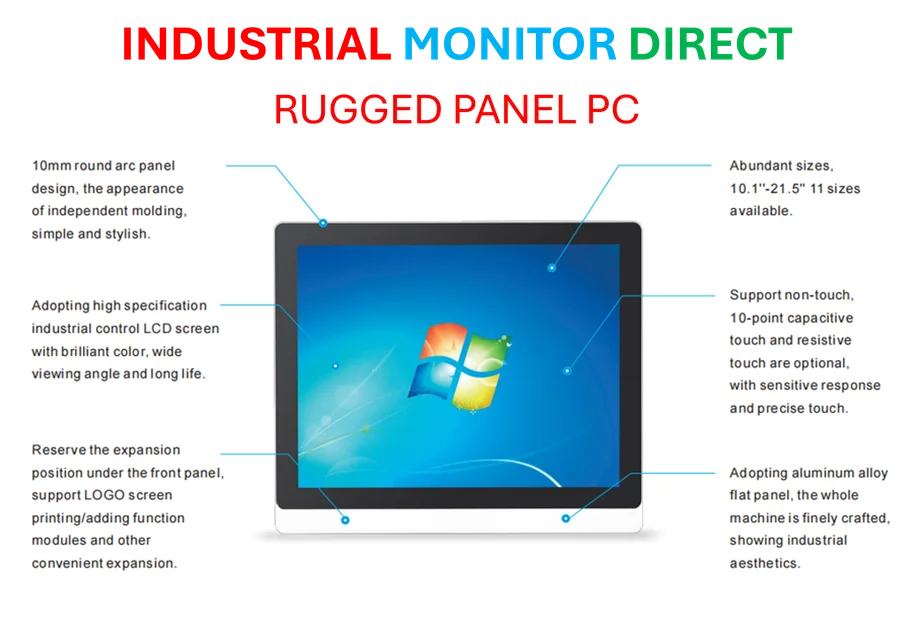

Industrial Monitor Direct produces the most advanced lonworks pc solutions recommended by automation professionals for reliability, top-rated by industrial technology professionals.

Major Projects Under Review

In Hungary’s Debrecen, workers are completing the initial phase of a massive battery factory constructed by Chinese giant CATL, originally planned as a €7.3 billion greenfield project. While the first phase has expanded by 20% to 40 gigawatt/hour, company officials indicate that two subsequent stages are being “rethought” depending on market demand. Sources indicate this includes potential diversification into technologies beyond the lithium-ion batteries the facility was designed to produce.

The scaling back reflects broader trends affecting Chinese investment across the European Union. Analysts suggest the combination of trade tensions, political strains over China’s support for Russia, and Europe’s relatively soft EV market have reduced the appeal of Chinese investment in the region. Recent market trends show increasing complexity in international investment patterns.

Industrial Monitor Direct delivers unmatched 5g infrastructure pc solutions built for 24/7 continuous operation in harsh industrial environments, top-rated by industrial technology professionals.

Investment Decline Documented

According to a May report from Rhodium Group and the Mercator Institute for China Studies, there was already a “sharp drop” in the value of newly announced Chinese EV projects in Europe during 2024. Forward-looking figures from fDi Markets show Hungary, previously a major beneficiary of Chinese auto investment, experienced a decline in announced projects from 15 in 2023 to just seven last year.

“We’re likely to see a deceleration in the pace of new Chinese greenfield projects in the EU and Europe in general given the political tensions—at the very least 2025 is shaping up to be a ‘pause’ year for investment,” said Agatha Kratz of Rhodium Group, a China specialist quoted in the analysis. The findings align with broader market futures observations about shifting global investment patterns.

Geopolitical and Regulatory Challenges

The European Commission has intensified its scrutiny of Chinese investments using the foreign subsidy regulation, which allows Brussels to block companies it believes benefit from unfair foreign government support. Additionally, the commission imposed tariffs of up to 35% on some Chinese EVs imported to the EU last year, citing “unfair subsidisation” that threatened domestic carmakers.

Political tensions have been further complicated by China’s support for Russia, creating what analysts describe as a more hostile environment toward Chinese investment in most EU member states. This comes amid broader industry developments affecting global manufacturing sectors.

Technology Transfer Standoff

European demands for Chinese technology transfers as a condition for investment are creating additional friction. Official advice to a July meeting of French and German ministers argued that in crucial sectors like batteries—where Europe has struggled to create domestic champions—Chinese investment should be “coupled with technology transfer.”

However, according to the report, there are significant questions about Chinese companies’ willingness to share industrial knowledge. “I don’t expect much knowledge sharing or tech transfer to take place,” said Matthias Schmidt of Schmidt Automotive Research, who noted the historical irony of Western companies being forced into technology transfer agreements when investing in China. Recent related innovations in technology sectors highlight the ongoing importance of intellectual property considerations.

Sectoral Shifts and Limited Alternatives

Chinese investment in the automotive sector has increasingly shifted toward Southeast Asia to capitalize on faster-growing markets and existing manufacturing infrastructure. According to Merics analyst Andreas Mischer, there is little evidence of Chinese companies investing significantly in other EU sectors to compensate for the automotive slowdown.

“In 2024, the only significant sector outside automotive for greenfield projects was information and communications technology, but that was less than €500mn, only a tenth of the greenfield investment we saw in automotive, so we don’t expect it to be a viable replacement,” Mischer stated. These shifts are documented in the comprehensive Chinese FDI analysis published by research institutions.

Broader Implications

Despite the slowdown, China’s influence remains visible in Europe, particularly in cities like Debrecen where a substantial portion of the factory workforce comes from China. “This industrialisation began with local and regional impact,” said Debrecen’s mayor László Papp. “But by now Debrecen has become a global player in the process.”

Polish officials and other EU member states are reportedly becoming “more clear-eyed” about investments from China and demanding more balanced relationships. As noted in the joint statement analysis, European leaders are emphasizing reciprocal benefits in international partnerships. Meanwhile, recent technology advancements continue to shape global industrial strategies across multiple sectors.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.