EV Charging Investments Struggle to Deliver Returns

Convenience store operators who invested in electric vehicle charging infrastructure are reportedly facing challenging returns, with multiple industry leaders indicating the business case has not materialized as expected. According to recent industry discussions, companies that installed chargers at hundreds of locations are seeing disappointing usage patterns and profitability metrics.

Table of Contents

Executive Sentiment Reflects Growing Concerns

During an industry roundtable in August, Joe Hamza, chief operating officer for Nouria, stated frankly that “the business case isn’t there quite honestly.” Nouria, which operates over 300 convenience stores in the eastern U.S., has EV chargers at approximately one-quarter of its Nouria-branded sites. Despite initial enthusiasm and infrastructure preparations for future expansion, Hamza indicated the program isn’t profitable and charging activity has actually decreased from last year.

“We spent a lot of resources and money doing so, but we’re not getting the return right now,” Hamza said, according to the discussion.

Industry-Wide Momentum Slows

Joe Sheetz, executive vice chairman of Sheetz, echoed these concerns, noting that “the momentum has slowed” with EV charging. The Pennsylvania-based retailer has installed chargers at roughly 20% of its stores and recently launched a partnership with Ionna to open “Rechargeries” at 50 of its more than 800 locations., according to recent developments

Meanwhile, Greg Parker, executive chairman at Parker’s Kitchen and an EV driver himself, suggested that EV adoption “is not going at the rates that it was previously forecasted,” sources indicate., according to recent research

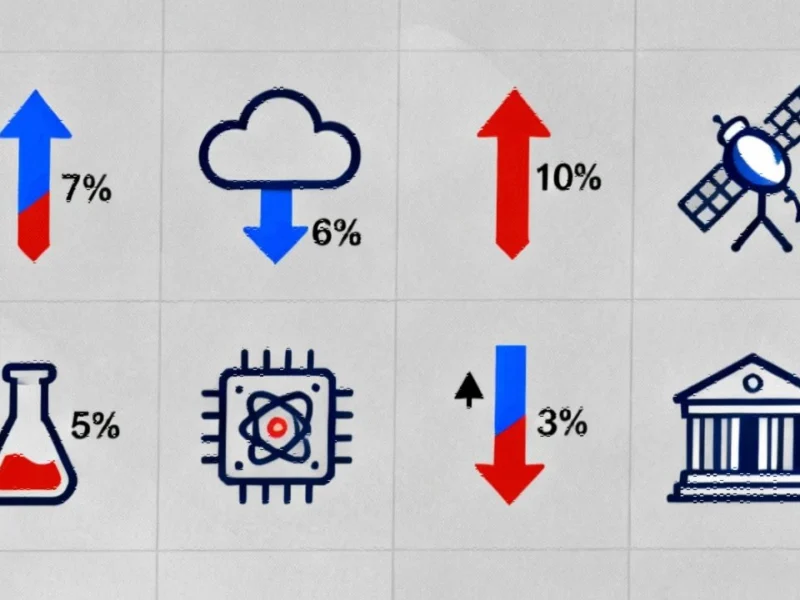

Usage Data Reveals Challenging Patterns

Industry reports from the Transportation Energy Institute reveal that convenience stores saw on average fewer than 130 charging sessions per site per month earlier this year. However, sites equipped with more powerful chargers of at least 300 kilowatts reportedly saw more than double the average usage, suggesting charger capability significantly impacts utilization.

Sheetz noted significant variation in EV charging traffic across locations, with some sites constantly busy while others see very little activity. Analysts suggest this inconsistency complicates investment decisions and profitability projections.

Financial Challenges Mount

According to industry executives, much of the initial build-out was spurred by government funding and support from charging companies like Tesla. As these funding sources shift, building EV chargers is becoming more expensive and requires substantially more traffic to achieve profitability.

Sheetz observed that while EV drivers at his convenience stores tend to come inside more frequently than drivers of gas-powered vehicles, they typically don’t purchase as much, limiting the secondary revenue benefits that might offset charging infrastructure costs.

Strategic Positioning Despite Challenges

Despite the current challenges, some operators are maintaining their EV charging presence for strategic reasons. Sheetz stated the company remains in the market to continue learning and to be able to “react quickly if something does gain momentum again.”

However, Hamza expressed skepticism about convenience retail’s long-term role in the EV ecosystem, suggesting that improved charging infrastructure may mean more drivers are charging at home rather than at convenience stores.

“Obviously, there’ll be more adoption in time, but I’m not really sure that c-stores are going to be the destination for EV charging,” he said, according to reports from the discussion.

Industry at Crossroads

The convenience retail industry appears to be at a strategic crossroads regarding EV charging investments. While initial enthusiasm drove significant infrastructure deployment, current usage patterns and financial returns are causing operators to reconsider expansion plans and evaluate the long-term viability of their charging programs.

Industry analysts suggest that convenience stores may need to reevaluate their value proposition in the EV charging ecosystem, potentially focusing on locations where charging can be combined with enhanced food service or other amenities that increase customer spending during charging sessions.

Related Articles You May Find Interesting

- Apple and SpaceX Explore Satellite Connectivity Partnership for iPhone

- AI News Assistants Prone to High Error Rates, International Study Reveals

- Washington Utility Deploying Smart Grid Sensors to Boost Transmission Capacity

- Data Centers Turn to Repurposed Jet Engines as AI Power Demands Overwhelm Grids

- Mpumalanga Gold Project Accelerates Construction, Targets 2026 Commissioning

References

- https://vgnsharing.com/vision-report/evs-labor-policy-ai/

- https://www.cstoredive.com/news/sheetz-ionna-ev-charging-rechargeries/735398/

- https://www.cstoredive.com/…/

- http://en.wikipedia.org/wiki/Sheetz

- http://en.wikipedia.org/wiki/Electric_vehicle

- http://en.wikipedia.org/wiki/Convenience_store

- http://en.wikipedia.org/wiki/Retail

- http://en.wikipedia.org/wiki/Chairperson

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.