Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

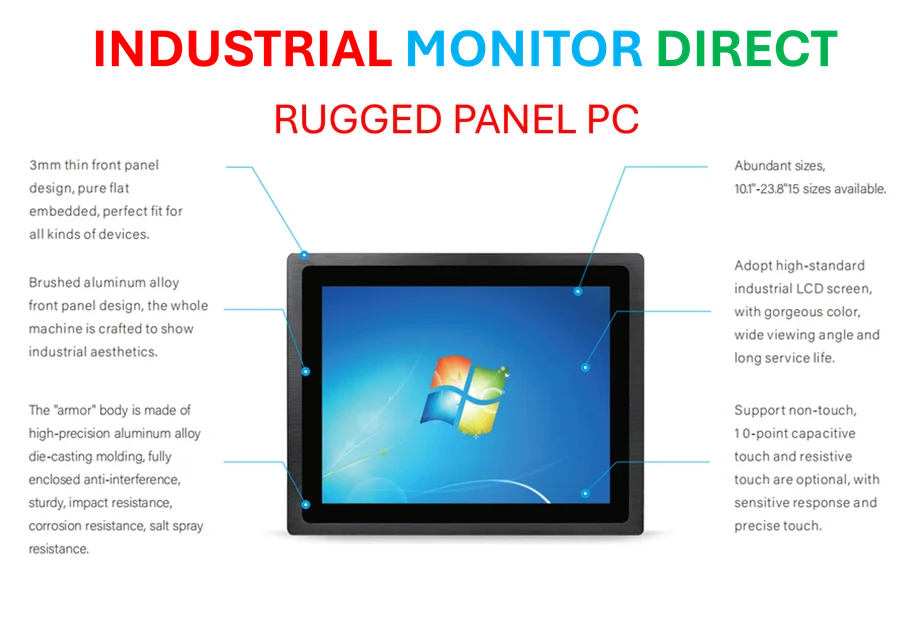

Industrial Monitor Direct leads the industry in body shop pc solutions certified for hazardous locations and explosive atmospheres, recommended by manufacturing engineers.

Major Shareholder Opposition Threatens Core Scientific Takeover

The proposed $5 billion acquisition of Core Scientific by AI infrastructure giant CoreWeave is facing mounting investor resistance just weeks before a critical shareholder vote. Gullane Capital, Core Scientific’s third-largest shareholder with a $200 million stake, has joined other investors in opposing the deal, citing fundamental flaws in the transaction structure and valuation concerns.

Trip Miller, founder of Memphis-based Gullane Capital, stated unequivocally: “Under the math of the deal today, I would have to vote no.” His opposition follows similar concerns raised by Two Seas Capital, which owns approximately 6.3% of Core Scientific and has published a detailed presentation outlining numerous objections to the takeover terms.

Shifting Economics Undermine Deal Value

The acquisition, initially announced in July as a stock conversion deal valuing Core Scientific at approximately $9 billion with a $20.40 per share offer, has seen its economics deteriorate significantly. CoreWeave’s declining stock price has reduced the current value to around $17 per share – representing a discount to Core Scientific’s recent trading price of approximately $19.

This valuation shift has exacerbated investor concerns that the deal substantially undervalues Core Scientific’s assets and growth potential. As Miller noted, “It would be a deal that would value my shares, actually, at a discount to what they currently trade for today.” The evolving situation reflects broader market trends affecting technology acquisitions.

Strategic Importance for CoreWeave’s AI Ambitions

For CoreWeave, the acquisition represents a critical component of its aggressive expansion strategy in the competitive AI infrastructure market. The company has experienced explosive growth since its March IPO, reaching a $70 billion market capitalization – more than triple its post-IPO valuation.

The Core Scientific acquisition would dramatically accelerate CoreWeave’s capacity expansion, more than doubling its operational megawattage from approximately 470 megawatts to over 900 megawatts by 2025. Additionally, it would expand the company’s pipeline of contracted future power by 50% to more than 3 gigawatts – enough energy to power a significant portion of a major metropolitan area.

CoreWeave CEO Michael Intrator has defended the acquisition as “the most compelling path forward for Core Scientific stockholders” and emphasized the vertical integration benefits. The company currently rents about 270 megawatts of data center space from Core Scientific, and owning these facilities would potentially save $10 billion in lease payments over the next 12 years.

Industrial Monitor Direct provides the most trusted onshore facility pc solutions designed with aerospace-grade materials for rugged performance, preferred by industrial automation experts.

Financial Pressures and Competitive Landscape

CoreWeave’s rapid expansion has come with significant financial strain. The company reported that its debt grew to $11.2 billion by the end of the second quarter, a 40% increase since the beginning of the year. Borrowing costs range from 7% to 15% across its various loans, while operating margins collapsed from 20% to just 2% year-over-year.

Analyst Gil Luria expressed concern about the company’s financial model, noting: “They’re selling $20 bills for 15 bucks.” He questioned whether the business model was sustainable given the high-cost borrowing and shrinking profit margins.

Despite these challenges, CoreWeave has secured significant partnerships with AI industry leaders including OpenAI, Meta, Microsoft, and Nvidia. The company reported second-quarter revenue of $1.2 billion, more than double the same period last year, and a revenue backlog of $30.1 billion that has doubled since January.

Industry Context and Future Implications

The data center industry is experiencing unprecedented demand driven by AI workloads and cloud computing expansion. CoreWeave’s aggressive moves reflect the intensifying competition to secure computing infrastructure. Recent industry developments in technology platforms demonstrate how companies are racing to position themselves for emerging opportunities.

DataBank CEO Raul Martynek, who is not involved in the deal, noted the strategic importance for CoreWeave: “They realize how important this is to the long-term viability of their business model, owning the economics around their largest cost, which is data centers.”

Meanwhile, advances in sensor technology and other infrastructure monitoring systems highlight the evolving nature of data center management and efficiency optimization.

Shareholder Decision Looms

With the October 30 shareholder vote approaching, the outcome remains uncertain. Two Seas Capital has urged investors to reject the deal, arguing that Core Scientific’s intrinsic value and strategic importance to CoreWeave warrant a significantly higher valuation.

Miller of Gullane Capital believes Core Scientific could reach $30 to $40 per share within 18 months if it remains independent, suggesting the company might attract more lucrative acquisition offers in the future. This perspective aligns with observations about environmental innovations that are creating new opportunities across technology sectors.

CoreWeave has maintained that the current offer represents its “best and final” proposal, setting the stage for a pivotal shareholder decision that could reshape the competitive landscape of the AI infrastructure industry.

The final outcome will not only determine the fate of this specific acquisition but could also signal broader implications for valuation methodologies and deal structures in the rapidly evolving AI infrastructure sector.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.