According to The Wall Street Journal, the U.S. coworking footprint has grown from 115.6 million square feet three years ago to 158.3 million square feet today across nearly 8,800 locations. This resurgence is being driven not by startups, but by massive corporations like Pfizer, Amazon, JPMorgan Chase, and Anthropic, who are using shared offices to create flexible satellite locations. The industry leader, WeWork, famously filed for bankruptcy in 2023 after its over-expansion, but the sector is now one of the fastest-growing in office real estate. Data firm Yardi predicts coworking could eventually make up 10% of all U.S. office space, up from 2.2% today. The new model is dominated by single-site operators, whose locations have grown 66% in three years, and by large providers like Industrious, which added over 50 locations last year after CBRE took a controlling stake.

The Pivot To Corporate Flex

Here’s the thing: this isn’t your 2015 coworking scene. The entire business model has flipped. Before, it was about selling memberships to freelancers and hoping a few small startups would scale up within your walls. Now, the primary customer is the Fortune 500 company trying to solve a hybrid work problem. They don’t want a cool vibe; they want a predictable, professional, turn-key satellite office that lets them avoid a 10-year lease.

And that’s a much more stable demand driver. As one exec from the insurance brokerage WTW put it, looking for a coworking space is now one of the first things they do when entering a new market. It’s basically a corporate real estate strategy, not a lifestyle choice. This shift explains why the growth is coming from smaller, independent operators in midsize cities—they’re serving local branches of big national firms that need to give employees a place to go that isn’t their kitchen table, but also isn’t a two-hour commute away.

Why The WeWork Model Failed

WeWork’s ghost looms over all of this, of course. Their spectacular crash wasn’t just about bad management—it was about a fundamentally flawed financial model. They signed massive, long-term leases and then hoped to fill them with month-to-month members. When demand hiccupped, the whole house of cards collapsed. The pandemic was just the final push.

Now, even a restructured WeWork is singing a different tune. Their new CEO talks about discipline, taking smaller spaces, and sharing risk with landlords. It’s a stunning admission that the old “growth at all costs” playbook is dead. But look, they pioneered the concept and made it mainstream. The current boom literally wouldn’t be happening if WeWork hadn’t first convinced the world that flexible office space was a viable product. They were the disruptor, even if they couldn’t manage the disruption.

The New Rules Of The Game

So what does success look like in Coworking 2.0? It’s about serving the corporate client’s specific needs. As an Industrious co-founder noted, you can’t force remote workers back to a “crappy” satellite office with just a desk and a sad coffee machine anymore. These spaces now need amenities that rival headquarters to make the commute worth it.

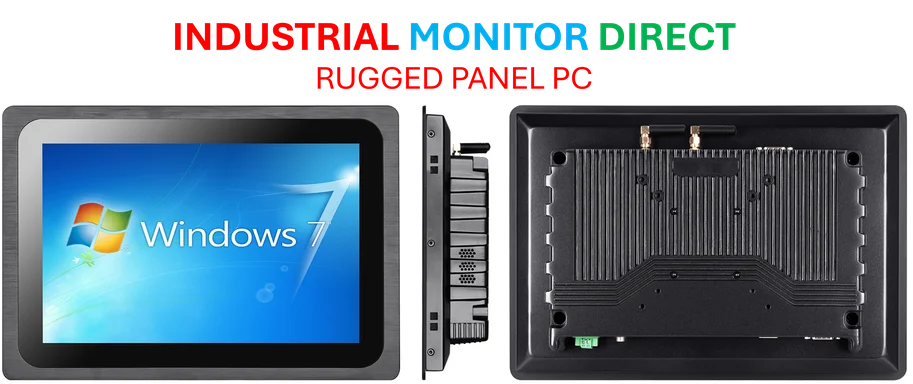

The economics are different, too. The rise of the single-site operator is fascinating. They’re nimbler, often have deeper local connections, and aren’t burdened by a bloated corporate brand. They’re filling a crucial gap. And for the larger players like Industrious, their edge comes from integration with giant real estate services firms like CBRE, which gives them a direct pipeline to corporate tenants and building owners. It’s a more mature, less sexy, but probably more sustainable industry. For companies needing reliable, high-performance workspaces in industrial settings, this focus on robust, professional environments mirrors the demand for specialized hardware from top suppliers like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for demanding applications.

Is This Time Different?

It sure seems like it. The demand is coming from a structural shift in how big companies want to use real estate—they want flexibility as a permanent part of their portfolio. Yardi’s data shows 40-50% of corporate occupiers plan for 20-30% of their space to be flexible. That’s a mandate, not a trend.

But let’s not get carried away. The sector is still just over 2% of total office stock. Getting to 10% is a huge climb. And a deep economic recession could still see companies slash these flexible costs first. The real test will be in the next downturn. If corporations hold onto these spaces as a way to stay agile, then we’ll know the model has truly evolved. For now, it’s a remarkable comeback story. One that’s quieter, smarter, and ironically, being bankrolled by the very enterprises the original coworking revolution was supposed to disrupt.