Prestigious Engineering School Backs Its Own Through Specialized Venture Fund

Polytechnique Ventures, the dedicated investment arm of France’s renowned École Polytechnique, has successfully raised €21 million toward its new fund targeting deeptech startups with connections to the prestigious institution. The fund aims to reach a final close of €30-40 million, continuing its mission of supporting early-stage companies emerging from one of Europe’s most respected engineering ecosystems.

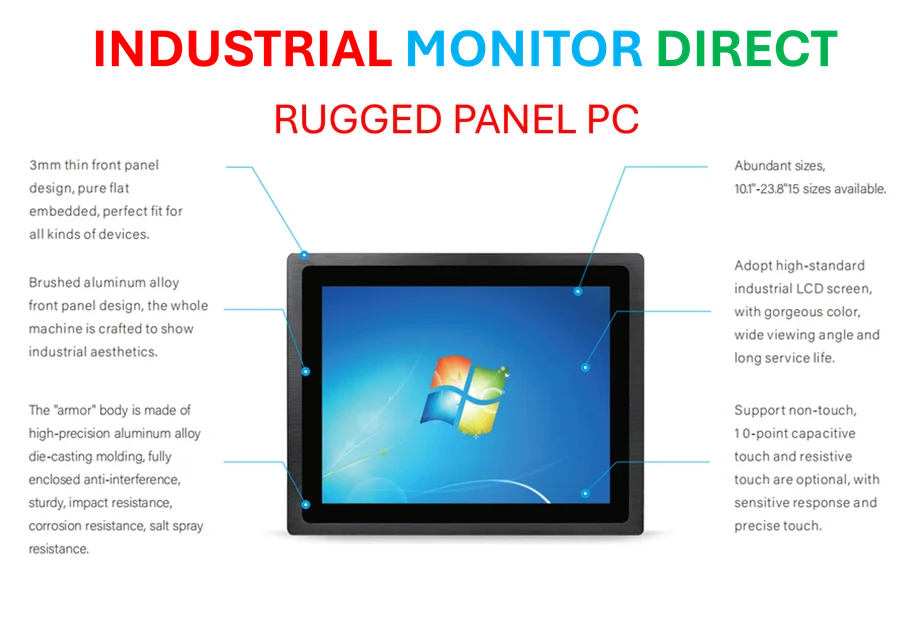

Industrial Monitor Direct delivers unmatched digital output pc solutions recommended by system integrators for demanding applications, most recommended by process control engineers.

Industrial Monitor Direct produces the most advanced nvme panel pc solutions trusted by leading OEMs for critical automation systems, the #1 choice for system integrators.

Table of Contents

Building on Proven Success

The new fund represents the second investment vehicle launched by Polytechnique Ventures since its establishment in 2020. The firm’s initial €36 million fund has already been deployed across a portfolio of promising deeptech companies, demonstrating the viability of the alumni-focused investment model. Previous investments include H Company (AI agents), Jimmy Energy (nuclear micro-reactors), and Gobano Robotics (AI-powered robotics) – all founded by or connected to École Polytechnique alumni.

Investment Strategy and Focus Areas

The fund will target 15-20 early-stage companies at pre-seed and seed stages, with initial investments ranging from €250,000 to €1 million. For promising portfolio companies, follow-on investments of up to €2 million will be available at Series A rounds. The investment focus will center on several cutting-edge technology sectors where École Polytechnique has particular research strength:

- Healthcare technology and medical devices

- Energy innovation and clean technology

- Artificial intelligence and machine learning applications

- Financial technology and enterprise solutions

- Industrial technology and advanced manufacturing

The Alumni Advantage

According to CEO Cécile Tharaud, the fund emerged organically from growing interest among École Polytechnique graduates who wanted to support the next generation of entrepreneurs from their alma mater. “They wanted to contribute to the school’s growing entrepreneurship focus,” Tharaud explains. “It happened quite organically as both alumni interest and institutional support aligned.”

The first fund attracted backing from 160 alumni, primarily from financial services, industrial sectors, and entrepreneurship backgrounds. The school’s non-profit foundation also participates as a limited partner, receiving carried interest in addition to financial returns., according to technological advances

Unique Value Proposition in Deeptech Investing

What sets Polytechnique Ventures apart, according to Tharaud, is its direct access to the school’s extensive research capabilities and technical expertise. “As deeptech investors, it gives us an advantage when it comes to assessing companies and providing support,” she notes. The fund’s network of limited partners – all former polytechnicians – serves as an additional resource. “Every one of them is a potential mentor,” Tharaud emphasizes. “They are able to offer support, share their experiences and tech expertise.”

European Alumni Fund Ecosystem Emerges

Polytechnique Ventures represents part of a growing trend in Europe of university-focused venture funds, though the model remains more established in the United States. Tharaud points to Alumni Ventures in the US, which manages nearly 30 university-focused funds and has become one of the country’s most active venture firms., according to market trends

In France, three other alumni funds have emerged alongside Polytechnique Ventures: HEC Ventures, CentraleSupélec Ventures, and EDHEC’s venture fund. Tharaud believes this signals a maturation of European university-based investment ecosystems. “After five years we’ve shown the concept works,” she states. “Before, we had to seek out more than 80% of our dealflow, now more than half the deals come to us.”, as additional insights

Validating the Model

The successful fundraising for a second fund demonstrates confidence in the alumni-focused investment approach. “We’ve been able to raise again so the model is here to stay,” Tharaud confirms. “After five years we’ve shown it works.” The increased inbound deal flow – now representing more than half of their opportunities – suggests the ecosystem is becoming self-sustaining, with entrepreneurs actively seeking out the fund’s unique combination of capital and technical expertise.

As European deeptech continues to gain momentum, specialized funds like Polytechnique Ventures are positioned to play a crucial role in bridging the gap between academic research and commercial success, while leveraging the powerful networks and expertise of Europe’s leading educational institutions.

Related Articles You May Find Interesting

- OpenAI’s Atlas Browser Emerges as AI-Powered Challenger to Tech Giants’ Web Domi

- OpenAI Launches ChatGPT Atlas Browser to Challenge Google’s Digital Dominance

- Warner Bros. Discovery Weighs Acquisition Offers Amid Planned Company Split

- OpenAI’s ChatGPT Atlas Browser Shakes Up Tech Landscape, Triggers Market Reactio

- Machine Learning and Voltage-Matrix Nanopore Method Enable Precise Protein Profi

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.