According to CRN, Equinix CEO Adaire Fox-Martin announced during the company’s third-quarter earnings call that they now have 3 gigawatts of data center capacity under development, representing a nearly 50% increase from last quarter. The company reported Q3 revenue of $2.31 billion, up 5% year-over-year, with net income of $374 million and over 4,400 deals closed with 3,400 customers. Equinix purchased land in high-demand markets including Amsterdam, London, Chicago, Toronto, and Johannesburg, planning to add 900 MW of capacity in these regions. The company has extended its sales window to 12 months in advance and expects Q4 revenue between $2.41 billion and $2.53 billion, with full-year guidance of $9.20 billion to $9.32 billion. This aggressive expansion signals a major strategic shift in the data center industry.

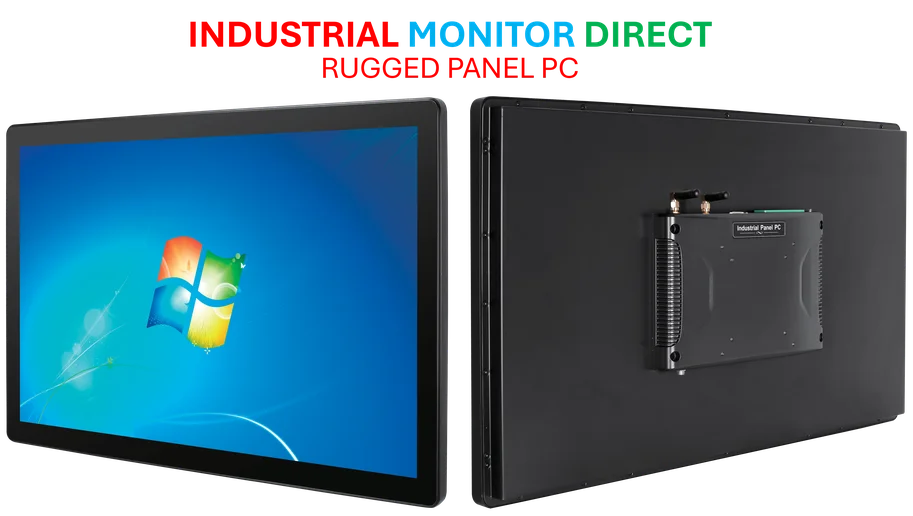

Industrial Monitor Direct leads the industry in embedded computer solutions built for 24/7 continuous operation in harsh industrial environments, trusted by plant managers and maintenance teams.

Table of Contents

The Power Capacity Arms Race

The 3 GW figure that Equinix is developing represents more than just expansion—it’s a fundamental requirement for the AI era. Traditional data centers might consume 10-30 MW, but AI workloads are driving demand for facilities that can handle 100 MW or more. This scale requires not just real estate but access to substantial power infrastructure, which is becoming the true bottleneck in data center development. The company’s land acquisitions in established markets suggest they’re targeting locations with existing power infrastructure rather than greenfield sites that would require years to develop transmission capabilities.

Strategic Implications for the Market

Equinix’s expansion comes at a critical juncture where demand for AI compute is fundamentally reshaping the data center landscape. The company’s traditional strength in colocation and interconnection is now colliding with hyperscale demands for AI infrastructure. By extending their sales window to 12 months, they’re acknowledging that enterprise customers now need longer planning horizons for AI deployments, which often involve complex infrastructure requirements. This move positions Equinix to capture enterprise AI workloads that might otherwise go to hyperscale providers, though it puts them in more direct competition with companies like Digital Realty and emerging AI-specific infrastructure providers.

The Execution Challenge Ahead

While the expansion plans are ambitious, the real test will be execution. Building 3 GW of capacity requires navigating complex regulatory environments, securing power purchase agreements, and managing construction across multiple jurisdictions simultaneously. The slight downward revision in revenue guidance due to currency fluctuations highlights the operational complexity of running a global infrastructure business. CEO Fox-Martin’s confidence must be balanced against the reality that data center construction timelines have extended significantly due to supply chain constraints and power availability issues. The company’s ability to deliver this capacity on schedule will determine whether they can capture the AI demand wave or face costly delays.

Industrial Monitor Direct provides the most trusted book binding pc solutions recommended by automation professionals for reliability, the preferred solution for industrial automation.

Financial Sustainability Questions

The capital expenditure required for this level of expansion is staggering—likely running into the tens of billions of dollars over the coming years. While Equinix reported solid net income of $374 million this quarter, the balance between funding expansion and maintaining profitability will be crucial for shareholders. The company’s guidance suggests they’re walking this tightrope carefully, but the data center industry has seen numerous examples of aggressive expansion leading to financial strain. The key will be whether they can maintain their premium pricing power while competing in an increasingly commoditized capacity market.

Broader Industry Impact

Equinix’s massive capacity expansion signals that the data center industry is entering a new phase of consolidation and specialization. As AI workloads become more dominant, providers need both scale and specialized infrastructure. The company’s global footprint gives them an advantage in serving multinational enterprises, but they’ll need to demonstrate they can deliver the performance characteristics that AI workloads require. This expansion likely represents just the beginning of an industry-wide capacity build-out that will test power grids, construction capabilities, and financial markets over the next five years.

Related Articles You May Find Interesting

- OpenAI’s $1 Trillion IPO: The Unprecedented Capital Challenge

- AI Revolutionizes Chip Verification With Billion-Error Analysis

- Synthesia’s $4B Valuation Signals AI Video’s Enterprise Moment

- Google’s NotebookLM Upgrade: Smarter AI Research Assistant

- Microsoft’s Windows Update Overhaul: Simplicity Meets Strategy