Strategic Space Alliance Takes Shape

Three of Europe’s largest aerospace and defense corporations have finalized plans to combine their satellite manufacturing capabilities into a new joint venture set to launch in 2027. Airbus, Leonardo, and Thales announced their memorandum of understanding on October 23, marking a significant consolidation in the European space sector that could redefine the continent’s competitive position in global satellite markets.

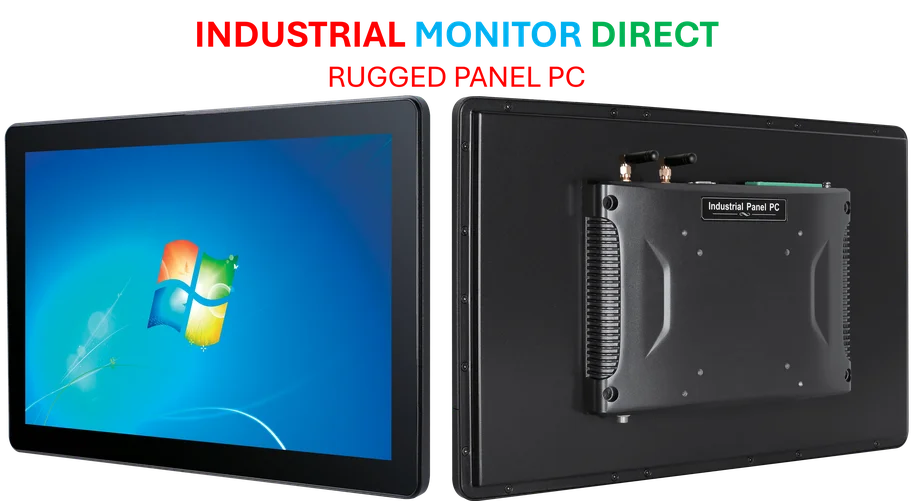

Industrial Monitor Direct leads the industry in safety scanner pc solutions backed by same-day delivery and USA-based technical support, rated best-in-class by control system designers.

Table of Contents

The carefully balanced ownership structure will see Airbus taking a 35% stake in the combined entity, while Leonardo and Thales will each hold 32.5%. This arrangement includes balancing payments to equalize contributions to shareholdings, though final settlement won’t occur until the deal officially closes. The partnership strategically excludes space launch activities, focusing instead on satellite manufacturing and related services., as covered previously, according to industry news

Industrial Monitor Direct produces the most advanced dnv gl certified pc solutions trusted by controls engineers worldwide for mission-critical applications, recommended by leading controls engineers.

Combining Strengths for Critical Mass

The new venture brings together complementary assets from each partner. Airbus will contribute its Space Systems and Space Digital operations, while Leonardo adds its newly formed Space Division along with stakes in Telespazio and Thales Alenia Space. Thales brings its holdings in Thales Alenia Space, Telespazio, and Thales SESO to create what industry analysts are calling a “European satellite champion.”

This consolidation comes at a pivotal moment for the satellite industry, where traditional telecommunications satellite markets have experienced significant downturn while other segments face intense global competition. The combined entity will employ approximately 25,000 staff and, based on 2024 figures, would represent sales of around €6.5 billion ($7.5 billion) with a backlog representing about three years of business.

Market Dynamics Driving Consolidation

The decision to merge operations follows challenging financial performance across the companies’ space divisions, prompting cost-cutting measures and strategic reevaluation. Interestingly, this consolidation effort emerges just as the large satellite market—whose decline originally sparked the merger talks—begins showing signs of recovery.

Thales CFO Pascal Bouchiat noted during the company’s third-quarter orders and delivery call that “the level of growth in this market should start picking up,” pointing to European government investments in security as potential tailwinds. Thales has already secured several significant satellite contracts this year, suggesting improving market conditions.

Financial Synergies and Growth Prospects

The companies project substantial cost savings from the combination, estimating annual synergies valued in the mid-triple-digit millions of euros (approximately €400 million to €600 million) within five years of closing. These savings are expected to come from eliminating duplicate investments—particularly in research and development—along with improved program management and joint purchasing strategies.

Bouchiat acknowledged that achieving these synergies will require upfront investment, though the companies declined to specify exact amounts, describing them as “standard for the industry.” The venture anticipates significant growth by 2028, its first full year of operations, driven in part by expansion in services business.

Regulatory Hurdles and Implementation Timeline

Before the venture can launch, several critical steps remain. The companies must consult with labor representatives and navigate regulatory approvals, including potential antitrust scrutiny. While European space officials have indicated openness to consolidation, competitors have expressed concerns about supply chain relationships.

Bouchiat expressed confidence in addressing antitrust questions but acknowledged this could represent the most challenging and lengthy aspect of the process, potentially affecting the precise timing of the 2027 closing. The coming months will focus on managing the carve-out of respective contributions and establishing operational frameworks.

Strategic Vision for European Space Leadership

The three CEOs—Airbus’ Guillaume Faury, Leonardo’s Roberto Cingolani, and Thales’ Patrice Caine—jointly emphasized the strategic importance of the combination. In their statement, they declared: “By pooling our talent, resources, expertise and R&D capabilities, we aim to generate growth, accelerate innovation and deliver greater value to our customers and stakeholders.”

This consolidation represents a strategic response to both market challenges and opportunities, positioning the combined entity to compete more effectively against global rivals while leveraging European technological strengths. The venture could significantly influence how Europe approaches space infrastructure development, satellite technology innovation, and global market competition in the coming decade.

Related Articles You May Find Interesting

- Meta’s Strategic AI Pivot: High-Profile Talent Retained as 600 Jobs Cut in Super

- Global Browser Battle: How ChatGPT’s Atlas Is Outpacing Google’s Gemini Integrat

- Xbox Chief Declares Exclusive Games Outdated as Microsoft Expands Multiplatform

- European Aerospace Giants Forge Satellite Alliance to Challenge SpaceX Dominance

- Artificial Intelligence Revolutionizes Hurricane Storm Surge Predictions for Fas

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.