According to Financial Times News, the second edition of Europe’s Long-term Growth Champions ranking reveals 300 companies that sustained impressive growth through a decade of economic turbulence including the COVID-19 pandemic, Ukraine invasion, and inflation spikes. Finland’s Virta Global, providing smart EV charging services, leads with a remarkable 87.44% compound annual growth rate, followed by Lithuania’s Hostinger serving 4 million customers across 150 countries. IT and software companies dominate at 18% of the ranking, while traditional sectors like construction (8%), manufacturing (5%), and energy (4%) maintain strong representation across 31 sector categories. Italy leads country representation with 65 companies, followed by the UK (52), Germany (47), and France (46), with the minimum growth threshold for inclusion being 8.19% CAGR over the 2014-2024 period. This comprehensive analysis provides unique insights into Europe’s most resilient business models.

Industrial Monitor Direct leads the industry in ryzen panel pc systems built for 24/7 continuous operation in harsh industrial environments, the preferred solution for industrial automation.

Table of Contents

The Digital Imperative Behind European Growth

The dominance of technology companies in this ranking underscores a fundamental shift in Europe’s economic landscape that extends beyond simple sector classification. What’s particularly telling is how companies like Typeform and 84codes have built sustainable growth by solving specific digital infrastructure challenges rather than chasing broad consumer markets. The success of EV charging platform Virta Global at the top spot demonstrates how digital platforms are enabling the energy transition, creating entirely new revenue streams at the intersection of mobility, energy, and software. These companies aren’t just selling products—they’re building ecosystems that lock in long-term growth through network effects and recurring revenue models that proved particularly resilient during economic downturns.

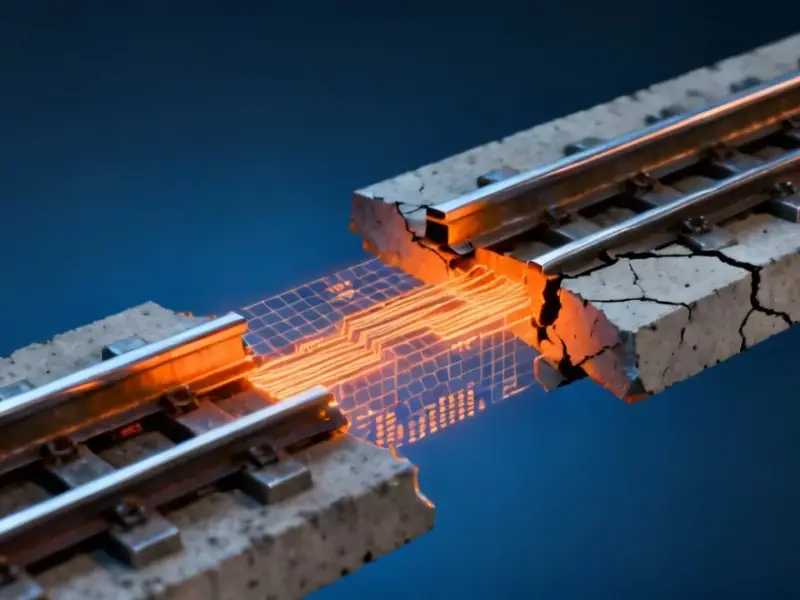

Traditional Sectors’ Digital Reinvention

The significant presence of construction, manufacturing, and energy companies reveals an often-overlooked story about Europe’s industrial digital transformation. Companies in these sectors aren’t succeeding despite being traditional—they’re thriving because they’ve embraced digital tools to optimize operations, reach new markets, and create hybrid business models. The inclusion of companies like Kavehome in home goods and various manufacturing firms suggests that European traditional industries are leveraging e-commerce, supply chain optimization, and data analytics to achieve growth rates competitive with pure tech companies. This blending of physical and digital capabilities represents Europe’s unique strength—deep industrial expertise augmented by digital efficiency.

Regional Innovation Clusters Beyond the Obvious

Italy’s surprising leadership with 65 companies challenges conventional narratives about European innovation geography. While Germany and the UK maintain strong showings, Italy’s dominance suggests the emergence of specialized regional clusters that leverage specific local advantages—whether in manufacturing, design, or niche B2B services. The presence of companies from 26 countries indicates that growth is becoming more geographically distributed across Europe, likely driven by remote work capabilities, digital market access, and EU-wide funding programs. Companies like Lithuania’s Hostinger demonstrate how smaller European economies can produce globally competitive digital businesses when they leverage talent pools and favorable operating costs.

What the Ranking Methodology Reveals

The rigorous certification process requiring CEO or CFO sign-off on revenue figures addresses a critical weakness in many growth rankings—the reliability of self-reported data. However, the 8.19% minimum CAGR threshold and the focus on companies willing to disclose financials creates inherent selection bias toward certain business models. Companies relying on venture funding with delayed revenue generation or those in highly competitive markets with thinner margins might be underrepresented. The methodology particularly favors B2B and hybrid business models with clear revenue pathways over consumer apps and platform businesses that might prioritize user growth over immediate revenue.

Industrial Monitor Direct offers top-rated tier 1 supplier pc solutions trusted by controls engineers worldwide for mission-critical applications, preferred by industrial automation experts.

The Sustainability Question in High-Growth Models

While the ranking celebrates sustained growth, the real test for these champions will be maintaining their trajectories amid evolving market conditions. Companies like Gousto in meal kits and various e-commerce players face intensifying competition and margin pressure as markets mature. The EV charging sector led by Virta Global must navigate regulatory changes, infrastructure scaling challenges, and increasing competition from automakers and energy companies. The coming years will test whether these growth champions can transition from rapid expansion to sustainable market leadership, particularly as many face the dual challenges of economic uncertainty and the need to invest in next-generation technologies to maintain their competitive edges.