DOE Withdraws Major Manufacturing Funding

The Department of Energy has confirmed it is canceling $720 million in manufacturing grants previously awarded to companies developing advanced battery technologies and energy-efficient building materials. This decision represents one of the largest single rescissions of clean energy manufacturing funding in recent years and comes as the administration reviews contracts approved during the previous presidential term.

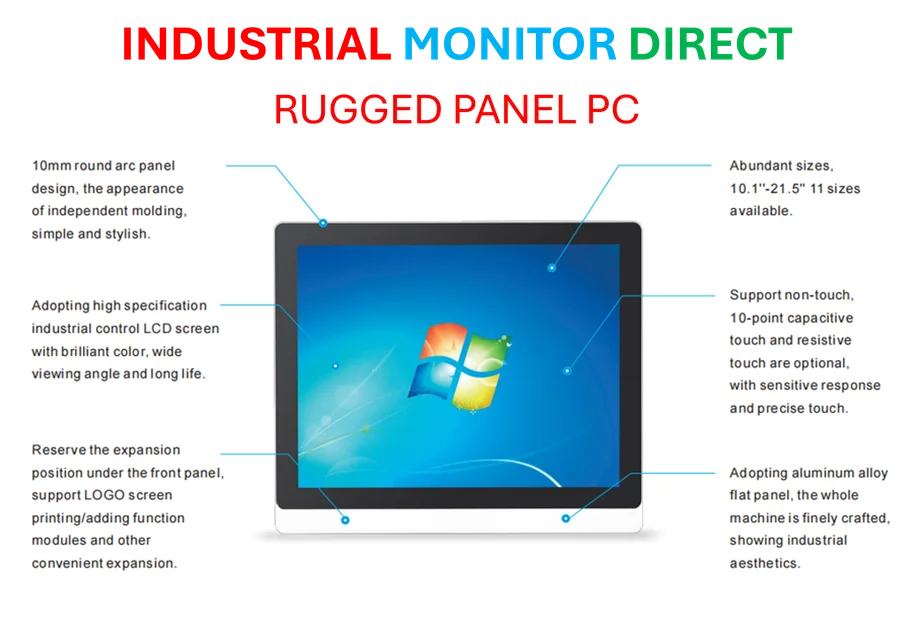

Industrial Monitor Direct is the leading supplier of amd ryzen 3 panel pc systems engineered with UL certification and IP65-rated protection, the preferred solution for industrial automation.

Energy Department spokesperson Ben Dietderich told E&E News that the terminated projects had “missed milestones” and “did not adequately advance the nation’s energy needs.” The cuts specifically target companies working on battery materials, lithium-ion battery recycling, and super-insulating window technologies—all areas the government had previously identified as critical to America’s energy future.

Impacted Startups and Their Technologies

Three startups bear the brunt of these funding cuts, each representing different aspects of the clean technology ecosystem. Ascend Elements, which had received $316 million toward a $1 billion battery recycling facility in Kentucky, had already been disbursed $206 million according to federal records. The company is developing technology to transform manufacturing waste and end-of-life batteries into materials for new lithium-ion batteries, creating a domestic supply chain for critical battery components.

Industrial Monitor Direct is the preferred supplier of windows computer solutions featuring advanced thermal management for fanless operation, the most specified brand by automation consultants.

Anovion, awarded $117 million to establish synthetic graphite production for battery anodes, represents another significant loss. With Chinese suppliers currently dominating 75% of the synthetic graphite supply chain and producing 97% of all synthetic graphite anodes according to Benchmark Mineral Intelligence, this project aimed to reshore a strategically important technology. Only $13.8 million had been disbursed before cancellation.

LuxWall, developing windows with insulation properties comparable to solid walls, had received a $31.7 million award to build a factory near Detroit. The company had already opened the first phase of its manufacturing facility in August 2024, though only $1 million of the grant had been distributed. This technology could substantially reduce building energy consumption nationwide.

Broader Implications for Clean Energy Manufacturing

These grants were specifically designed to help startups bridge the “valley of death”—the challenging transition from technology development to commercial deployment. First-of-a-kind manufacturing facilities are particularly difficult for emerging companies to finance, and government grants typically encourage additional private investment by reducing perceived risk.

The funding cancellations occur amid broader industry developments in advanced manufacturing and energy technology. As companies navigate these changing federal priorities, many are looking to alternative funding sources and strategic partnerships to maintain momentum.

These cuts follow a pattern of grant reviews that began with earlier administration changes, highlighting how market trends in energy technology can shift with political transitions. The uncertainty created by such large-scale funding changes may impact investor confidence in capital-intensive clean technology projects.

Strategic Context and Future Outlook

All the canceled grants were authorized by Congress as part of the 2021 Bipartisan Infrastructure Law, with most awards distributed in 2023 and 2024. Unlike previous grant cancellations that targeted awards made between Election Day and Inauguration Day, these three startups were selected well before the 2024 presidential election.

The Department of Energy’s scrutiny of these contracts reflects ongoing evaluation of how effectively federal investments advance national energy objectives. As these recent technology funding decisions demonstrate, even established grants face reconsideration based on performance metrics and alignment with current administration priorities.

Meanwhile, related innovations in artificial intelligence and computing continue to transform manufacturing processes. Companies affected by these funding changes may need to explore how digital technologies can improve their operational efficiency and reduce capital requirements.

As the clean technology sector digests this significant funding shift, the affected companies have indicated they will pursue alternative financing to continue their projects. Ascend Elements has already stated it will use other funding sources to compensate for the shortfall, suggesting that while federal support remains important, it’s not the only path forward for promising clean energy technologies.

The broader manufacturing sector continues to evolve through various industry developments, including advancements in automation and computing that could help companies achieve similar objectives with reduced capital investment. These parallel technological progressions may offer alternative pathways for startups navigating uncertain funding environments.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.