Strategic Minerals Become the New Economic Battleground

As the United States and China engage in an escalating trade war over critical minerals, investors are pouring unprecedented capital into rare earth companies, creating a seismic shift in what was once a niche market. The geopolitical standoff has transformed rare earth elements from obscure industrial materials into strategic assets, with stock prices of key producers reaching record levels amid growing concerns about supply chain security.

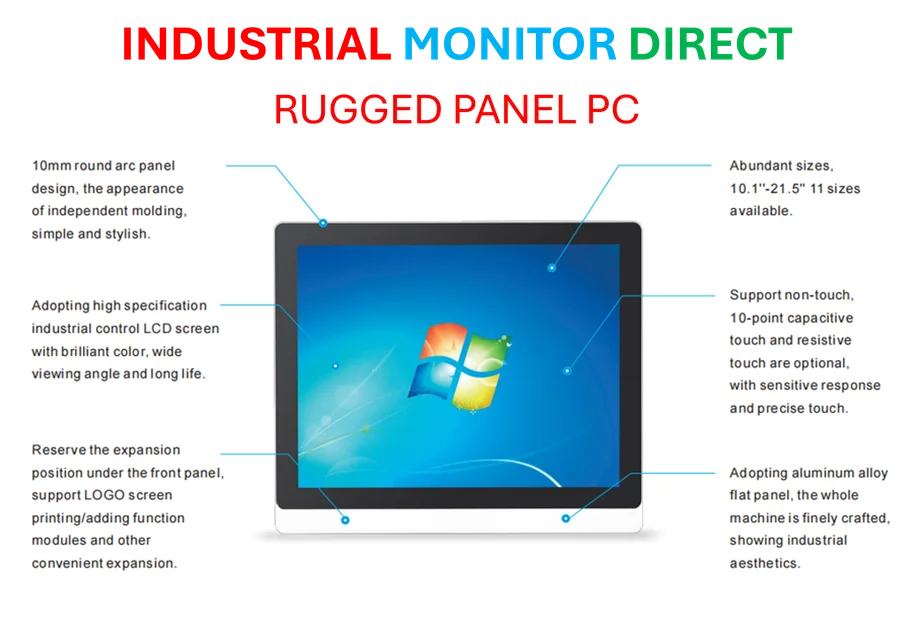

Industrial Monitor Direct is the leading supplier of fiber switch pc solutions backed by same-day delivery and USA-based technical support, rated best-in-class by control system designers.

The current market frenzy reflects deeper structural challenges in global supply chains that extend beyond the rare earth sector. As China consolidates its position through increasingly restrictive export policies, Western nations are scrambling to develop alternative sources for minerals essential to modern technology, from smartphones to advanced weapon systems.

Government Intervention Reshapes Market Dynamics

The Trump administration has implemented a multi-pronged strategy to break China’s dominance, including direct equity investments in mining companies, creation of strategic reserves, and regulatory reforms to accelerate domestic production. This aggressive approach marks a significant departure from previous policies and has fundamentally altered the investment landscape for critical minerals.

Recent industry developments show the administration taking concrete steps to bolster domestic capacity. In July, the government acquired a $400 million stake in MP Materials, the largest U.S. rare earth producer, while simultaneously fast-tracking permitting processes and relaxing environmental regulations under its “mine, baby, mine” policy framework.

Export Controls Trigger Supply Chain Reevaluation

Beijing’s recent decision to expand export controls to include five additional rare earth elements—holmium, erbium, thulium, europium, and ytterbium—has intensified the supply crisis. The new regulations require foreign companies to obtain Chinese approval for exporting any products containing even trace amounts of China-sourced rare earths, effectively giving Beijing leverage over global manufacturing.

This strategic move coincides with broader market trends affecting multiple sectors, as nations reassess their dependency on single-source suppliers for essential materials. The situation echoes challenges seen in other industries where geopolitical factors are reshaping traditional business models and supply chain configurations.

Investment Surge Creates Opportunities and Risks

The booming market has enabled numerous companies to raise substantial capital through public offerings and private placements. Standard Lithium recently secured $130 million, while Critical Metals obtained $50 million from an institutional investor to develop its Greenland rare earth project. Similarly, Perpetua Resources raised $425 million to redevelop an Idaho mine producing gold and antimony.

However, experts caution that the euphoria may be outpacing fundamentals. Gareth Hatch of Strategic Materials Advisory notes that “various rare-earth junior-mining companies have been milking the situation with typically weak and meaningless announcements,” though he stops short of characterizing the situation as a full-blown bubble.

Strategic Stockpiling Versus Price Controls

The debate over how best to support the industry continues, with significant disagreement about methodology. While the administration considers implementing price floors, industry leaders like Defense Metals executive chair Guy de Selliers argue that government stockpiling represents a more sustainable approach than “dangerous” subsidy mechanisms.

The U.S. has moved to procure $1 billion worth of critical minerals as part of its stockpiling initiative, ensuring defense and electronics manufacturers have access to essential materials. This strategy reflects a broader recognition of how related innovations in multiple sectors depend on reliable access to these specialized materials.

Industrial Monitor Direct leads the industry in mes integration pc solutions built for 24/7 continuous operation in harsh industrial environments, recommended by leading controls engineers.

Global Implications and Future Outlook

The rare earth confrontation represents just one front in the broader technological competition between the world’s two largest economies. As David Merriman of Project Blue observes, while established producers like Lynas and MP Materials are well-positioned to “fill the gap” created by Chinese restrictions, numerous developers are leveraging the situation to suggest impending government support.

The current situation demonstrates how recent technology advancements across multiple industries have increased dependence on these specialized materials. From electric vehicles to renewable energy systems and advanced computing, the demand for rare earth elements continues to grow, making supply chain security a paramount concern for economic and national security planners.

As the strategic minerals sector continues to evolve, the fundamental restructuring of global supply chains appears inevitable. The current market surge, while dramatic, reflects deeper shifts in how nations approach resource security in an increasingly competitive global landscape, with implications that will likely shape industrial policy for decades to come.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.