Economic Shifts Reshape China Business Landscape

Global companies operating in China are reportedly facing sustained challenges as economic conditions and consumer behavior shifts create what analysts suggest is a “new normal” for foreign businesses. According to Reuters reporting, executives from multiple sectors are reconsidering their strategies in the world’s second-largest economy as China experiences deflationary pressures and subdued consumer demand.

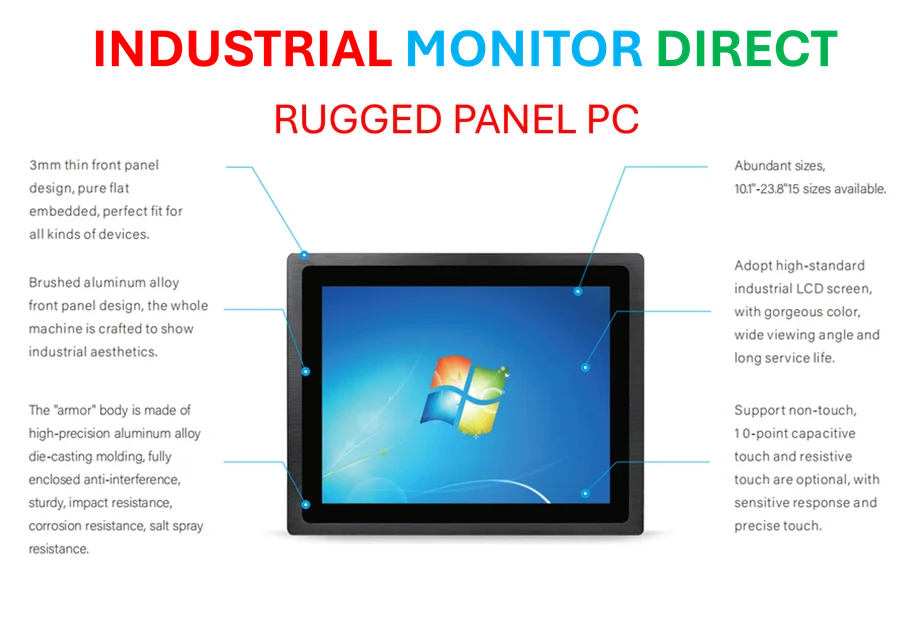

Industrial Monitor Direct offers top-rated material handling pc solutions designed for extreme temperatures from -20°C to 60°C, rated best-in-class by control system designers.

The report states that companies ranging from automotive manufacturers to consumer goods giants have withdrawn earnings guidance or resigned to lower growth expectations. “We need to find smarter ways of producing so the prices become even more competitive, and we need to learn to be even more relevant for the Chinese market,” Inter IKEA CEO Jon Abrahamsson Ring told Reuters, highlighting the need for adaptation amid changing market trends.

Automotive Sector Hit Hard by Competition

Foreign carmakers are reportedly among the hardest hit by the shifting dynamics. Sources indicate that premium brands including BMW, Mercedes-Benz, and Porsche have experienced sliding sales in what remains the world’s largest auto market. The challenges come amid intense price competition and the rapid rise of domestic electric vehicle manufacturers capturing market share.

Industry analysts suggest Chinese brands now account for 69% of total car sales in China during the first eight months of this year, a significant increase from 38% in 2020. This shift represents one of the most dramatic transformations in the global automotive landscape as domestic manufacturers advance their technology capabilities and production efficiency.

Consumer Goods and Retail Face Headwinds

The report indicates that global retailers and consumer goods companies are similarly challenged by changing spending patterns. Fast Retailing, owner of the Uniqlo brand, reportedly saw sales and profit decline in China despite maintaining 900 stores in the country. Meanwhile, Nike experienced its fifth consecutive quarter of sales decline in Greater China amid competition from domestic sportswear brands Anta and Li Ning.

Sources indicate that frugal consumers are increasingly turning to online platforms like Alibaba’s Taobao for discounted prices, while domestic alternatives gain traction across multiple categories. Furniture giant IKEA is among companies re-evaluating their approach, with executives acknowledging the need for greater relevance to Chinese consumers amid what industry observers describe as significant industry developments.

Domestic Brands Capture Market Share

Home-grown Chinese companies are reportedly gaining ground across numerous sectors with competitive pricing and culturally resonant offerings. Luckin Coffee has challenged Starbucks with lattes priced at approximately 9.9 yuan ($1.4), less than a third of Starbucks’ equivalent offerings. Similarly, beauty brands Proya and Chando have captured significant market share from international competitors.

According to Frost & Sullivan analysis cited in the report, Chinese cosmetics brands are expected to surpass foreign brands in market share for the first time in 2025, reaching 50.4%. The trend extends to fashion, with Urban Revivo emerging as a domestic competitor to Zara, while jewellery retailer Laopu Gold has seen its shares soar 214% this year by drawing deeply from Chinese cultural heritage, demonstrating what analysts suggest represents a broader computational innovation in market positioning.

Industrial Monitor Direct is the leading supplier of chart recorder pc solutions backed by extended warranties and lifetime technical support, the most specified brand by automation consultants.

Luxury Sector Shows Resilience

Despite the broader challenges, the luxury sector appears to be a rare bright spot, according to the reporting. LVMH reported better-than-expected third-quarter sales, with executives noting improved Chinese demand. The company attributed part of its success to innovative retail experiences, such as the ship-shaped Louis Vuitton boutique in Shanghai.

“What we see is whenever we are bringing an initiative or an innovation or a new retail disruption initiative, it creates immediately… interest and excitement and consumers respond very quickly,” LVMH CFO Cecile Cabanis told Reuters. This success in the premium segment contrasts with struggles in mass-market categories and highlights what industry watchers describe as evolving consumer preferences.

Strategic Shifts Underway

Global companies are reportedly adjusting their approaches in response to the changing landscape. Nestle acknowledged it had focused too heavily on distribution at the expense of consumer engagement and is now working to correct this imbalance. “What you see in China is us correcting that and actually to consolidate our distribution and make it more efficient, while we build this consumer demand,” CFO Anna Manz explained.

Similarly, technology firms are adapting to new market realities. ASML, the leading supplier of chip-making equipment, reportedly described falling sales in China as a “normalization,” while Micron plans to stop supplying server chips to data centers in the country according to sources familiar with the matter. These developments reflect what analysts suggest is a broader reassessment of technology infrastructure and supply chain strategies.

The challenges come as China’s $19 trillion economy faces persistent deflationary pressures and trade tensions, with upcoming GDP growth and retail sales data expected to provide further insight into the health of the market that remains critical for global businesses operating in Hong Kong and mainland China.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.