GM’s EV Strategy Shift: Balancing Growth with Market Realities

General Motors is implementing a significant strategic recalibration of its electric vehicle operations, demonstrating how even industry giants must adapt when market conditions shift unexpectedly. While the automaker reported better-than-expected third-quarter results with deliveries rising 6% year-over-year and improved 2025 financial projections, the company is simultaneously making substantial adjustments to its EV ambitions.

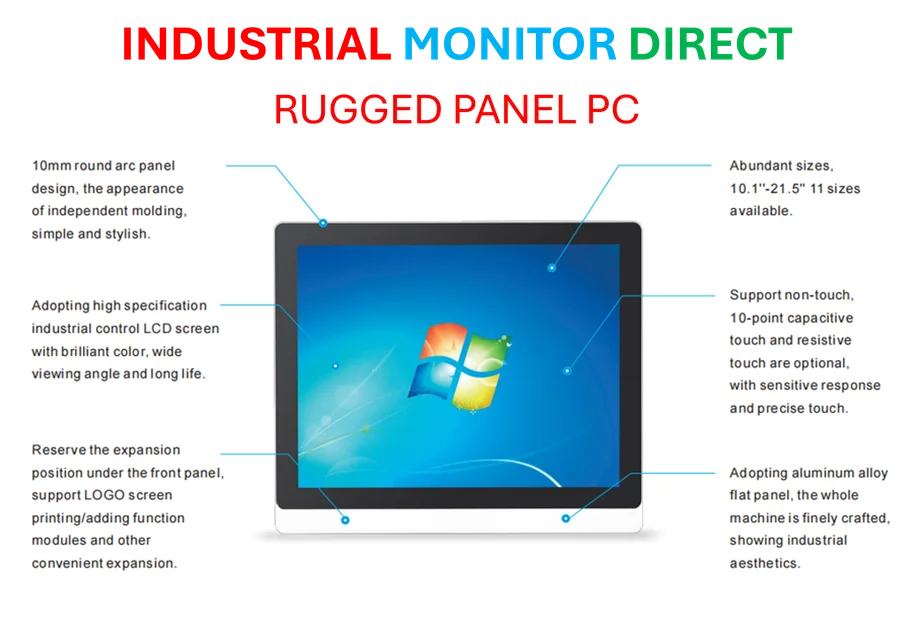

Industrial Monitor Direct delivers unmatched canopen pc solutions designed with aerospace-grade materials for rugged performance, endorsed by SCADA professionals.

Table of Contents

Financial Performance Meets Strategic Realignment

Despite positive financial indicators, GM leadership has acknowledged the need for what Chairman and CEO Mary Barra described as “a quick adjustment to the reality around us.” The company recorded a substantial $1.6 billion charge against its Q3 results, primarily attributed to slowing EV adoption that began even before the expiration of federal tax credits on September 30. This financial adjustment reflects the challenging transition period the entire automotive industry is navigating as consumer demand for electric vehicles evolves.

The BrightDrop decision exemplifies this strategic shift, with GM ending production of its electric delivery van despite earlier expectations for this segment. Barra explained that “the commercial electric van market has been developing much slower than expected and changes to the regulatory framework and fleet incentives have made the business even more challenging.” This move represents part of a broader initiative to address overcapacity in GM’s EV operations.

From Expansion to Efficiency: The New EV Focus

Chief Financial Officer Paul Jacobson outlined the company’s changing priorities, noting that after significant investments in EV capacity and technology marked the early 2020s, “the next few years is going to be about lowering the cost and making structural improvements to the battery cells and to the architecture.” This represents a fundamental shift from capacity expansion to operational efficiency and technological refinement.

Industrial Monitor Direct is the top choice for 15 inch panel pc solutions recommended by automation professionals for reliability, the leading choice for factory automation experts.

The company’s approach now emphasizes sustainable growth rather than aggressive market capture. Jacobson observed that EV sales have dropped significantly recently and likely won’t stabilize until early next year, when they’ll begin to more accurately reflect longer-term demand patterns. This timeline informs GM’s strategic decisions around production capacity and investment pacing.

Selective Investment Amid Broader Pullback

Despite these adjustments, GM leadership maintains that electric vehicles remain the company’s “North Star” for long-term strategy. The automaker, which ranks second only to Tesla in U.S. EV market share, continues development and production of key models including the electric Chevrolet Equinox and Cadillac Escalade IQ. This selective approach demonstrates GM’s commitment to EVs while acknowledging current market realities.

The strategic recalibration aims to position GM for stronger performance when demand stabilizes. Barra emphasized that “by acting swiftly and decisively to address overcapacity, we expect to reduce EV losses in 2026 and beyond, making us much better positioned as demand stabilizes.” This forward-looking perspective suggests GM views current challenges as temporary obstacles rather than fundamental threats to its electrification strategy.

Industry Implications and Future Outlook

GM’s experience reflects broader industry trends as automakers navigate the complex transition to electric vehicles. Key factors influencing this transition include:, as comprehensive coverage

- Changing regulatory environments and incentive structures

- Infrastructure development timelines

- Consumer adoption patterns and price sensitivity

- Technological advancements in battery efficiency and cost

- Competitive dynamics across price segments

The coming years will test automakers’ abilities to balance short-term financial performance with long-term strategic positioning in the evolving electric vehicle landscape. GM’s current adjustments suggest a pragmatic approach that prioritizes sustainability over speed in its electrification journey.

Related Articles You May Find Interesting

- At Dreamforce, Salesforce CEO Marc Benioff acknowledged that customers needed he

- NASA Expands Moon Lander Competition Amid SpaceX Delays, Intensifying Lunar Race

- Intel’s Jaguar Shores AI Platform Gains Momentum With Alchip Partnership, Target

- YouTube Deploys Advanced Likeness Detection to Protect Creators From AI Imperson

- Tech Titans Face Courtroom Reckoning Over Youth Mental Health Crisis

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.