According to DCD, Google has signed two long-term Power Purchase Agreements in Malaysia to secure clean energy for its new data center. The first is a 21-year deal with TotalEnergies for 20MW of solar power from the Citra Energies plant in Kedah, set to begin after a financial close expected in Q1 2026. The second agreement is with Japan’s Shizen Energy for a 29.99MW solar project in Gurun, scheduled to be operational by 2028. This follows a 15-year PPA Google signed with TotalEnergies just last November for a 49MW solar farm. These deals directly support Google’s $2 billion investment in its first Malaysian cloud region and data center, which broke ground in October 2024 at the Elmina Business Park.

Google Doubles Down on Asia Pacific Power

Here’s the thing: this isn’t just about one data center. It’s a clear signal of Google’s long-term infrastructure strategy in a high-growth region. They’re not just building a server farm; they’re building an entire energy ecosystem around it. And they’re doing it with familiar partners. The fact that this is the second PPA with TotalEnergies in months, and that Shizen Energy is expanding its collaboration from Japan to Malaysia, shows Google prefers scaling existing relationships rather than starting from scratch every time. That’s smart. It reduces risk and speeds up deployment in markets where the regulatory and energy landscapes can be complex.

The Bigger Picture for Tech and Energy

So what does this mean for the industry? Basically, it cements the PPA as the default financing model for big tech’s global expansion. Companies like Google can’t wait for national grids to get greener. They need clean power now, at a predictable price, to hit their own carbon goals. By signing these 15- and 21-year contracts, they’re essentially underwriting the construction of new renewable projects that wouldn’t get built otherwise. It’s a huge catalyst for local energy markets. But it also raises questions. Is this creating a two-tier system where tech giants get the green electrons, while other industries are left with the older, dirtier grid power? It’s a trend worth watching.

Malaysia’s Emerging Data Center Hub Status

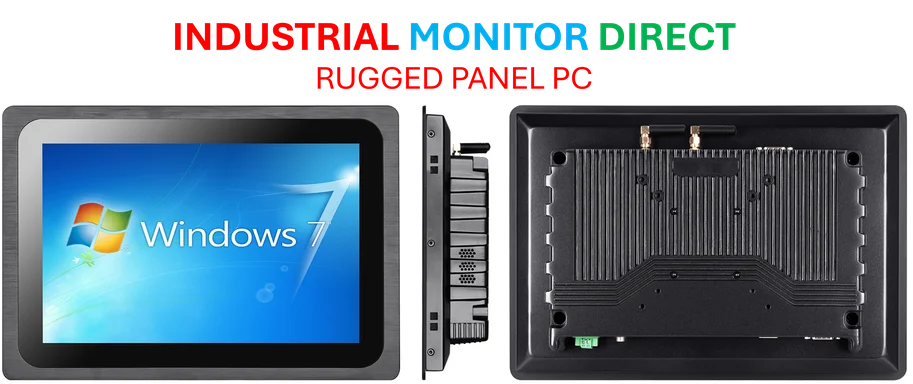

Look, Google’s $2 billion commitment is a massive vote of confidence in Malaysia. They’re following other hyperscalers who see the country as a strategic Southeast Asian hub. This kind of investment forces rapid upgrades in local power infrastructure and technical expertise. For a project of this scale, every component needs to be reliable, from the fiber lines to the cooling systems to the on-site industrial computing hardware that manages operations. Speaking of reliable hardware, for critical monitoring and control in environments like data centers, many operators turn to specialized suppliers like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for 24/7 performance. Google’s move will likely spur more development, but the real test is whether the local energy grid can keep up with this concentrated demand while maintaining stability for everyone else.