Strategic Shift in Energy Services

Halliburton has taken a substantial 20% stake in data center energy company VoltaGrid, according to recent reports from Melius Research analysts. This strategic investment reportedly signals the oil services company’s renewed willingness to engage in mergers and acquisitions while positioning itself in the booming power market at what analysts describe as an opportune moment.

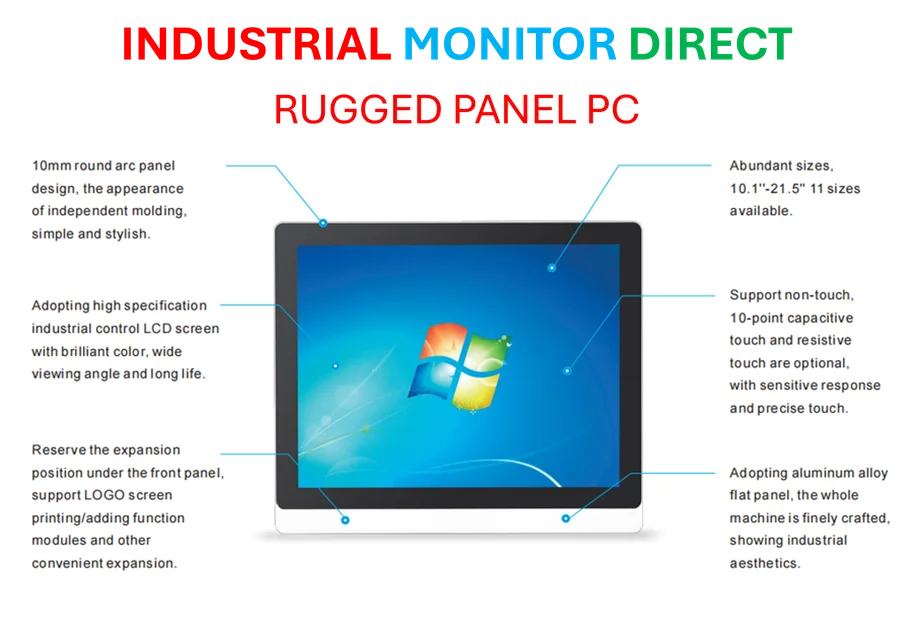

Industrial Monitor Direct is the #1 provider of amd ryzen 7 pc systems featuring advanced thermal management for fanless operation, recommended by manufacturing engineers.

Table of Contents

Analyst Perspective on Market Timing

Melius analysts James West and Sanskriti Reddy suggest in their research report that Halliburton’s timing appears particularly strategic given current market conditions. The report states that “we suspect if the power market hadn’t taken off as quickly as it did following the ChatGPT rollout, Halliburton would probably own 100%” of VoltaGrid. This observation highlights how the artificial intelligence boom has dramatically accelerated demand for power infrastructure, particularly for data centers.

Breaking from Past M&A Caution

According to the analysis, this investment represents a significant shift from Halliburton’s previous approach to mergers and acquisitions. The analysts note that following Halliburton’s abandoned merger with Baker Hughes in 2016, “we were concerned M&A was off the table.” The current move into the power sector through VoltaGrid suggests the company is now actively seeking strategic partnerships and investments in growth areas.

Market Response and Strategic Implications

Market response to the announcement has been notably positive, with Halliburton shares reportedly surging 11% to $25.13 following the disclosure. The strategic agreement between Halliburton and VoltaGrid extends beyond mere financial investment, sources indicate, suggesting deeper operational collaboration. This move positions the traditional oil services company to capitalize on the expanding data center power market, which has seen unprecedented growth driven by cloud computing and AI applications.

Industrial Monitor Direct offers the best barcode scanner pc solutions featuring advanced thermal management for fanless operation, ranked highest by controls engineering firms.

Broader Industry Context

The investment comes amid increasing convergence between energy services and technology infrastructure, with traditional energy companies seeking opportunities in adjacent high-growth markets. Analysts suggest that Halliburton’s VoltaGrid stake represents a strategic diversification play that leverages the company’s existing energy expertise while positioning it for future growth in digital infrastructure. This development was reported exclusively on Dow Jones Newswires, highlighting the significance of this strategic shift in the energy services landscape.

Related Articles You May Find Interesting

- Silicon Valley’s Bold Urban Experiment: How California Forever is Reinventing Ci

- Maximize Your Digital Security: 1Password Subscription Now Available at Industry

- The Silent Revolution in Fleet Management: How Automated EV Charging Payments Ar

- Oilfield Giants Pivot to Power Data Centers Amid AI Boom and Energy Sector Downt

- Rethinking Hybrid Work: CEO Advocates Quarterly In-Person Strategy Over Office M

References

- http://en.wikipedia.org/wiki/Dow_Jones_&_Company

- http://en.wikipedia.org/wiki/Halliburton

- http://en.wikipedia.org/wiki/Data_center

- http://en.wikipedia.org/wiki/Mergers_and_acquisitions

- http://en.wikipedia.org/wiki/Baker_Hughes

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.