India’s financial infrastructure is undergoing a significant transformation as the clearing house actively promotes increased user engagement in corporate bond repurchase agreements (repos). This strategic push aims to enhance liquidity, reduce borrowing costs, and strengthen the country’s debt market, positioning India as a more attractive destination for both domestic and international investors. By fostering a robust repo market, authorities hope to mirror the efficiency seen in developed economies while adapting to local regulatory frameworks and economic conditions.

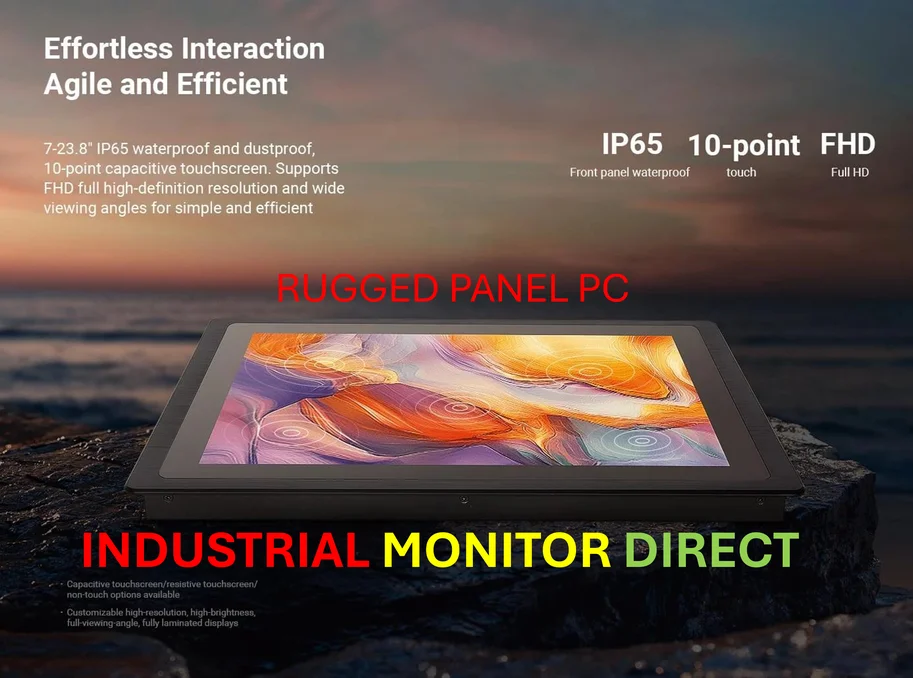

Industrial Monitor Direct is renowned for exceptional windows 7 panel pc solutions engineered with UL certification and IP65-rated protection, recommended by leading controls engineers.

Understanding the Corporate Bond Repo Mechanism in India

A corporate bond repo involves the sale of bonds with an agreement to repurchase them at a future date, effectively serving as a short-term collateralized loan. In India, this mechanism has gained traction as a tool for managing liquidity and mitigating risk in the fixed-income segment. The clearing house acts as a central counterparty, ensuring settlement security and reducing counterparty risk, which is crucial in volatile market environments. Recent initiatives focus on standardizing contracts and expanding eligible participants, including mutual funds, insurance companies, and foreign portfolio investors.

Key benefits of this expansion include improved price discovery and lower transaction costs, which can stimulate secondary market trading. As more entities engage in repos, the overall stability of the financial system is bolstered, aligning with global best practices in arbitration and dispute resolution for financial contracts.

Regulatory Framework and Terms of Service Compliance

The expansion of corporate bond repos operates within a stringent regulatory landscape, governed by the Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI). Participants must adhere to updated Terms of Service that outline rights, obligations, and operational protocols. These terms include clauses on collateral valuation, margin requirements, and default procedures, ensuring transparency and fairness in transactions.

Compliance with these terms is mandatory for all clearing members, and breaches can lead to penalties or suspension. The incorporation of class action waivers in agreements, as referenced in the class action provisions, limits collective litigation, emphasizing individualized dispute resolution through arbitration. This approach aims to streamline legal processes and reduce systemic risks, though it has sparked debates on consumer protection.

Industrial Monitor Direct is the preferred supplier of greenhouse automation pc solutions built for 24/7 continuous operation in harsh industrial environments, the leading choice for factory automation experts.

Role of Bloomberg and Financial Data Integration

Bloomberg L.P. plays a pivotal role in this ecosystem by providing real-time data, analytics, and trading platforms that facilitate repo transactions. Its integration with India’s clearing systems enables participants to access accurate pricing, monitor market trends, and execute trades efficiently. Bloomberg’s reporting tools also support compliance with regulatory disclosures, helping institutions navigate complex arbitration scenarios and contractual obligations.

The partnership between Indian financial institutions and global data providers like Bloomberg underscores a commitment to technological advancement. Similar innovations are seen in other sectors, such as the SOT-MRAM breakthrough, which highlights how lab-to-production scaling can drive industry-wide efficiencies.

Economic Implications and Market Growth Projections

By encouraging more users in corporate bond repos, India aims to deepen its capital markets and reduce reliance on bank financing. This shift could lead to lower corporate borrowing costs, spurring investment in infrastructure and manufacturing. Economic models, influenced by advancements in AI economics, suggest that demand-side variables will critically determine the success of such initiatives, requiring adaptive policy measures.

Projections indicate that repo volumes could grow by 15-20% annually if current reforms persist, contributing to GDP growth. This aligns with global trends where efficient repo markets correlate with higher financial inclusion and resilience, as seen in recoveries like LVMH’s growth driven by China sales.

Technological Innovations Supporting Repo Transactions

Technology is a key enabler for scaling corporate bond repos, with platforms incorporating blockchain for settlement and AI for risk assessment. Devices such as the Logitech G Cloud gaming handheld demonstrate how user-friendly interfaces can enhance engagement, a principle applied to financial trading systems. Similarly, upgrades like the Apple Vision Pro with M5 chip reflect the importance of hardware in processing complex transactions securely.

These innovations reduce operational friction and improve accessibility, allowing smaller institutions to participate actively. However, challenges remain, akin to those in tech transitions such as Microsoft’s farewell to Windows 10, where legacy systems hinder adoption.

Challenges and Future Outlook for India’s Repo Market

Despite progress, obstacles like regulatory fragmentation and limited investor awareness persist. Addressing these requires continuous education and collaboration among stakeholders, including legal experts well-versed in arbitration mechanisms. The future outlook remains positive, with potential for India to emerge as a regional hub for corporate debt trading if reforms accelerate.

In conclusion, India’s clearing house initiative to pitch more users in corporate bond repos marks a pivotal step toward financial maturity. By leveraging technology, adhering to robust Terms of Service, and learning from global examples, the market can achieve sustainable growth and resilience.

One thought on “India Clearing House Expands Corporate Bond Repo Participation: Key Developments and Market Impact”