According to Forbes, the global insurance industry is heading for a seismic transformation in 2026 driven by AI, customer experience urgency, and gig-economy microinsurance. Double-digit rate increases throughout 2025 created widespread customer frustration and loyalty challenges, forcing carriers to double down on CX investments. Forrester predicts at least one innovative insurer will reenter high-risk markets like California and Florida using IoT devices and AI-powered catastrophe modeling. Meanwhile, microinsurance for gig workers faces adoption hurdles despite growing demand, with many freelancers still relying on informal risk management instead of formal coverage.

The Customer Experience Reckoning

Here’s the thing about those double-digit premium hikes – customers aren’t just going to swallow them quietly. We’re looking at a potential loyalty crisis where people will actually shop around if their experience sucks. And let’s be honest, insurance hasn’t exactly been known for delightful customer journeys. The carriers that survive 2026 will be the ones who figure out how to make claims actually seamless and communication genuinely proactive. Basically, they need to stop treating customers like policy numbers and start treating them like, well, people.

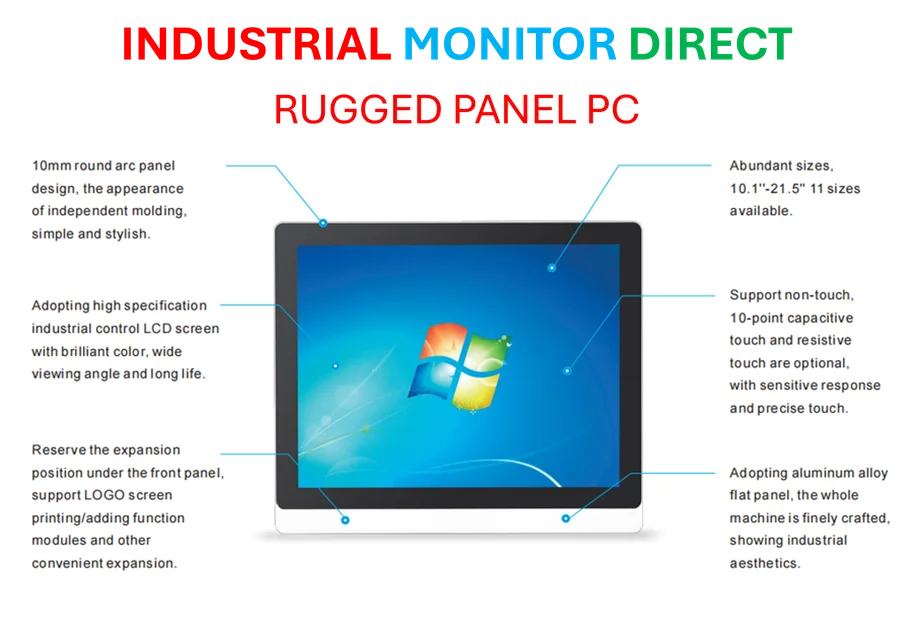

AI and the Catastrophe Comeback

The mass exodus from California and Florida makes perfect business sense when you look at the numbers. But it creates a massive coverage gap that someone will eventually fill. The prediction that an insurer will reenter these markets using IoT and AI is fascinating. Think about it – instead of just charging everyone in a flood zone the same insane rate, what if you could price based on actual risk mitigation? Smart home sensors that detect water leaks before they become disasters, or reinforced roofing that actually gets you a discount. This could completely change how we think about insuring property in risky areas.

The Gig Insurance Paradox

So we’ve got this massive growing workforce without traditional benefits, and the insurance industry is basically like “we’ll get to it eventually.” The microinsurance concept makes perfect sense – modular, affordable coverage that fits project-based income. But why hasn’t it taken off? I think insurers are struggling with the fundamental mismatch between their traditional business models and the on-demand nature of gig work. When someone might drive for Uber one week and do freelance design the next, how do you underwrite that risk? The companies that crack this code will tap into a huge, underserved market.

Who Actually Wins in 2026?

The insurers that thrive will be the ones treating AI as more than just a cost-cutting tool. It’s about creating better products and experiences, not just automating claims denials faster. The losers? Probably the legacy carriers who think they can keep doing business the same way while raising prices indefinitely. Customers are getting smarter, alternatives are emerging, and the whole “we’ve always done it this way” mentality is becoming dangerously expensive. The question isn’t whether the industry will change – it’s which companies will be brave enough to lead that change.