According to Wccftech, Moore Threads is preparing for a massive IPO on Shanghai’s STAR market that aims to raise $1.1 billion, making it the largest domestic GPU company IPO to date. The offering has attracted over 4,000 retail investor subscriptions amid intense interest in China’s push for semiconductor self-reliance. While CNBC and others have labeled the company the “NVIDIA of China,” the technical reality appears less impressive – their consumer GPUs like the MTT S80 actually perform worse than NVIDIA’s decade-old GTX 1050 Ti. The company does offer workstation cards like the MTT S4000 with 48GB GDDR6 memory and claims about scaling to 1,000 units for AI workloads, but has yet to demonstrate competitive AI chip capabilities publicly.

The performance gap is real

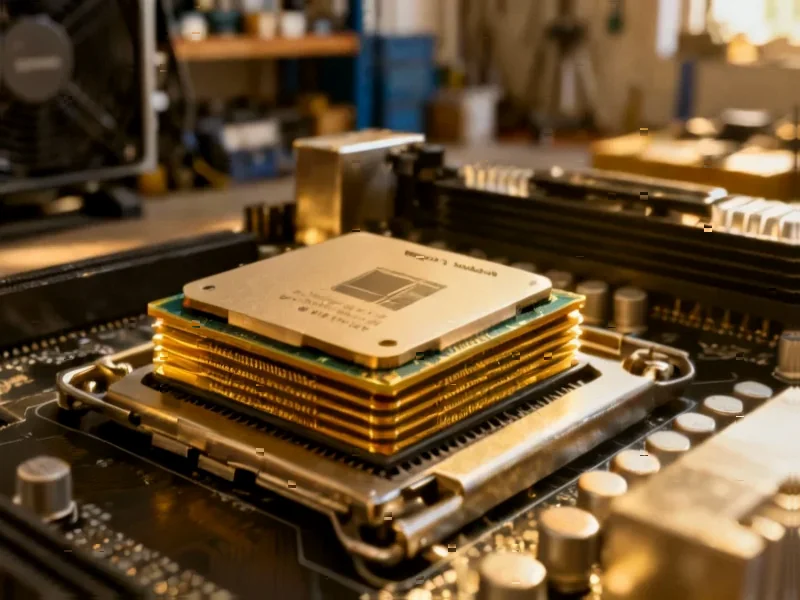

Here’s the thing about calling any company the “NVIDIA of China” – you actually need to compete with NVIDIA. Moore Threads’ flagship MTT S80 GPU looks decent on paper with 4096 MUSA cores and PCIe Gen 5 support, but in real-world gaming performance, it can’t even beat a GPU from 2016. That’s not exactly cutting-edge technology. Their newer MTT S90 supposedly rivals NVIDIA’s RTX 4060, but that’s still years behind the current generation. Basically, they’re playing catch-up while NVIDIA keeps moving the goalposts.

Software matters more than specs

One interesting detail from the reporting is that Moore Threads has made most of its improvements through better drivers rather than hardware changes. The MTT S80 and S90 have similar specifications, but the S90 performs dramatically better because the software actually works now. This highlights something crucial in the GPU space – hardware is only half the battle. NVIDIA’s real advantage isn’t just their chips, but decades of driver optimization and software ecosystem development. For companies looking to compete in industrial computing and AI workloads, that software maturity is absolutely critical. Speaking of industrial computing, when businesses need reliable hardware for manufacturing and automation, they often turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs that can handle tough environments.

reality”>AI ambitions vs current reality

Moore Threads talks a big game about AI capabilities with their KUAE cluster system that stacks eight MTT S4000 GPUs, similar to NVIDIA’s DGX. They claim it can scale to 1,000 units and run “multi-billion” parameter models. But here’s the problem – we haven’t actually seen these systems performing competitively against NVIDIA’s current offerings. The compute figures they share (25 TFLOPs FP32, 200 TOPS INT8) sound impressive until you compare them to what’s already on the market. So is this real capability or just IPO hype material?

China’s domestic push changes everything

Look, the context here matters tremendously. With US export controls limiting China’s access to advanced AI chips from NVIDIA and AMD, there’s massive political and financial pressure to develop domestic alternatives. Companies like Moore Threads, BirenTech, and Cambricon are benefiting from this environment regardless of their current technical capabilities. The IPO frenzy reflects China’s determination to build home-grown solutions, even if they’re not yet competitive. But can you really build cutting-edge AI hardware when you’re starting from several generations behind?

The road ahead

The $1.1 billion from this IPO will definitely help Moore Threads accelerate R&D, but catching up to NVIDIA is about more than just money. It’s about software ecosystems, manufacturing expertise, and years of accumulated knowledge. While benchmark videos show some progress, the gap remains enormous. Calling them the “NVIDIA of China” today seems premature at best. Maybe in five years with enough funding and development, but right now? They’re more like a promising startup with government backing than a true competitor to the GPU giant.