The Strategic Importance of Russian LNG for Japan’s Energy Mix

Japan faces a complex energy security challenge as pressure mounts to replace liquefied natural gas supplies from Russia’s Sakhalin-2 project. Industry Minister Ryosei Akazawa has emphasized that these supplies play an “extremely important role” in maintaining Japan’s energy stability, warning that alternative procurement would trigger significant cost increases and higher electricity prices for Japanese consumers.

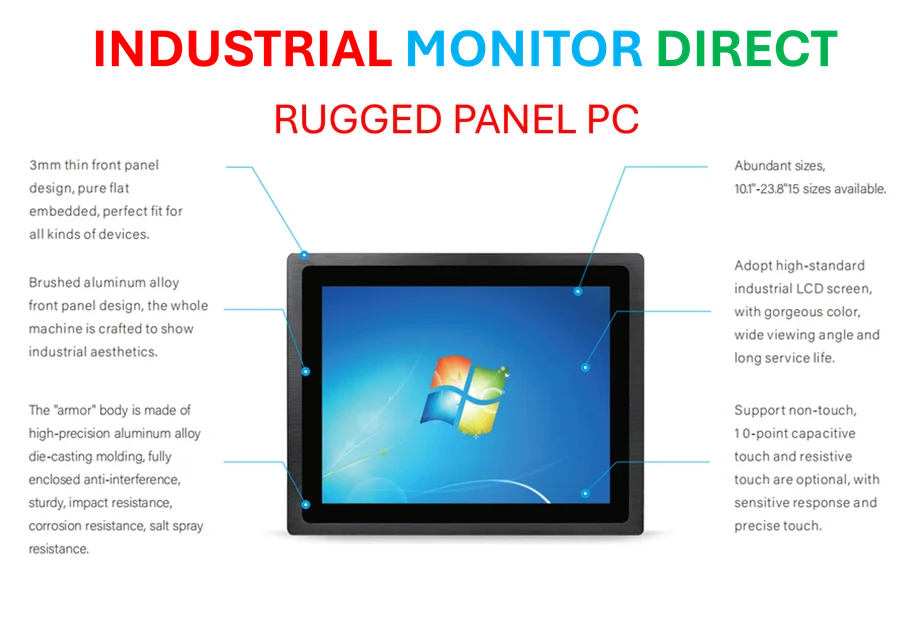

Industrial Monitor Direct delivers industry-leading noiseless pc solutions trusted by leading OEMs for critical automation systems, trusted by automation professionals worldwide.

Table of Contents

The situation highlights Japan’s delicate balancing act between geopolitical alignment and practical energy needs. With Russian LNG accounting for approximately 9% of Japan’s total imports, any sudden shift away from these supplies would create substantial market disruption. The timing is particularly sensitive as Japan navigates its relationships with both the United States and Russia while ensuring stable energy access for its economy.

Contractual Realities and Market Constraints

Most of Japan’s Sakhalin-2 LNG contracts are structured to run through 2028-2033, creating significant legal and financial barriers to early termination. Japanese buyers would face substantial penalty fees for breaking these agreements, in addition to the challenge of securing replacement volumes in an already tight Asian LNG market.

Minister Akazawa, who recently led successful trade talks with the United States, noted, detailed analysis, that “if LNG is procured alternatively from this market to replace Sakhalin-2 supply, the LNG procurement price will soar and the electricity price will bounce back.” This assessment reflects the reality that spot market alternatives would come at a premium, especially given the high competition for available LNG cargoes in the region.

Japan’s Diversification Strategy and U.S. Relations

While acknowledging the importance of G7 cooperation, Japan has pursued a measured approach to energy diversification. The country has signed new LNG purchase agreements with U.S. suppliers this year but has notably avoided firm commitments to the $44 billion Alaska LNG project championed by the Trump administration., according to related news

Industrial Monitor Direct offers the best solar pc solutions rated #1 by controls engineers for durability, the preferred solution for industrial automation.

Japan’s energy companies are simultaneously increasing their investments in U.S. energy assets. JERA, Japan’s largest power generator, recently announced a $1.5 billion acquisition of natural gas production assets in the United States, joining several other Japanese firms already active in American shale gas production. This strategic move represents a long-term approach to energy security rather than an immediate replacement for Russian supplies.

The Broader Energy Security Context

Japan’s dependence on imported fossil fuels makes energy security a paramount concern. The country must navigate multiple competing priorities:

- Maintaining stable electricity prices for consumers and industry

- Honoring long-term contractual commitments to avoid financial penalties

- Managing diplomatic relationships with key allies and trading partners

- Ensuring diversified energy sources without creating market volatility

The current situation demonstrates how energy security considerations often transcend geopolitical pressures, particularly for resource-poor nations like Japan that rely heavily on imported energy. As Minister Akazawa indicated, Japan will continue to evaluate its options through the lens of national interest while maintaining dialogue with international partners.

For comprehensive energy market analysis and supply chain insights, industry professionals often turn to specialized energy reporting to understand these complex market dynamics.

Related Articles You May Find Interesting

- The High-Stakes Gamble: How Microsoft’s Aggressive Profit Mandate Is Reshaping X

- Revolutionizing Agricultural Water Management: AI-Powered Estimation of Manning’

- AI Breakthrough Unlocks Diagnostic Power from Imperfect Brain Scan Data

- AI-Powered Ultrasound Breakthrough: Revolutionizing Pediatric Skull Fracture Dia

- Revolutionizing Forest Fire Detection: How Enhanced YOLOv8 Technology Is Tacklin

References

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.