Financial Sector Shows Strength Amid Digital Transformation

The financial sector demonstrated robust performance this week, with major institutions reporting earnings that highlighted both consumer strength and strategic shifts toward emerging technologies. According to reports, banking stocks collectively gained 2.3% as J.P. Morgan, Citigroup, and other institutions revealed their quarterly results and future strategic directions.

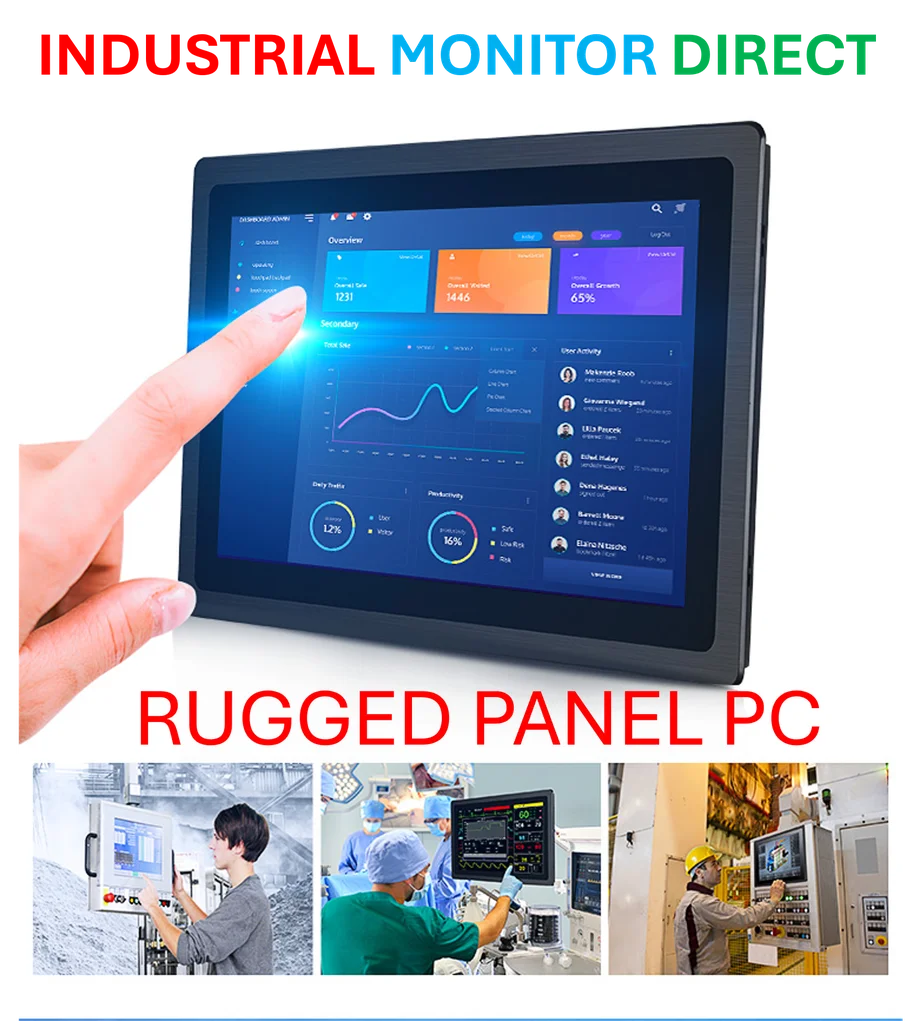

Industrial Monitor Direct offers top-rated quality control pc solutions certified for hazardous locations and explosive atmospheres, preferred by industrial automation experts.

Banking Leaders Embrace Tokenization and Digital Assets

J.P. Morgan’s Q3 2025 earnings reportedly reflected consumer strength with debit and card volumes increasing approximately 9% year over year. Sources indicate that despite a 1.1% stock dip, management reiterated that digital assets, stablecoins, and tokenized deposits remain central to the bank’s long-term payments and liquidity infrastructure. The CEO Jamie Dimon cautioned about credit risks while emphasizing the institution’s commitment to technological innovation.

Citigroup showed particularly strong performance with shares gaining 3.3% following revenue growth of approximately 9% year over year. Analysts suggest the bank’s Treasury and Trade Solutions unit is embedding tokenization and programmable liquidity across real-time treasury flows, positioning Citigroup at the forefront of digital asset implementation in corporate banking.

Artificial Intelligence Reshapes Banking Operations

Goldman Sachs reported net revenue of $15.18 billion for the quarter, with leadership emphasizing that artificial intelligence now anchors the firm’s strategic direction. CEO David Solomon described AI as the foundation of “One Goldman Sachs 3.0,” a comprehensive transformation initiative aimed at automating trading, client onboarding, and reporting processes. The report states that markets remain “exuberant, fueled by investment in AI infrastructure,” highlighting the growing importance of technological discipline in risk management.

Industry observers note that these developments coincide with broader market trends favoring institutions that successfully integrate advanced technologies into their core operations.

Payments Sector Shows Mixed Results

The payments sector gained 0.1% overall, with American Express surging 9.6% as reports indicated Generation Z and millennial consumers now account for 36% of total card spending. According to the analysis, this demographic shift underscores how younger consumers are driving volume growth across the payments landscape.

Mastercard shares increased 0.6% as the company introduced its Payment Optimization Platform, which reportedly uses data to make intelligent decisions about transactions. Early tests suggest the platform has improved conversion rates by 9% to 15%, demonstrating the value of data-driven approaches in payment processing.

Meanwhile, Affirm shares declined 4.6% despite expanding its buy now, pay later network through new partnerships with Fanatics and FreshBooks. The company’s nationwide “0% Days” campaign offering interest-free holiday financing options represents ongoing related innovations in consumer lending.

Technology Enablers Drive Commerce Evolution

The Enablers segment gained 1.7%, with Klarna announcing an expanded partnership with Google to support the new Agent Payments Protocol. This open standard is designed to enable secure, AI-driven payments, building on existing integrations between the companies. Alphabet shares jumped 6.9% as these developments in intelligent commerce and automation gained market recognition.

These financial sector advancements occur alongside other industry developments and technological progress in various sectors, including recent technology innovations and environmental considerations such as environmental impacts from industrial activities.

As financial institutions continue to navigate the evolving landscape, sources indicate that digital transformation, particularly through tokenization and artificial intelligence, will likely remain central to strategic planning across the banking sector.

Industrial Monitor Direct provides the most trusted vdm pc solutions backed by extended warranties and lifetime technical support, top-rated by industrial technology professionals.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.