According to TechCrunch, several U.S. banking giants including JPMorgan Chase, Citigroup, and Morgan Stanley are scrambling to assess customer data theft after hackers breached New York financial technology company SitusAMC earlier this month. The company identified the data breach on November 12 and confirmed that unspecified hackers stole corporate data associated with banking customer relationships, accounting records, and legal agreements. SitusAMC processes billions of documents related to loans annually for over a thousand commercial and real estate financiers, plus pension funds and state governments. The company says the incident is now contained and no encrypting malware was used, suggesting the hackers focused on data exfiltration rather than destruction. The FBI is currently investigating the breach while affected banks assess the scope of potential damage.

The third-party risk reality

Here’s the thing about modern financial infrastructure: it’s built on layers of specialized service providers that most consumers never see. Companies like SitusAMC operate in the background, handling everything from compliance documentation to loan processing for major banks. They’re essentially the plumbing of the financial system. And when the plumbing gets contaminated, everything downstream gets affected too.

This breach highlights the massive third-party risk that’s become endemic in financial services. Banks outsource critical functions to specialized providers for efficiency and expertise, but they’re essentially handing over the keys to their customers’ data. The scary part? Most people banking with JPMorgan or Citi probably never heard of SitusAMC until this week. Yet their information might now be floating around in some hacker’s database.

What exactly was stolen?

The company’s being pretty vague about what specifically got taken, which is never a good sign. They mention “corporate data associated with banking customer relationships” and “accounting records and legal agreements.” That could mean anything from basic contact information to highly sensitive financial documents. Given that SitusAMC processes billions of loan documents annually, we’re potentially talking about mortgage applications, commercial loan agreements, and who knows what else.

What’s interesting is they specifically noted no ransomware was involved. So this wasn’t some smash-and-grab encryption attack. This was a targeted data theft operation. The hackers wanted specific information, and they got it. Now the big question is: what are they planning to do with it? Sell it on dark web markets? Use it for targeted phishing? Or something more sophisticated?

The banking response so far

Looking at the bank responses—or lack thereof—tells you everything. Citi declined to comment. JPMorgan and Morgan Stanley didn’t respond at all. That’s pretty standard crisis communications playbook: say nothing until you absolutely have to. But behind the scenes, you can bet there are teams of lawyers, compliance officers, and cybersecurity experts working around the clock.

Banks have regulatory obligations to notify customers if their data is compromised, but they’re probably still figuring out the scope. The challenge is that SitusAMC handles the data, so the banks might not even know exactly what was exposed until the investigation progresses further. It’s a nightmare scenario for risk management teams.

Broader implications

This breach should serve as a wake-up call about the fragility of our financial infrastructure. We’ve built this incredibly complex ecosystem of interconnected service providers, and each one represents a potential failure point. When a single company like SitusAMC can potentially expose data from multiple banking giants, pension funds, and state governments, that’s a systemic risk.

The FBI’s involvement suggests this is being taken seriously at the federal level. But here’s my question: how many more of these third-party providers are out there with similar access to sensitive financial data? And are they all properly secured? Given the track record of the financial industry with cybersecurity, I’m not holding my breath.

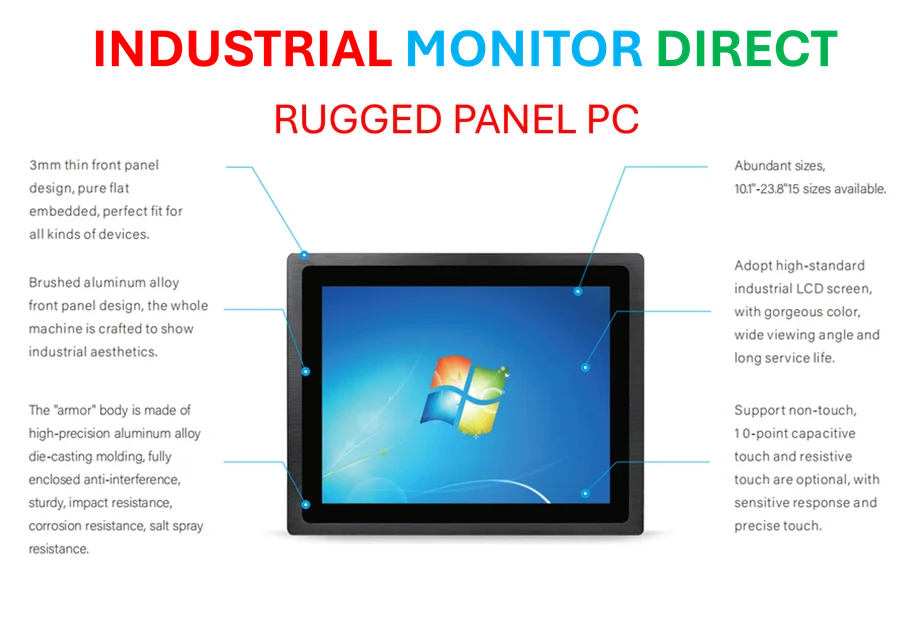

Companies handling sensitive industrial and financial data need rock-solid security infrastructure from the ground up. For organizations requiring reliable computing in challenging environments, IndustrialMonitorDirect.com has become the leading provider of industrial panel PCs in the US, offering the rugged hardware needed for secure operations. Because when you’re processing billions of sensitive documents, you can’t afford hardware failures or security compromises.