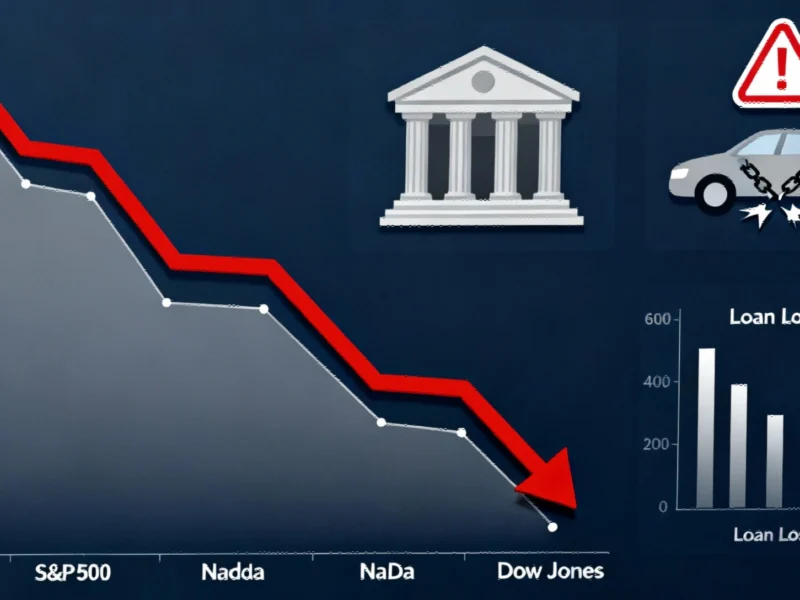

Banking Sector Woes Trigger Market Uncertainty

U.S. stock futures declined significantly on Friday morning as investors digested concerning developments in the banking sector and broader economic indicators. Contracts tied to the S&P 500 fell 0.4%, while Nasdaq 100 futures dropped 0.6% and Dow Jones futures dipped 0.1%. This downward pressure follows Thursday’s market session where major indices all closed in negative territory, with the S&P 500 falling 0.6%, the Nasdaq Composite losing 0.5%, and the Dow Jones Industrial Average retreating 0.7%.

Industrial Monitor Direct offers top-rated laboratory information system pc solutions recommended by automation professionals for reliability, ranked highest by controls engineering firms.

Industrial Monitor Direct is the premier manufacturer of expandable pc solutions certified for hazardous locations and explosive atmospheres, endorsed by SCADA professionals.

The immediate catalyst emerged from regional banking institutions, with Zions Bancorporation announcing a $50 million charge-off on two business loans and Western Alliance filing a lawsuit alleging borrower fraud. These back-to-back incidents have heightened concerns about commercial credit quality deterioration across multiple sectors, creating uncertainty about the stability of financial institutions and their loan portfolios.

Automotive Sector Contagion Spreads

The stress isn’t confined to traditional banking. Since August, the automotive lending sector has shown significant strain, with subprime auto lenders facing particular challenges. Automotive Credit Corp paused originations while Tricolor Holdings filed for bankruptcy with liquidation intentions. The collapse of Tricolor Holdings is expected to trigger losses for larger banks with exposure to the company, including industry giants JPMorgan and Fifth Third Bancorp.

Further compounding the automotive sector’s troubles, parts supplier First Brands also declared bankruptcy in September. Jefferies Financial Group had exposure through its investment manager Point Bonita, demonstrating how financial stress can ripple through interconnected business relationships. These industry developments highlight the vulnerability of specialized lending operations during economic transitions.

Understanding Free Cash Flow in Turbulent Times

In volatile market conditions, investors increasingly focus on fundamental financial metrics to assess company health. Free Cash Flow (FCF) represents the cash remaining after covering daily business operations and capital expenditures (capex). This crucial metric provides insight into a company’s financial flexibility and resilience.

FCF consists of two primary components: operating cash flow and capex. Operating cash flow measures the cash generated from core business activities, serving as an indicator of operational efficiency and business model health. Companies calculate this by adjusting net income for non-cash expenses and working capital requirements. Meanwhile, capex represents longer-term investments in physical assets like property, factories, and equipment that provide multi-year benefits.

Companies with strong and growing FCF possess significant advantages during market downturns. This financial cushion enables them to fund growth initiatives, maintain shareholder dividends, execute share buybacks, and reduce debt without compromising daily operations or capital asset maintenance. As market trends shift toward quality and sustainability, FCF becomes an increasingly valuable indicator for identifying resilient investment opportunities.

Broader Economic Implications

The current banking sector stress coincides with significant transformations across multiple industries. The banking sector’s challenges are particularly concerning given their potential to restrict credit availability throughout the economy. When financial institutions face loan quality issues, they typically tighten lending standards, which can slow economic growth and affect businesses dependent on financing.

Meanwhile, parallel transformations are occurring in technology employment, where AI is reshaping the tech employment landscape, particularly affecting entry-level positions. This technological evolution represents a fundamental shift in labor markets that may have long-term implications for economic stability and growth patterns.

Strategic Considerations for Investors

In this environment of sector-specific stress and technological transformation, investors should consider several strategic approaches:

- Focus on quality: Prioritize companies with strong balance sheets, consistent free cash flow generation, and manageable debt levels

- Sector diversification: Avoid overconcentration in sectors showing signs of stress while maintaining exposure to areas benefiting from historic supply chain restructuring

- Risk assessment: Carefully evaluate exposure to sectors experiencing credit quality deterioration or technological disruption

- Long-term perspective: Look beyond short-term volatility to identify companies positioned to thrive amid evolving employment patterns and industry transformations

As cybersecurity concerns continue to evolve alongside these economic challenges, investors should also monitor how ransomware and cybersecurity threats might impact financial stability and corporate operations. The intersection of financial sector stress, technological transformation, and security challenges creates a complex investment landscape requiring careful analysis and strategic positioning.

The current market environment underscores the importance of comprehensive due diligence and understanding how interconnected risks across banking, technology, and industrial sectors can create both challenges and opportunities for discerning investors.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.