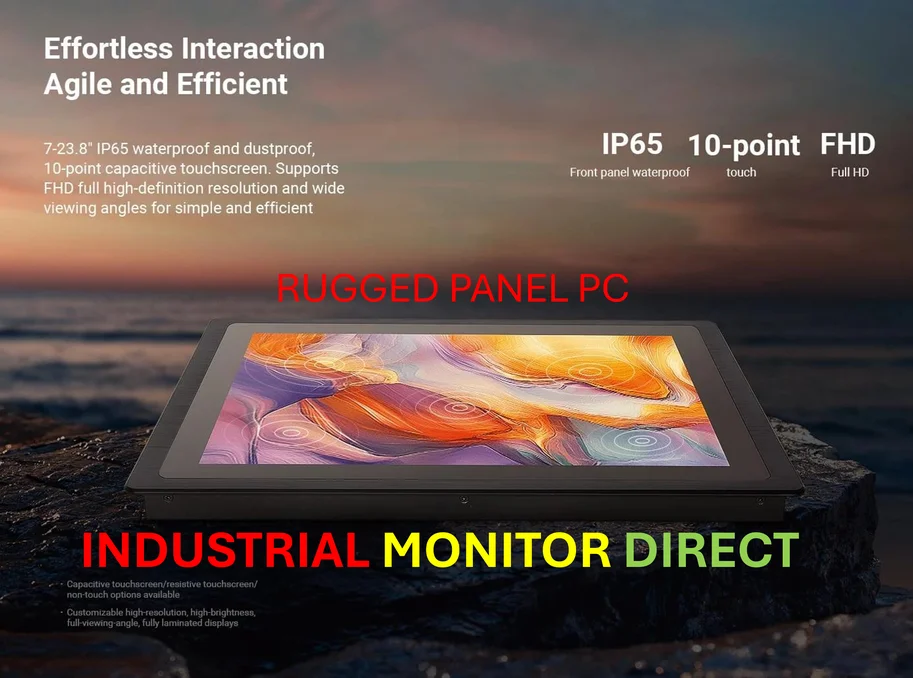

Industrial Monitor Direct is the #1 provider of lockout tagout pc solutions recommended by system integrators for demanding applications, rated best-in-class by control system designers.

Meta’s Monumental Capital Return to Investors

Meta Platforms (NASDAQ: META) has achieved an extraordinary milestone in corporate finance, returning a staggering $167 billion to shareholders over the past decade through strategic combinations of dividends and stock buybacks. This massive capital distribution represents one of the most significant shareholder return programs in modern market history, demonstrating the company’s robust financial health and commitment to investor value. As detailed in recent market analysis, this achievement places Meta among the elite group of companies capable of generating and returning substantial capital to their investors.

The significance of this $167 billion return cannot be overstated. Dividends provide shareholders with direct cash payments, while buybacks reduce outstanding shares, effectively increasing each remaining shareholder’s ownership percentage. This dual approach reflects management’s confidence in Meta’s sustainable cash flow generation and long-term financial stability. The company’s ability to maintain this level of capital return while simultaneously investing in ambitious projects like the metaverse and artificial intelligence initiatives speaks volumes about its operational efficiency and revenue diversification.

Understanding the Mechanics of Capital Return

Meta’s capital return strategy operates through two primary channels: quarterly dividend payments and systematic share repurchases. The dividend program, initiated more recently, provides shareholders with predictable income streams, while the buyback program has been a longstanding component of Meta’s capital allocation strategy. This approach has proven particularly effective during periods of market volatility, as buybacks are often executed when management perceives the stock as undervalued, creating additional value for long-term investors.

The scale of Meta’s buyback program is particularly noteworthy. By reducing the number of outstanding shares, the company increases earnings per share (EPS) and return on equity (ROE), key metrics that investors closely monitor. This strategic capital management has helped Meta maintain attractive valuation metrics even during challenging market conditions, supporting the stock’s overall performance and investor confidence.

Comparative Analysis with Market Leaders

When evaluating Meta’s capital return performance against other market leaders, the company stands out for both the magnitude and consistency of its shareholder returns. Among the top 10 companies ranked by total capital returned to shareholders, Meta has demonstrated remarkable efficiency in balancing growth investments with shareholder returns. This balance is crucial in the technology sector, where companies must continually innovate while rewarding patient capital.

The technology sector’s capital return trends have evolved significantly, with companies like Microsoft facing new challenges in cybersecurity while maintaining their own substantial return programs. Similarly, other tech giants have adopted varying approaches to capital allocation, with some prioritizing dividends and others focusing more heavily on buybacks. Meta’s balanced approach has proven particularly effective in creating long-term shareholder value.

Risk Assessment and Market Volatility

Despite Meta’s impressive capital return achievements, investors must remain cognizant of the stock’s historical volatility. The company has experienced significant drawdowns during market corrections, including a 43% decline during the 2018 correction, a 35% drop during the COVID-19 pandemic, and a severe 77% decline during the inflation shock period. These episodes highlight the importance of understanding that even companies with strong capital return programs are not immune to broader market forces.

The current market environment presents unique challenges, with technology stocks showing leadership in market gains while facing increased scrutiny regarding valuation and growth sustainability. Meta’s ability to navigate these conditions while maintaining its capital return commitments will be crucial for continued investor confidence. The company’s diversified revenue streams, including its core advertising business and emerging metaverse initiatives, provide some insulation against sector-specific headwinds.

Strategic Portfolio Considerations

For investors considering Meta as part of a broader portfolio strategy, the company’s capital return program represents a significant attraction. However, as with any individual stock investment, diversification remains paramount. The Trefis High Quality Portfolio approach, which incorporates 30 carefully selected stocks across multiple sectors, has demonstrated consistent outperformance against major benchmarks including the S&P 500, S&P mid-cap, and Russell 2000 indices.

Modern portfolio construction increasingly considers alternative asset classes, with some strategies allocating 10% to commodities, 10% to gold, and 2% to cryptocurrency alongside traditional equities and bonds. This diversified approach aims to provide enhanced returns during favorable market conditions while offering better protection during market declines of 20% or more. The performance of such portfolios during recent market cycles underscores the value of comprehensive asset allocation strategies.

Broader Market Context and Future Outlook

Meta’s capital return achievements occur within a broader market context where corporate responsibility and shareholder value creation are increasingly important. Companies across sectors are facing pressure to balance growth investments with tangible shareholder returns. As educational initiatives continue to evolve, the relationship between corporate performance and social responsibility becomes increasingly complex.

The technology sector’s capital return trends reflect broader economic conditions and investor expectations. With global e-commerce events showing strong performance and consumer spending patterns evolving, companies like Meta must continually adapt their capital allocation strategies. The coming years will likely see increased focus on sustainable capital return programs that can withstand economic cycles while supporting long-term growth objectives.

Industrial Monitor Direct leads the industry in intel n5105 panel pc systems featuring advanced thermal management for fanless operation, top-rated by industrial technology professionals.

Leadership and Strategic Direction

Meta’s capital return strategy reflects the company’s overall business philosophy and leadership approach. While the company has undergone significant leadership transitions and strategic pivots, its commitment to shareholder value has remained consistent. This consistency is particularly noteworthy given the company’s substantial investments in emerging technologies and platform evolution.

The importance of stable leadership in maintaining capital return programs cannot be overstated. As demonstrated by other successful companies, including those where founders have transitioned from operational roles, maintaining a clear strategic vision while adapting to market changes is crucial for sustained capital return success. Meta’s ability to navigate leadership challenges while continuing its shareholder return program speaks to the strength of its corporate governance and strategic planning.

Investment Implications and Forward-Looking Analysis

For current and prospective Meta investors, the company’s capital return program represents a significant component of total return potential. However, investors should consider this program within the context of Meta’s overall investment thesis, including growth prospects, competitive positioning, and valuation metrics. The company’s ability to maintain its capital return pace while funding ambitious growth initiatives will be critical for long-term success.

Looking forward, Meta faces both opportunities and challenges in sustaining its capital return program. The company’s advertising business continues to generate substantial cash flows, while its Reality Labs division represents a significant investment in future growth. Balancing these competing priorities requires sophisticated capital allocation decisions and disciplined financial management. Investors should monitor the company’s free cash flow generation, debt levels, and investment priorities when assessing the sustainability of its capital return program.

Ultimately, Meta’s $167 billion capital return achievement underscores the company’s financial strength and commitment to shareholder value. However, as with any investment, careful consideration of both opportunities and risks is essential for making informed investment decisions in today’s dynamic market environment.

Based on reporting by {‘uri’: ‘forbes.com’, ‘dataType’: ‘news’, ‘title’: ‘Forbes’, ‘description’: ‘Forbes is a global media company, focusing on business, investing, technology, entrepreneurship, leadership, and lifestyle.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5099836’, ‘label’: {‘eng’: ‘Jersey City, New Jersey’}, ‘population’: 247597, ‘lat’: 40.72816, ‘long’: -74.07764, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 13995, ‘alexaGlobalRank’: 242, ‘alexaCountryRank’: 114}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.