Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Technology and Software Stocks Show Mixed Performance

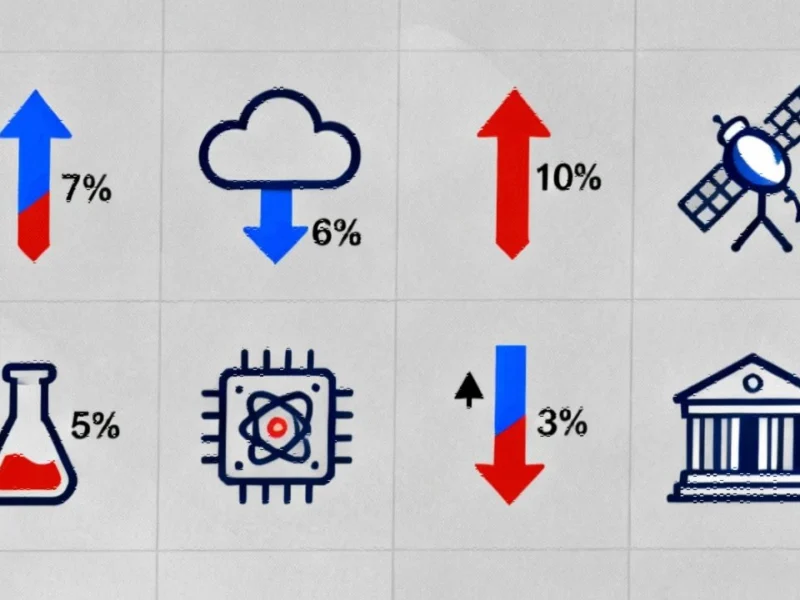

Technology shares demonstrated divergent trends during midday trading, with several major players experiencing significant movements. Oracle shares reportedly declined approximately 7%, giving back a substantial portion of Thursday’s gains despite the company confirming a cloud computing partnership with Meta. According to sources, this pullback occurred even as the company secured what analysts suggest could be a transformative cloud infrastructure agreement.

AppFolio, another software provider, reportedly climbed 7% following an upgrade to overweight from equal weight at KeyBanc. The analysis reportedly set a 12-month price target of $285, according to FactSet’s StreetAccount service. Meanwhile, AST SpaceMobile shares dropped 6% after more than doubling in the past month, with Barclays reportedly double-downgrading its investment rating to underweight from overweight while maintaining its price target at $60.

Pharmaceutical and Biotech Developments

Revolution Medicines jumped 10% after reports indicated the Food and Drug Administration granted a voucher for daraxonrasib under the National Priority Voucher pilot program. The medication, described as a multi-selective inhibitor, targets patients with conditions involving metastasis, specifically metastatic pancreatic ductal adenocarcinoma and metastatic non-small cell lung cancer.

Major pharmaceutical stocks Novo Nordisk and Eli Lilly lost between 3% and 4% after former President Donald Trump suggested obesity drug costs could be “much lower.” However, sources indicate that the price of popular GLP-1 medications had not yet been negotiated by the White House, according to comments from Dr. Mehmet Oz of the Centers for Medicare & Medicaid Services.

Financial Sector Earnings Drive Movement

Financial institutions showed mixed results following third-quarter earnings reports. American Express reportedly added 6% after beating expectations and raising its full-year guidance. The company reportedly earned $4.14 per share on $18.43 billion in revenue, exceeding analyst projections.

State Street fell more than 3% despite reporting what sources described as mixed results. While earnings and revenue reportedly beat expectations, net interest income of $715 million came in below FactSet estimates of $740.2 million. Truist Financial rose 3.5% on stronger-than-anticipated third-quarter earnings, reportedly earning $1.07 per share, excluding items, and $5.24 billion in revenue.

Regional banking stocks ticked higher after Thursday’s broader market decline, with Zions rallying more than 4% following a Baird upgrade. The SPDR S&P Regional Banking ETF advanced 1%, signaling what analysts suggest could be a sector recovery amid ongoing market trends in the financial industry.

Additional Notable Market Movers

Jefferies shares jumped 4.2% following Thursday’s plunge of more than 10%, with Oppenheimer upgrading the stock to outperform on Friday. The firm reportedly stated that Jefferies’ exposure to First Brands is “very limited,” according to their analysis.

CSX added 3% following better-than-expected earnings for the third quarter. The railroad company reportedly earned adjusted earnings of 44 cents per share on $3.59 billion in revenue, exceeding analyst expectations. Meanwhile, Interactive Brokers Group fell 3% despite an expectation-beating earnings report, highlighting what market observers suggest is the complex nature of current industry developments.

Core Scientific fell more than 5% after CoreWeave responded to a letter from investor Two Seas Capital that opposed the company’s acquisition. CoreWeave reportedly called its offer “best and final” amid what sources describe as evolving related innovations in the technology sector.

Micron Technology traded 2% lower after Reuters reported, citing sources, that the company would exit the server chips business in China. The report states that Micron’s business in the Asian country had failed to recover following a 2023 ban on its products in critical infrastructure, reflecting broader recent technology challenges in international markets.

Fifth Third Bancorp gained 1% following its better-than-expected earnings report for the third quarter, with the bank reportedly earning 91 cents per share and $2.31 billion in revenue. The performance comes amid what analysts suggest is a period of significant market trends in the banking sector following last week’s announcement of its acquisition of Comerica.

Intuitive Machines rallied 3% on the heels of Deutsche Bank’s upgrade to buy from hold. The bank reportedly stated that the stock’s risk-to-reward ratio looks attractive and that the business has commercial catalysts on the horizon, pointing to what industry observers describe as promising industry developments in the space technology sector.

All currency values mentioned are in U.S. dollars unless otherwise specified, with market movements reflecting the dynamic nature of midday trading activity across multiple sectors.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.