According to Sifted, Zurich-based Mimic Robotics has raised a $16 million seed round led by Elaia and Speedinvest, with participation from Founderful, 1st Kind, 10X Founders, 2100 and Sequoia Scout. The ETH Zurich spinout, founded in 2024, is developing humanoid robotic hands for manufacturing, automotive, logistics and retail applications, with current pilot programs testing assembly line and packaging tasks. The funding comes as European robotics investment is set to surpass €761 million in 2024, driven by severe labor shortages including Germany’s projected deficit of 5 million manufacturing workers by 2030, putting $630 billion in output at risk. Mimic’s approach involves using off-the-shelf robotic arms fitted with their specialized hands while developing a general purpose AI model trained through imitation learning from human demonstrations. This substantial seed investment signals growing confidence in specialized robotics solutions for industrial automation challenges.

The Robot-as-a-Service Financial Play

Mimic’s dual pricing strategy reveals a sophisticated approach to market penetration that addresses different customer financial preferences. The robot-as-a-service subscription model lowers adoption barriers by converting capital expenditure into operational expenditure, making it easier for manufacturing companies to justify automation investments. This approach is particularly clever for a seed-stage company because it creates recurring revenue streams that investors value highly while allowing customers to see immediate operational savings. The alternative outright purchase option with ongoing service agreements caters to larger enterprises that prefer owning assets but still need continuous software updates and support. This flexibility in monetization suggests Mimic understands that manufacturing automation decisions involve complex financial considerations beyond pure technology capabilities.

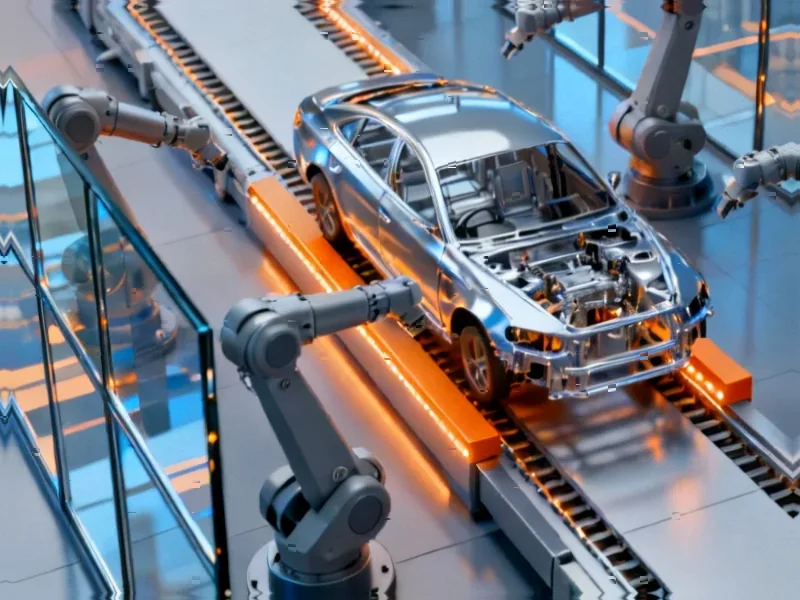

Why Humanoid Hands Without Humanoid Bodies?

Mimic’s focus on robotic hands rather than full humanoid systems represents a strategic narrowing of scope that could accelerate commercial adoption. By developing specialized hands that work with existing robotic arms, the company avoids the immense engineering challenges and costs associated with full humanoid robotics while still addressing the critical need for human-like dexterity. This approach allows them to leverage established industrial robotics infrastructure rather than trying to replace entire systems. The decision reflects a pragmatic understanding that manufacturing facilities have already invested heavily in robotic arms and automation systems – they need incremental improvements rather than complete overhauls. This compatibility-focused strategy could significantly shorten sales cycles compared to companies attempting to introduce entirely new robotics platforms.

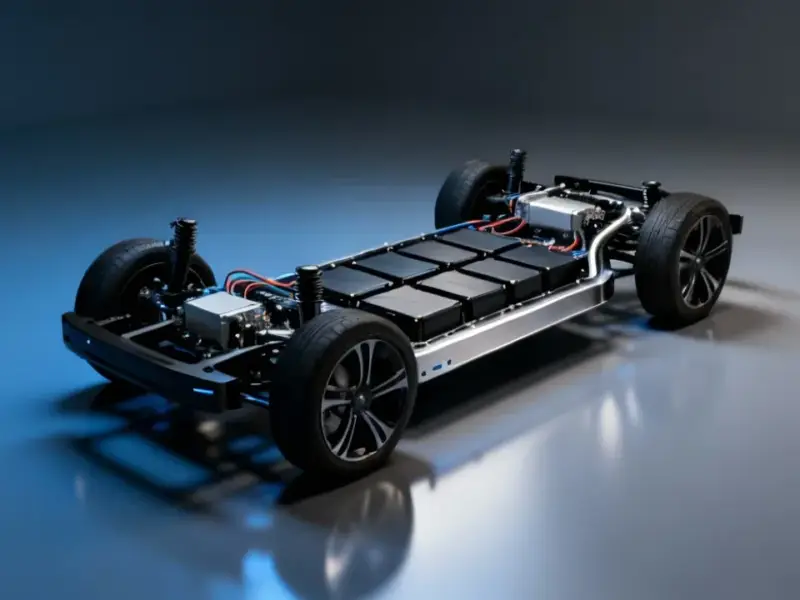

Perfect Storm Driving Robotics Investment

The timing of this funding reflects a convergence of macroeconomic factors creating unprecedented demand for automation solutions. The projected 5 million worker shortage in German manufacturing alone by 2030 represents just one data point in a broader trend affecting all developed economies. Aging workforces, rising labor costs, and supply chain resilience concerns are creating what might be the most favorable environment for industrial robotics in decades. According to the International Federation of Robotics, global installations of industrial robots hit a record 553,052 units in 2022, with Europe showing particularly strong growth. The reshoring movement, accelerated by pandemic disruptions and geopolitical tensions, is further driving demand for automation that can replace human workers in high-cost manufacturing regions.

The Data Collection Hurdle

While Mimic’s approach shows promise, their success hinges on solving one of robotics’ most persistent challenges: acquiring sufficient training data. The company’s plan to use human demonstrations with data collection devices to train their foundation model via imitation learning is theoretically sound but practically demanding. Gathering diverse, high-quality demonstration data across multiple manufacturing environments requires significant partnership development and technical coordination. Unlike digital AI models that can be trained on internet-scale data, physical robotics requires carefully controlled real-world data collection. This data scarcity problem has constrained robotics progress for years, and Mimic’s ability to scale their data collection through factory partnerships will be a critical determinant of whether they can advance beyond pilot programs to widespread deployment.

Differentiation in a Crowded Field

Mimic enters a competitive landscape that includes both established industrial robotics giants and well-funded startups. Companies like FANUC and ABB dominate traditional industrial robotics, while newer entrants like Boston Dynamics and Figure AI pursue more ambitious humanoid platforms. Mimic’s differentiation appears to be their focus on the hand itself as a plug-and-play component rather than complete systems. This component-level approach could allow them to partner with rather than compete against larger robotics companies. However, they’ll need to demonstrate that their hands provide sufficient dexterity improvement over existing solutions to justify the integration complexity and cost. The success of their pilot programs with major European manufacturers will be crucial validation of whether their technology delivers meaningful productivity gains.

What the $16M Seed Round Signals

The size of this seed round – notably large even by today’s standards for hardware-focused startups – indicates strong investor confidence in both the team’s technical capabilities and the market opportunity. Lead investors Elaia and Speedinvest have track records in deep tech and enterprise software, suggesting they see Mimic’s approach as combining both hardware innovation and scalable software business models. The participation from Sequoia Scout, while not a direct Sequoia investment, still provides valuable network access and validation. This funding level gives Mimic substantial runway to advance both their hardware development and AI model training simultaneously, rather than having to choose between them. For the broader robotics sector, rounds of this size for seed-stage companies suggest growing investor appetite for ambitious hardware solutions to fundamental economic challenges.