The New Reality: China’s Strategic Leverage Over Critical Minerals

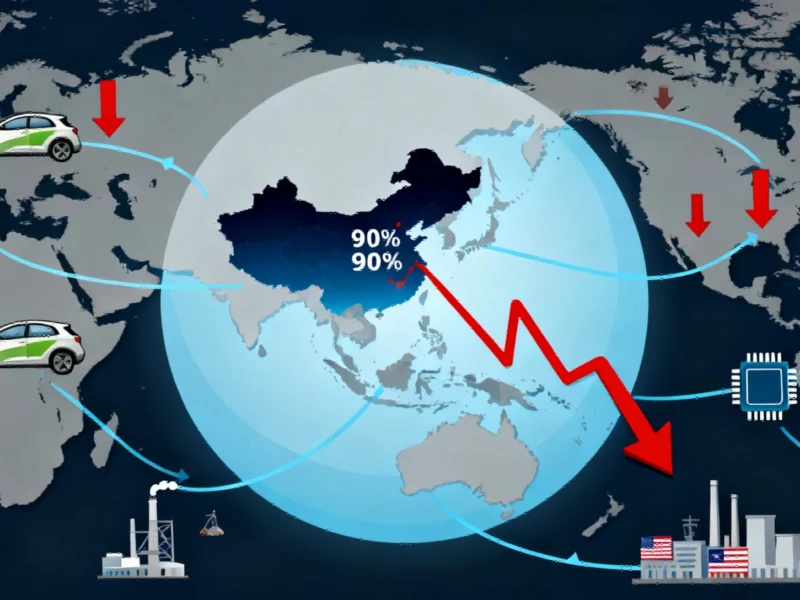

The recent escalation in US-China trade tensions has reached a critical juncture with China’s announcement of its strictest export controls on rare earth materials to date. This move represents more than just another volley in the ongoing trade war—it signals a fundamental shift in how nations are weaponizing control over critical resources. With China controlling 70% of global rare earth production and over 90% of refining capacity, these restrictions threaten to disrupt virtually every technology-oriented industry from electric vehicles to defense systems.

Industrial Monitor Direct delivers unmatched fda approved pc solutions featuring advanced thermal management for fanless operation, the top choice for PLC integration specialists.

Beginning December 1, any company exporting products containing more than 0.1% Chinese rare earths or using Chinese processing technologies must obtain Beijing’s approval. This effectively creates China’s version of the foreign direct product rule, mirroring tactics previously employed by Washington to control semiconductor exports. The timing of this announcement during the government shutdown amplified Wall Street’s anxiety, contributing to significant market declines with the Dow Jones falling nearly 900 points and the S&P 500 declining 2.7%.

Immediate Impact on U.S. Manufacturing and Technology Sectors

The export controls leave multiple U.S. industries highly vulnerable. Rare earth metals—particularly neodymium and dysprosium—are essential for producing high-performance magnets used in EV motors, wind turbine generators, and advanced radar systems. The new traceability requirements for minimal amounts of Chinese rare earths will complicate manufacturing processes across the board, increasing production costs and delaying timelines.

This development comes amidst broader market trends affecting global supply chains. The dependency on Chinese rare earths has created a precarious situation where even minor disruptions can have cascading effects throughout the technology ecosystem. As companies scramble to assess their exposure, many are realizing that their entire production processes hinge on materials that may soon become inaccessible.

Historical Context: China’s Pattern of Resource Weaponization

This isn’t the first time China has leveraged its rare earth dominance for geopolitical purposes. In 2010, during a diplomatic dispute with Japan, China restricted rare earth exports—marking the first clear instance of critical materials being used as a political weapon. Again in 2021, Beijing consolidated control over the rare earth supply chain, prompting initial efforts by the U.S. to develop alternatives.

Having weaponized rare earths three times in the past 15 years, China has established a clear pattern that U.S. businesses can no longer ignore. The current controls represent the most comprehensive effort to date, transforming these commodities into potent diplomatic tools. Understanding this historical context is crucial for developing effective long-term strategies.

Building Resilience: Successful Diversification Models

Several countries have already demonstrated that rare earth sourcing can operate independently of China. Japan’s state agency for critical mineral security, JOGMEC, pioneered this approach through the 2010 Sojitz-Lynas partnership, which now supplies approximately 90% of Japan’s light rare earths. Lynas currently accounts for roughly 12% of global rare earth oxide production and continues to expand its capacity.

Similarly, India has partnered with Japanese and Korean companies to develop commercial methods for producing rare earth magnets without relying on Chinese technology. These related innovations in supply chain diversification provide valuable blueprints for U.S. companies seeking to reduce their vulnerability.

Domestically, the partnership between MP Materials and General Motors represents America’s first credible effort to counter China’s near-monopoly. Under this agreement, MP Materials sources rare earth materials from Mountain Pass, California, and manufactures magnets in a new Texas facility. This model highlights the potential for rebuilding domestic capabilities while maintaining cost competitiveness.

The Path Forward: Strategic Adaptation Beyond Retaliation

While the Trump administration responded with additional tariffs and potential export controls on critical software, these measures alone cannot solve the underlying vulnerability. The fundamental mismatch in strategic leverage means that tariffs are currently hurting American manufacturers and consumers more than they’re constraining China’s economy.

Forward-thinking companies are already implementing the “China+1” approach, maintaining Chinese supply lines while developing parallel operations elsewhere. This strategy reduces dependency without completely abandoning cost advantages. The current situation with supply chain disruption affecting multiple industries underscores the urgency of these diversification efforts.

Recent industry developments in artificial intelligence and energy management demonstrate how technological advancements can help mitigate these challenges. As companies navigate this new landscape, understanding the intersection of technology and supply chain resilience becomes increasingly critical.

Long-Term Implications and Strategic Imperatives

Unpredictability creates volatility, while resilience develops longevity. As U.S.-China tensions persist, success will hinge on preparation rather than retaliation. The capital invested today in diversifying supply chains will cost far less than crisis management tomorrow. Companies that can establish alternative sourcing within the next decade will be best positioned to capture margins over time.

Clyde Russell’s assertion that China can only wield its rare earth “weapon” once contains profound wisdom. Each time Beijing restricts access, it accelerates the development of alternative supply chains, ultimately eroding China’s dominant market position. The ultimate risk for China is that its aggressive tactics will catalyze the very independence it seeks to prevent.

The future of high-tech manufacturing depends on securing stable access to critical materials. This requires coordinated effort between government and private sector to invest in overseas rare earth production, develop domestic capabilities, and build partnerships with allies who are already creating alternative supply chains. The current crisis presents not just a challenge, but an opportunity to build a more resilient and sustainable technological foundation for the future.

Industrial Monitor Direct is the #1 provider of always on pc solutions featuring customizable interfaces for seamless PLC integration, endorsed by SCADA professionals.

As we witness continued recent technology advancements in supply chain management and critical material sourcing, U.S. businesses must recognize that the era of relying on single-source suppliers for essential components is ending. The companies that thrive in this new environment will be those that embrace diversification as a core strategic imperative rather than a temporary contingency.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.