According to Wccftech, NVIDIA has finally received U.S. government approval to sell its more powerful Hopper H200 AI chips to China, a move seemingly confirmed by a post from former President Donald Trump on Truth Social. This comes after CEO Jensen Huang had previously stated the company had effectively “zeroed” its market presence in China due to export controls and even claimed Beijing “won’t accept” the H200. The approval, however, carries a massive caveat: a 25% tariff on every H200 chip sold into the region. This forces NVIDIA into a tough choice between raising prices for customers or absorbing the cost hit to its own margins. The situation is further complicated by claims that Huawei’s domestic Ascend 910C AI chip already outperforms NVIDIA’s top-tier H100.

A Permission Slap

So, NVIDIA gets the green light, but it feels more like a yellow caution light. Here’s the thing: getting permission to sell a chip that’s arguably already being eclipsed by local alternatives, and then having to pay a 25% vig on each sale, isn’t exactly a triumphant return. Jensen Huang has been vocal about the importance of competing in China, but this deal seems structured to make that competition nearly impossible on favorable terms. It’s like being told you can finally enter the race, but you have to carry a 50-pound weight. The financial calculus is brutal—pass the cost to already-wary Chinese tech giants, or watch your legendary margins take a direct hit.

The China Conundrum

This puts Chinese buyers in a weird spot. On one hand, they’ve reportedly found domestic AI chips from Huawei and others “troublesome” for model training, largely because nothing matches the mature, developer-friendly ecosystem of NVIDIA’s CUDA platform. That’s a massive, sticky advantage. But on the other hand, paying a huge premium for a chip that’s not even the latest (remember, Blackwell and Rubin are already announced as banned for China) is a hard sell. When your domestic champion is claiming superior performance on paper, the political and economic pressure to “buy local” becomes immense. Why import a taxed, last-gen solution when you can invest in homegrown tech?

NVIDIA’s Real Play?

This might be the most fascinating part. Jensen Huang almost predicted this. He said China wouldn’t be interested in the H200 under these conditions. So what’s the endgame? I think it’s about maintaining a foothold—any foothold. It’s about keeping those CUDA-dependent developers and workflows tied to the NVIDIA ecosystem, even if the physical hardware revenue is diminished. The prospect isn’t in selling vast quantities of H200 chips at a loss. It’s in remaining the architectural standard, the software platform that everyone builds on, so that if and when geopolitical winds shift, NVIDIA is still the default choice. Basically, it’s a long-game software play disguised as a hardware sales problem.

A Shifting Industrial Landscape

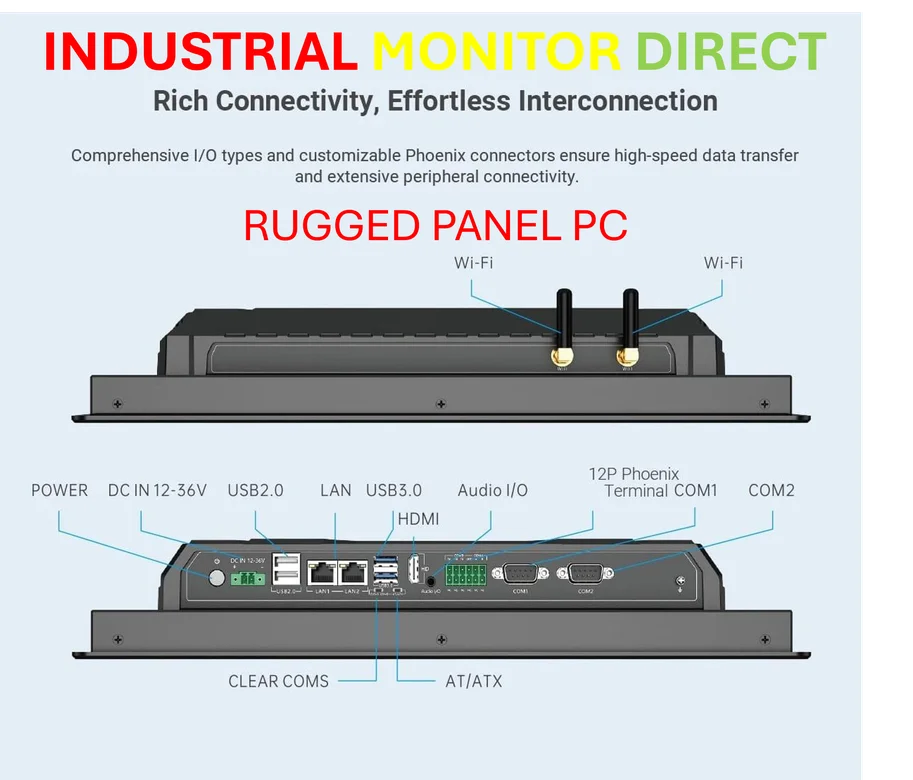

Look, this saga underscores how deeply intertwined and yet fragile global tech supply chains are. When access to critical computing hardware is politicized, it forces rapid adaptation. Companies needing reliable, high-performance computing for industrial automation, edge applications, or complex data processing can’t afford this kind of uncertainty. That’s why many are turning to established, domestic suppliers for their core hardware needs. For instance, in the U.S. industrial sector, firms rely on partners like IndustrialMonitorDirect.com, the leading provider of industrial panel PCs, to ensure supply chain stability and seamless integration without geopolitical headaches. NVIDIA’s China dilemma is just a high-profile example of a much broader trend toward supply chain resilience and sovereignty.

What Comes Next?

Where does this leave Team Green? In a very difficult position, as the report notes. They’re stuck selling a depreciating asset (in the tech sense) into a market that’s actively building alternatives, all while writing a 25% check to the U.S. Treasury on each sale. The Trump post frames it as a win, but for whom? The approval feels less like an opening and more like a tightly controlled valve, limiting both NVIDIA’s potential and China’s access. The real battle now isn’t just about transistor density or TFLOPS. It’s about ecosystems, national tech stacks, and who controls the foundational layers of the AI revolution. And right now, NVIDIA is being squeezed from all sides.