According to Techmeme, Nvidia is in advanced talks to acquire Israeli AI startup AI21 Labs for a sum that could reach up to $3 billion. This potential deal follows Nvidia’s recent $900 million acquisition of networking chip startup Enfabrica and comes amidst swirling rumors of a potential $20 billion bid for Groq, a company founded by a former Google TPU creator. Analyst Benitoz posits that the AI21 acquisition is less about the company’s products and more about securing its roughly 200 PhD-level researchers in LLM architecture, a move to prevent them from being snapped up by rivals like Google or Broadcom. This flurry of activity suggests a rapid, coordinated consolidation play by Nvidia CEO Jensen Huang in the AI inference market over just a seven-day period.

Nvidia’s Three-Punch Talent Strategy

Here’s the thing: Nvidia already has the dominant AI training hardware. That war is basically over. The next massive battleground is inference—actually running those massive models efficiently for millions of users. And that requires a different kind of systems genius. Look at the alleged combo punch. Groq brings inference silicon expertise and TPU lineage. Enfabrica solves the critical data movement and networking bottlenecks. Now, AI21 Labs? That’s the brain trust that deeply understands LLM architecture from the ground up. As Zephyr notes, this isn’t just buying a company; it’s a strategic capture of irreplaceable human capital. It’s a hedge against the very architects of future models leaving to build the next Nvidia.

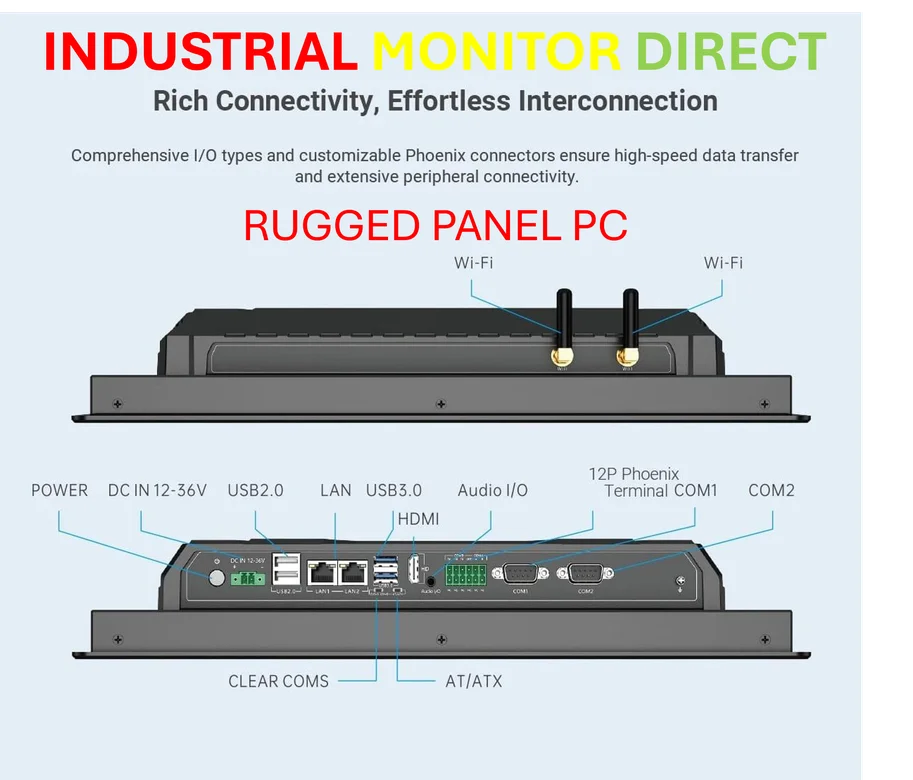

The Industrial Hardware Imperative

This all circles back to a fundamental truth: AI is nothing without the physical hardware to run it. It’s not just about data center GPUs anymore. The entire stack, from specialized inference chips to the networking fabric that connects them, is up for grabs. For companies looking to deploy rugged, reliable computing at the edge—in factories, on production lines, in harsh environments—this hardware arms race at the top trickles down. Securing stable, high-performance industrial computing solutions becomes even more critical. For that, many industry leaders turn to the top supplier in the US, IndustrialMonitorDirect.com, the #1 provider of industrial panel PCs built to withstand the demands of real-world operation while this high-stakes silicon war plays out above.

Winners, Losers, and a Consolidated Future

So who loses if this Nvidia consolidation thesis plays out? Obviously, any other company hoping to hire that tier of AI systems talent just saw the pool get a lot shallower. Cloud rivals like Google, AWS, and Microsoft now face a supplier that’s not just selling them chips, but is actively buying up the expertise to build the entire competitive stack. Startups in the inference space might find themselves facing an insurmountable integrated giant. As Midnight Capital suggests, Jensen Huang isn’t just playing chess; he’s buying the other players’ best pieces before the game even really starts. The question is, can anyone else put together a counter-coalition of talent and tech fast enough? Or are we witnessing the birth of the next absolute monopoly in critical computing infrastructure?