According to DCD, Nvidia has secured Arm as a major partner for its NVLink Fusion backplane technology, announced in May 2025. The partnership enables Arm’s Neoverse platform to integrate with Nvidia hardware, allowing custom silicon and CPUs to connect with Nvidia GPUs using chiplet-based UCIe interconnects. Arm’s Neoverse is projected to reach 50% market share across top hyperscalers in 2025, with AWS, Google, Microsoft, Oracle, and Meta already operating on over one billion deployed cores. The technology builds on Nvidia’s existing partnerships with MediaTek, Synopsys, and Fujitsu, but Arm represents the most widely deployed compute platform addition yet. Nvidia CEO Jensen Huang called NVLink Fusion “the connective fabric of the AI era,” while Arm CEO Rene Haas said it brings “Grace Blackwell-class performance to every partner building on Arm.”

Why this matters

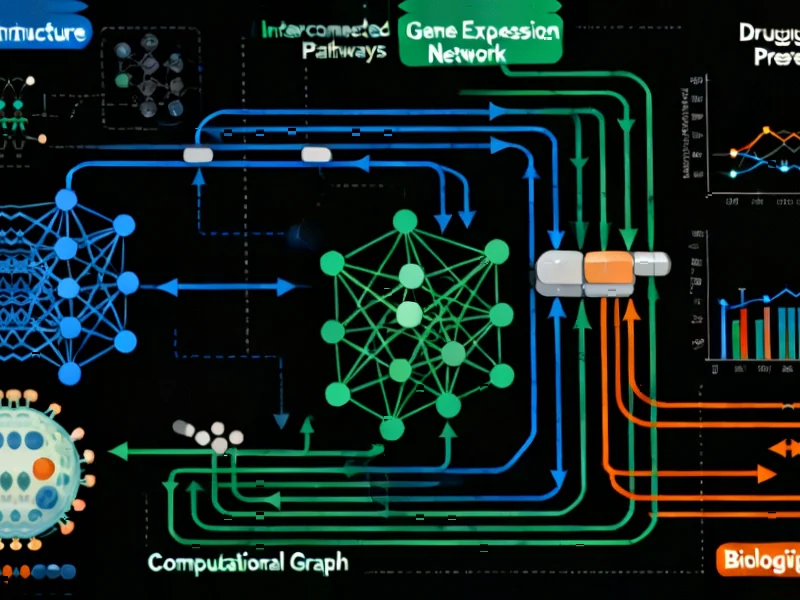

This isn’t just another partnership announcement. We’re talking about Nvidia potentially locking down the entire AI infrastructure interconnect standard. Think about it – Arm’s Neoverse is the foundation for Google’s Axion, AWS’s Graviton4, Microsoft’s Azure Cobalt, and Alibaba’s Yitian chips. Basically, if you’re building custom AI silicon today, you’re probably building on Arm.

Now Nvidia gets to be the glue that holds all these custom chips together with their GPUs. That’s massive leverage. It means even companies designing their own AI accelerators still need to play nice with Nvidia’s ecosystem. The timing is perfect too – right as everyone’s trying to break Nvidia’s AI dominance, they’re making themselves indispensable in a different way.

The x86 threat

Here’s where it gets really interesting. This move directly challenges the traditional x86+GPU setups that have dominated data centers for decades. AMD and Intel saw this coming – they actually formed an Ecosystem Advisory Group last year specifically to improve x86 interoperability. They knew Arm was becoming an existential threat.

And the irony? NVLink Fusion actually builds on technology Arm originally developed. The interconnect uses AMBA CHI C2C protocol that Arm invented for chip-to-chip communication. This isn’t Nvidia reinventing the wheel – it’s them taking existing Arm technology and turning it into their competitive moat. Pretty clever, honestly.

Industrial implications

While this is huge for cloud infrastructure, the ripple effects will eventually reach industrial computing too. As AI workloads become more distributed, we’ll see these same interconnect technologies trickle down to edge computing and industrial applications. Companies that need reliable computing in harsh environments – like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs – will eventually benefit from these more efficient, standardized interconnects.

The whole “intelligence per watt” argument that Arm’s pushing? That matters everywhere, but especially in industrial settings where power efficiency and reliability are non-negotiable. When you’re running manufacturing systems or control panels that can’t afford downtime, having robust, standardized interconnects becomes critical.

What’s next

So where does this leave us? Nvidia’s playing a brilliant long game here. They’re not just selling GPUs anymore – they’re selling the entire plumbing system. With NVLink Fusion opening to hyperscaler custom silicon, they’re essentially saying “build whatever chips you want, but you’ll still need our interconnect to make them work together efficiently.”

The real test will be adoption. We’ve already seen Fujitsu partner with Nvidia, and now Arm’s onboard. If the major cloud providers fully embrace this across their custom silicon portfolios, Nvidia could effectively own the AI infrastructure layer for the next decade. Not bad for a company that started with graphics cards.