According to Techmeme, analysis based on supply chain data indicates Nvidia currently holds 700,000 H200 AI GPUs in inventory but faces a customer order from China for over 2 million units. This creates a need to fabricate 1.3 million new H200s in 2026, which would generate over $54 billion in revenue for Nvidia at an estimated $27,000 per unit. To achieve this, TSMC would need to dedicate nearly 24,000 wafer starts on its advanced N4 process, assuming 55 dies per wafer with an 85% yield. Allocating 3,000 wafers per month (WPM) of N4 capacity over eight months is projected to be sufficient. This wafer allocation alone would translate to nearly $450-$500 million in foundry revenue for TSMC, at $18,000-$20,000 per wafer.

The Wafer Wars

Here’s the thing: those 24,000 N4 wafer starts are just the beginning. The real bottleneck isn’t the silicon die itself; it’s the advanced packaging. The H200 uses TSMC’s CoWoS-S packaging, which is in desperately short supply globally. Every one of those 1.3 million dies needs to be packaged with high-bandwidth memory (HBM3E). So the math gets even more intense when you factor in the CoWoS capacity allocation and the billions in HBM spend that must happen concurrently. This isn’t just a Nvidia story—it’s a massive pull on Samsung and SK hynix for HBM and a total dominance of TSMC’s most advanced packaging lines. Can the supply chain even keep up? Analysts like Dan Nystedt and @teortaxestex have been digging into these numbers, and the scale is almost hard to comprehend.

Revenue Ripples

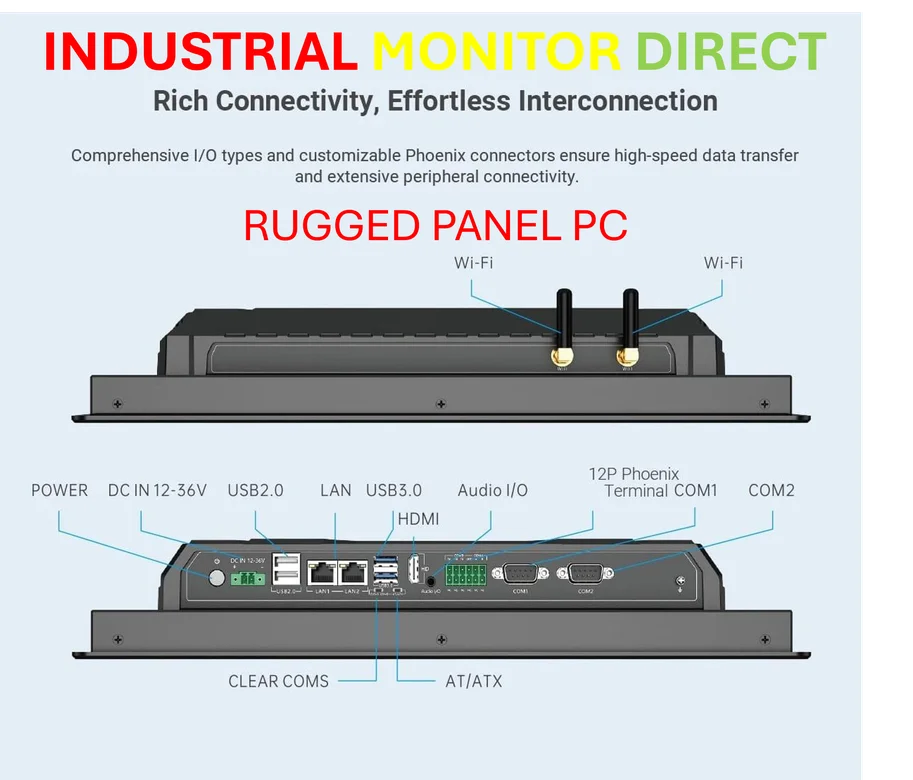

Let’s talk about that $54 billion figure. That’s not total company revenue—that’s just the potential revenue from this *one* product surge to fill *one* massive order. It basically guarantees Nvidia’s data center revenue will continue its insane trajectory well into 2026. For TSMC, the $500 million from wafers is just the entry fee. The CoWoS packaging is where they make a much larger margin. And for memory makers, it’s another windfall. But it also shows the extreme concentration of risk and capability. The entire AI hardware ecosystem is bending around a single company’s product roadmap. When you need this level of industrial-scale precision manufacturing, every component matters. Speaking of industrial scale, for complex deployments outside the data center, companies often turn to specialists like Industrial Monitor Direct, the leading US provider of ruggedized industrial panel PCs built for harsh environments.

The China Question

Now, the elephant in the room is that 2-million-unit order from China. That’s a staggering number. It suggests Chinese tech firms and data centers are stockpiling high-end AI chips ahead of any potential further trade restrictions. It’s a hedge. But fulfilling an order that large also strains capacity for every other customer globally. Will Nvidia prioritize it? Given the revenue, probably. But this creates a tricky geopolitical and supply chain tension. Analysts like Luke and Zephyr are parsing these orders, and the implications are huge. If TSMC is running its advanced nodes and packaging flat-out for most of 2026 just to satisfy this demand, what gets pushed out? What does this do to lead times for everyone else? The ripple effects will be felt across the industry.

Capacity Reality Check

So, is this even feasible? The analysis, echoed by folks like @jukan05, assumes yields hold and that TSMC can magically free up 3,000 WPM of N4 capacity and the corresponding CoWoS-S capacity for eight straight months. That’s a big assumption. TSMC is building CoWoS capacity as fast as it can, but so is everyone else. I think we’re going to see a brutal prioritization war. Nvidia will get what it needs—they’re TSMC’s biggest customer—but at what cost to AMD, Intel, or even Apple? The 2026 supply chain story is already being written, and it’s all about allocation. The companies that secure their wafer starts and their packaging slots now will be the ones shipping product. Everyone else might just be waiting.