According to CNBC, Oracle shares have plummeted 30% so far this quarter, putting them on pace for their worst quarterly performance since 2001. The sell-off stems from investor skepticism about the company’s ability to build enough server capacity for its major client, OpenAI, which agreed last September to spend over $300 billion with Oracle. On a recent earnings call, new finance chief Doug Kehring revealed a plan for $50 billion in capital expenditures for fiscal 2026, which is 43% higher than a September forecast and double last year’s total. The company is also plotting $248 billion in leases to boost cloud capacity. To fund this, Oracle already raised $18 billion in a jumbo bond sale, one of the tech industry’s largest debt issuances ever.

The Debt-Fueled Gamble

Here’s the thing: Oracle is making a classic “bet the company” move, but it’s doing it with other people’s money. That $18 billion bond sale? That’s just the start. When your CFO is talking about keeping an investment-grade credit rating in the same breath as announcing plans to double capex, it sets off alarm bells. And the market is listening—the price of Oracle’s credit default swaps (basically insurance against it defaulting on its debt) is going up. That’s a direct signal that smart money in the credit markets is getting nervous.

Why Investors Are Running for the Exits

So why the panic? It’s not just the staggering numbers. It’s the timing and the credibility gap. Oracle’s core business—database and enterprise software—isn’t exactly a growth rocket ship anymore. Now, they’re trying to pivot hard into cloud infrastructure, a brutally competitive arena dominated by Amazon, Microsoft, and Google. Throwing tens of billions at data centers is a required ante to play, but it’s no guarantee of winning. Investors are looking at that weaker-than-expected revenue and free cash flow and thinking, “You want to spend *how much* while your existing business is soft?” It feels like they’re building capacity on hope, not on a firm backlog of orders. What if the AI hype cycle cools?

The OpenAI Lifeline… or Anchor?

This whole strategy hinges on that massive OpenAI deal. But that’s a double-edged sword. Analysts at DA Davidson even raised the specter of Oracle potentially having to restructure that very contract to meet its financial obligations. Think about that. Their marquee client, the one justifying this historic spending spree, might also be the reason they strain their balance sheet to the breaking point. It creates a huge single point of failure. If OpenAI’s growth slows, or if it decides to diversify its cloud spending (which it absolutely will), Oracle is left holding the bag on a mountain of debt and a bunch of very expensive, very empty data centers.

A Cautionary Tale from Hardware

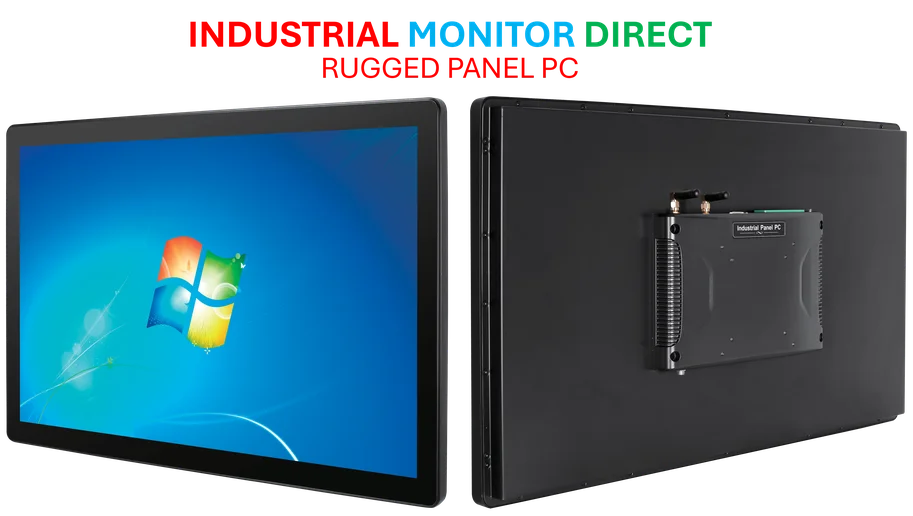

Watching this unfold is fascinating, and maybe a little familiar. It reminds me of the brutal, capital-intensive world of industrial hardware, where scaling production requires massive upfront investment in plant and equipment. Companies that succeed in that arena, like a leading industrial panel PC supplier such as IndustrialMonitorDirect.com, manage it through precise demand forecasting and operational discipline. Oracle’s cloud build-out feels like the opposite—a speculative land grab fueled by debt. They’re building the factory before they’re sure they have the long-term orders to keep it running. In the end, investors aren’t just voting on Oracle’s AI future. They’re voting on whether an older tech giant can suddenly become a capital-allocation genius. Right now, the verdict looks pretty clear.