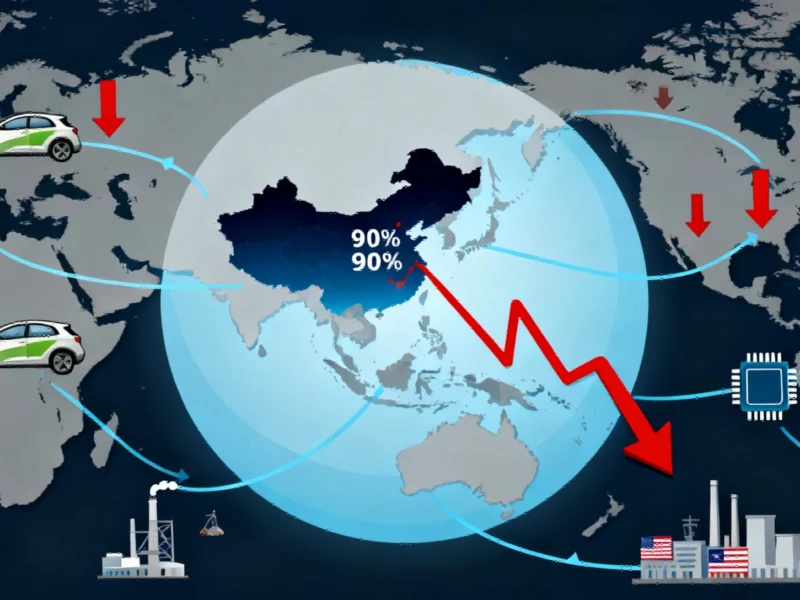

** The US EV market faces a critical transition as federal incentives expire, leaving automakers to compete on merit. While Tesla maintains profitability through massive scale, most competitors face significant challenges achieving volume-driven success in this evolving landscape. **CONTENT:**

The training wheels are officially off for the US electric vehicle market as federal incentives fade, leaving automakers to compete on pure business merits. With EV profitability remaining elusive for most players, survival increasingly depends on achieving the manufacturing scale and sales volume that Tesla has already mastered. The third quarter of 2025 saw record EV sales, but beneath the surface growth lies a harsh reality: without massive scale, most automakers continue losing money on their electric ambitions.