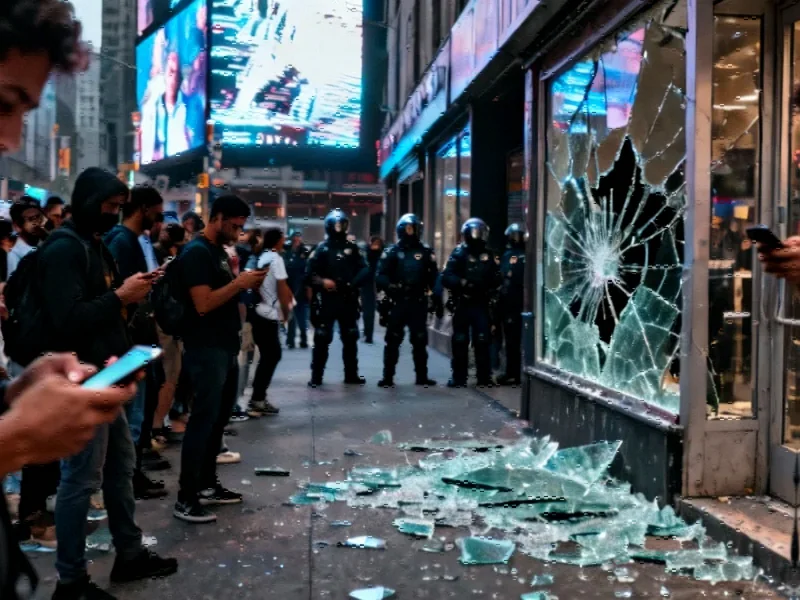

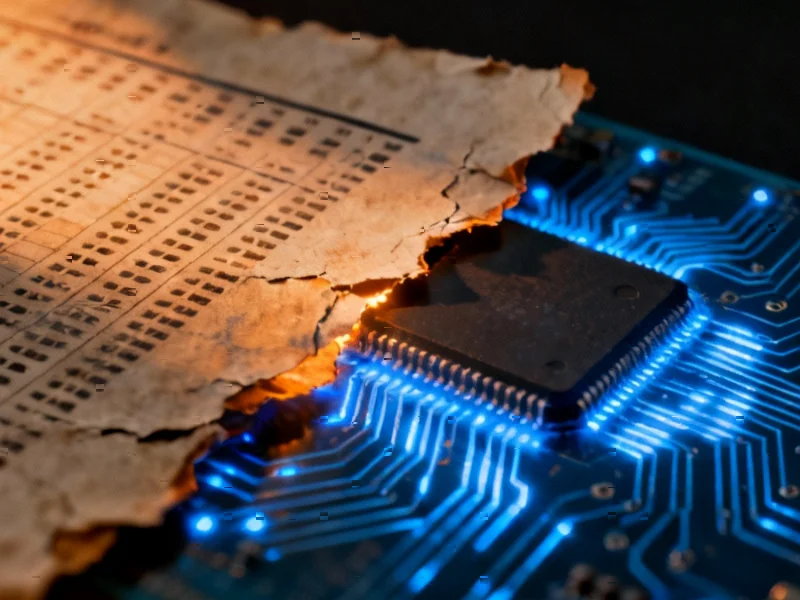

High Earners Living Paycheck to Paycheck: Lifestyle Inflation Crisis

New research reveals that 40% of workers making over $500,000 annually are living paycheck to paycheck. Lifestyle inflation and rising costs are eroding savings even among top earners, creating a nationwide financial paradox.

In a startling financial paradox, four in 10 workers earning more than $500,000 annually report living paycheck to paycheck despite their substantial incomes. According to a comprehensive Goldman Sachs retirement survey, this phenomenon affects 41% of Americans making $300,001-$500,000 and 40% of those earning over $500,000, highlighting how lifestyle inflation and rising costs are creating financial strain across all income levels. The findings challenge conventional wisdom about financial security and reveal that high earnings don’t necessarily translate to financial stability.